Nvidia unveils next-gen AI supercomputing platform; Move underscores efforts to boost market confidence, navigate pressures amid US restrictions: analyst

Vera Rubin platform Photo: Official website of Nvidia

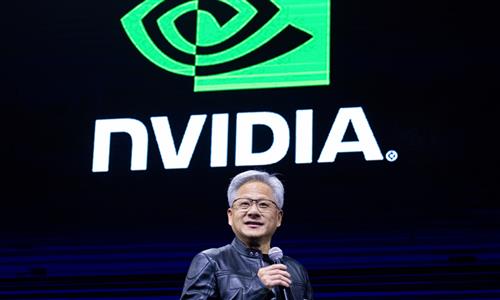

Nvidia CEO Jensen Huang said on Monday that the company's next-generation AI supercomputing platform, Vera Rubin, has entered full-scale production and is scheduled for official launch in the second half of 2026. A Chinese industry analyst said it highlights the US chipmaker's effort to bolster market confidence and navigate mounting operational and competitive pressures amid US tech restrictions.

All six chips for a new generation of computing equipment - named after astronomer Vera Rubin - are back from manufacturing partners and on track for deployment by customers in the second half of the year, Huang said during a keynote speech at the 2026 Consumer Electronics Show (CES) in Las Vegas, Bloomberg reported on Tuesday.

"Rubin arrives at exactly the right moment, as AI computing demand for both training and inference is going through the roof," Huang noted, adding that the new platform "takes a giant leap toward the next frontier of AI."

In outlining the positioning of the new platform, Nvidia said in an official statement that Rubin is designed to support the building, deployment and security of the world's largest and most advanced AI systems at the lowest cost, a move that the company said will help accelerate mainstream adoption of AI.

Analysts said that Nvidia is seeking to defend its lead in AI accelerators amid growing pressure on returns from massive computing investments, intensifying competition in the sector, as well as impact of US restrictions on its chip sales.

Against this backdrop, emphasizing key improvements in performance and energy efficiency is aimed at reinforcing market confidence in Nvidia's technology roadmap, product capabilities and long-term prospects, Ma Jihua, a veteran telecom industry analyst and founder of Beijing-based Darui Management Consulting Co, told the Global Times on Tuesday.

Ma noted that Nvidia is currently facing multiple real-world pressures. In the Chinese market, despite recent easing of US restrictions, uncertainty remains over how many H200 chips Nvidia can ultimately sell and how much revenue they can generate, adding pressure to the company's earnings outlook.

The analyst said that the new platform gives Nvidia greater room to maneuver commercially, particularly in China, where the company has been seeking to restore profitability. "As the latest products enter mass production, older chips such as the H200 move down the product stack, allowing the company to lower prices and adjust its sales strategy," Ma said.

Although the company said on Monday that it has seen strong demand from customers in China for the H200 chip, China's drive for indigenous semiconductor innovation, coupled with lingering security concerns over Nvidia's AI chips, including potential backdoor risks, continue to cast a shadow over the company's longer-term outlook in the market, Ma added.

Analysts also point to broader market headwinds, including concerns over overheated AI investment, overstated computing demand and rising competition from alternatives such as Google's Tensor Processing Units.

The AI boom that powered Wall Street's technology stocks is "now in the early stages of a bubble," hedge fund manager Ray Dalio warned in a post on social media platform X on Monday.

Wall Street's main indexes posted double-digit gains in 2025, marking a third straight year of advances, fueled largely by heavy investor demand for AI-related stocks that pushed US equity benchmarks to record highs, according to Reuters.

Major technology companies, including Meta, Microsoft and Amazon, have spent tens of billions of dollars in capital expenditures in 2025 alone, while McKinsey & Company estimates that global investment in data center infrastructure could reach nearly $7 trillion by 2030, according to CNN.

"Nvidia is both a major driver and key beneficiary of the current AI boom," Ma said. "But hardware sales alone are unlikely to sustain such elevated expectations. Rolling out products with sharply improved performance to slow a cooling in market sentiment and buy time for business adjustments is likely the rationale behind this choice."

Nvidia has been accelerating efforts to broaden its business scope to address mounting competitive and market pressures. According to Bloomberg, the company is pushing both software and hardware aimed at expanding the adoption of AI across the economy, including in robotics, healthcare and heavy industry.

As part of that broader push, the company unveiled a set of tools at the CES aimed at speed up the development of autonomous vehicles and robots, the Bloomberg report said.

As the AI industry moves into faster real-world deployment, new product launches are increasingly about market confidence, competition and industry direction, not just technical specifications, Ma said. "While Nvidia pushes to expand the adoption of AI technologies, it must also prioritize robust security and reliability to maintain long-term user trust."