A-share earnings preannouncements signal positive performance

Attractiveness of China’s capital market expected to be enhanced amid continuous reform efforts: analyst

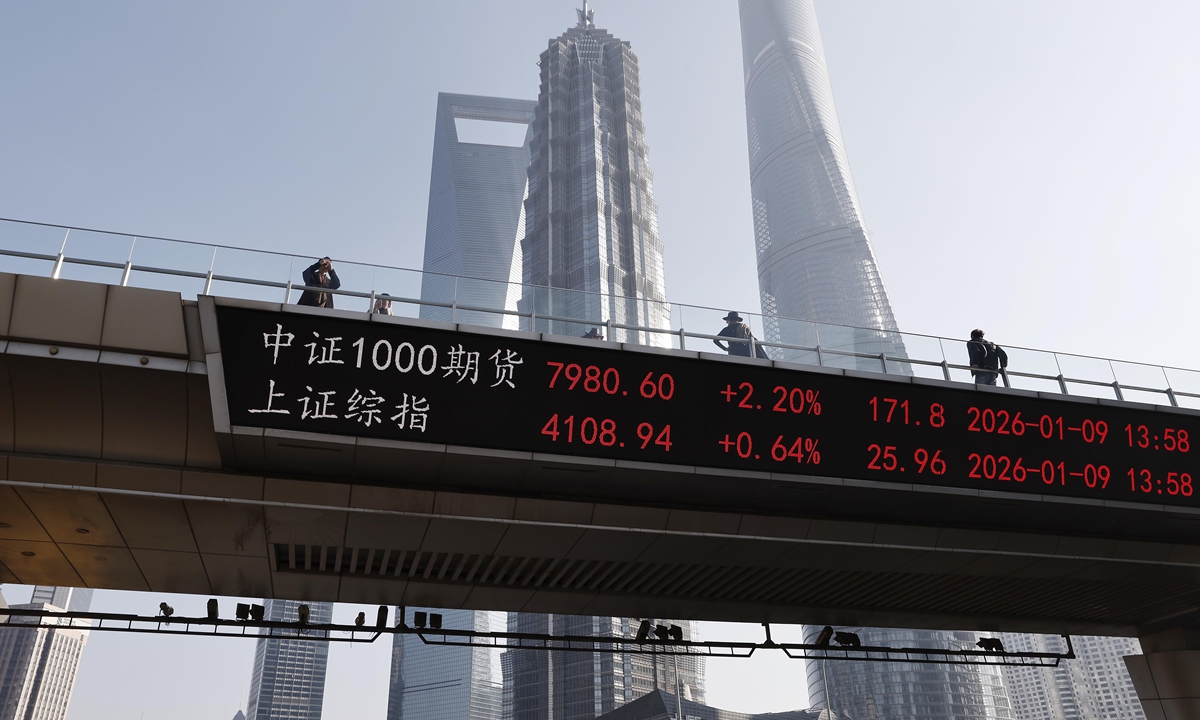

Real-time stock market quotes scroll continuously on the pedestrian overpasses in Shanghai's Lujiazui Financial City on January 9, 2026. Chinese stocks closed higher on the day, with the benchmark Shanghai Composite Index up 0.92 percent to 4,120.43 points. Photo: VCG

As 2025 concluded, a batch of A-share companies have taken the lead in signaling positive performance. Under the dual drive of the macroeconomic recovery and industrial upgrading, hard-technology enterprises with core technologies are entering a period of rapid profit growth, analysts said on Sunday.

Analysts said that the A-share market is expected to offer more investment opportunities this year as corporate profits rise and stepped-up macro-policies take effect.

According to data from financial industry information provider Choice Data, 87 A-share listed companies had announced preliminary 2025 results as of press time on Sunday, and 17 said that net profits attributable to shareholders had more than doubled, domestic media outlet National Business Daily reported.

In terms of industry distribution, the 17 companies are mainly from sectors such as electronics, pharmaceuticals and biotech, power equipmen tand basic chemicals.

For example, Advanced Fiber Resources, a leading fiber optic isolator manufacturer based in Zhuhai, South China's Guangdong Province, announced in a filing with the Shenzhen Stock Exchange that the company expected to achieve net profit of 169 million yuan ($24.22 million) to 182 million yuan, which would be year-on-year growth of 152 to 172 percent.

Last year, the company achieved steady revenue growth through various measures including technological innovation, launching new products, and actively developing new domestic and international customers, which drove the growth of net profit, the company said.

Guangzhou Tinci Materials Technology Co said that sales of lithium-ion battery materials rose significantly last year amid market demand for new-energy vehicles and energy storage, with net profit estimated at 1.1 billion yuan to 1.6 billion yuan, which would represent year-on-year growth of 127.31 to 230.63 percent.

"Bolstered by the development of artificial intelligence, semiconductors and smart manufacturing, hard-tech sectors are embracing booming demand from both the international and domestic markets. It's great to see the excellent performance of China's hard-tech enterprises in production, sales and operation in 2025," Dong Shaopeng, a senior research fellow at the Chongyang Institute for Financial Studies at Renmin University of China, told the Global Times on Sunday.

The market capitalization of China's high-tech firms listed on the A-share market grew substantially in 2025, driving the broader market's expansion, according to a report from the China Association for Public Companies on January 5.

As of the end of 2025, the total market cap of all 5,469 A-share companies reached 123 trillion yuan. Last year, 116 firms were newly listed, according to the report.

The driving role of sci-tech firms in the A-share market indicates that the capital market is effectively playing the role of resource allocation by precisely channeling funds into key areas for the development of new quality productive forces, Dong said.

Compared with US stock valuations being at high levels, the average valuations of A-shares and H-shares remain at about their historical averages, and many traditional sectors are still at historical lows, so there is still substantial room for price growth, Yang Delong, chief economist at Shenzhen-based First Seafront Fund, told the Global Times on Sunday.

Multiple foreign financial institutions have also expressed a positive outlook. Standard Chartered said that it maintains an overweight position in Chinese stocks for 2026, with targeted policies and strong earnings growth related to artificial intelligence-themed sectors expected to provide strong support for China's economy, according to a note sent to the Global Times on January 7.

Goldman Sachs has projected an annual appreciation of 15 to 20 percent for Chinese equities in 2026 and 2027, mainly driven by the adoption of AI, going global trends, and anti-involution policies.

Chen Huaping, vice chairman of the China Securities Regulatory Commission (CSRC), said at the 30th China Capital Market Forum in Beijing on Sunday that the 15th Five-Year Plan period (2026-30) is a critical period for advancing Chinese modernization and accelerating the task of building the country into a financial powerhouse, the China Securities Journal reported.

By following "strengthening regulation, forestalling risks and promoting the high-quality development of the capital market," the CSRC will step up efforts to improve capital market foundations, strengthen regulation, continuously deepen the comprehensive reform of investment and financing by working with relevant parties, and enhance institutional inclusiveness and adaptability in a bid to promote the capital market to achieve effective qualitative improvement and reasonable quantitative growth, Chen said.