Markets gain some direction from nomination of Kevin Warsh as new Fed chair, yet questions linger over potential Fed policy moves: analysts

A view of the US Federal Reserve building in Washington, DC on January 26, 2026. Photo: AFP

US President Donald Trump said he thinks Kevin Warsh, his pick to head the Federal Reserve, could pick up votes from some Democrats in the Senate, calling him a "high-quality person" who should have no trouble winning Senate confirmation, Reuters reported on Sunday.

Trump told reporters aboard Air Force One on Saturday that he expected Warsh to lower interest rates if confirmed, citing Warsh's comments in interviews and other statements, according to Reuters, marking the latest remarks the US president has made about the new Fed chair nominee.

Trump announced on Friday his decision to nominate Kevin Warsh as the next Federal Reserve chair, who would take over from Federal Reserve Chair Jerome Powell, whose term as chair ends in May, CNN reported.

Warsh is currently a fellow at a conservative think tank called the Hoover Institution, which is based at Stanford University, according to ABC News.

In 2006, former US president George W. Bush appointed Warsh to serve on the Fed's Board of Governors, a top policymaking body that helps set the level of interest rates, where he served until 2011.

While the role requires Senate confirmation, the nomination has already sent mixed signals to markets.

Meanwhile, the announcement caps an extensive search that began in September and was spearheaded by Treasury Secretary Scott Bessent, who narrowed a list of half a dozen candidates and presented four finalists to the president, according to the CNN report.

Hu Qimu, deputy secretary-general of the Forum 50 for Digital-Real Economies Integration, told the Global Times on Sunday that the Fed chair not only sets interest rates but also influences the "independence narrative," a key anchor for global risk pricing. As a result, when a nominee is announced, assets most sensitive to rates and credibility, including the US dollar, bonds and gold, tend to react first.

While the clarity provided by a confirmed Fed candidate may give markets some guidance, its implications for both US and global markets remain complex, Hu said.

Hu noted that in a global economy still unsettled by unilateralism and protectionism, the nominee's policy stance and the pace of implementation could significantly affect global capital flows, the US dollar and cross-border economic balance at a time when predictability is badly needed.

Wide responses

In a social media post on Friday, Trump lauded Warsh, citing his experience in both the public and private sectors. "I have known Kevin for a long period of time, and have no doubt that he will go down as one of the GREAT Fed Chairmen, maybe the best. On top of everything else, he is 'central casting,' and he will never let you down," the US president wrote on his Truth Social platform.

According to ABC News, Warsh is the husband of Jane Lauder, whose father Ronald Lauder is the heir to the Estée Lauder Companies. Ronald Lauder, a billionaire, is a major donor and supporter of Trump.

The announcement immediately received mixed messages from international media and markets.

The pick of a former Fed governor to replace Jerome Powell comes as the White House seeks to tighten its grip on the central bank, the Guardian reported.

The move ends months of speculation over who the US president would pick to replace Powell, after he waged an extraordinary campaign to influence policymaking at the Fed by repeatedly calling for interest rate cuts, the Guardian reported.

Another report by the New York Times said that in recent months, Warsh has been calling more forcefully for lower interest rates and for the Fed to reduce its $6 trillion bond holdings as a way to lower borrowing costs without fueling inflation.

If the Senate confirms Warsh, what remains to be seen is how his independent streak will play out once he becomes chair and how he will respond to pressure from Trump and Treasury Secretary Scott Bessent, according to the New York Times.

Reuters raised a related issue, under the headline "Warsh 'regime change' faces steep hurdles at sprawling US central bank," noting that while "Warsh checks a long list of boxes for Trump as his pick to run the Federal Reserve, with longstanding political and social ties to the president, deep Wall Street connections and a well-tailored demeanor, how deeply and quickly he will cut interest rates and how aggressively he will pursue his 'regime change' at the Fed remain open questions."

In a more serious tone, Financial Times claimed that Trump's nomination of Kevin Warsh to lead the Federal Reserve would trigger a sweeping reappraisal of the central bank's role at the center of the world's biggest economy, citing leading economists.

The market also reacted immediately to the nomination during Friday's trading session.

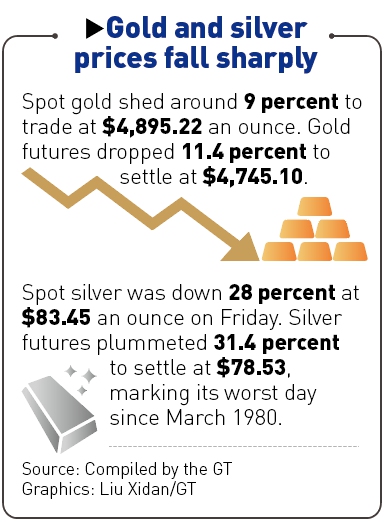

Gold and silver prices plunged on Friday, as Trump's nomination for the next chair of the Federal Reserve appeared to ease concerns about the central bank's independence and sent the US dollar soaring, CNBC reported.

On Friday, spot silver fell 28 percent at $83.45 an ounce, nearing its intraday lows. Silver futures plummeted 31.4 percent to settle at $78.53, marking their worst day since March 1980. Meanwhile, spot gold shed around 9 percent to trade at $4,895.22 an ounce. Gold futures dropped 11.4 percent to settle at $4,745.10, CNBC reported.

Despite the selloff, David Bahnsen, chief investment officer of The Bahnsen Group, said on CNBC's "Squawk Box" that Warsh "has the respect and credibility of the financial markets... I believe longer term he will be a credible candidate."

"Following the nomination announcement, gold and silver prices dropped sharply, with data from multiple markets showing a significant single-day correction, marking an adjustment from multi-year highs. This reflects the immediate impact of the move on related markets," Hu told the Global Times.

Moreover, the decline in gold prices primarily reflects market expectations that the US dollar could strengthen and that interest rates are unlikely to be cut significantly in the near term, Hu said.

Most importantly, having a clear Fed nominee provides the market with greater certainty, reducing risk expectations and demand for safe-haven assets and thereby boosting risk appetite, Hu said.

Kevin Warsh File photo: VCG

Uncertainties remain

However, uncertainties remain as the pace and extent of the potential policy shifts under the new Fed chair nominee remains unclear, experts said.

The 55-year-old Warsh has a high-profile and well-connected background, combining strong ties to Wall Street with experience navigating both political and financial arenas. In 2006, Warsh was appointed to the Federal Reserve Board at around 35 years old. He served as a Fed governor from 2006 to 2011, placing him at the heart of central bank decision-making during the financial crisis, an experience that gave him a deep understanding of policy logic as well as insight into market expectations and the complexities of the financial system, Hu said.

At the same time, Warsh has a reputation as a "hawk," meaning he tends to favor higher interest rates to combat inflation, CNN reported; however, he has also previously expressed support for rate cuts, aligning with Trump's preferences.

During his time as a Fed governor from 2006 to 2011, Warsh warned against cutting rates - including during the Great Recession - only to embrace rate cuts when Trump returned to office, the New York Times reported.

According to a Reuters report, Trump said it would be inappropriate to ask Warsh whether he would cut interest rates, saying he wanted to keep his nominee "nice and pure." However, the US president said he was confident Warsh was inclined to lower them.

"This suggests that the new nominee may be more willing than Powell to adjust policy direction when necessary, in line with calls from the US president," Hu said.

The nomination comes at a time when the US is facing inflation pressure.

The US Labor Department reported Friday that its producer price index, which measures inflation before it reaches consumers, rose from November to December at the fastest pace in three months and exceeded the 0.3 percent economists had forecast, according to an AP News report. Economists warned that Trump's double-digit taxes on imports would drive inflation higher, the report said.

"Historically, the Federal Reserve has been viewed as a stabilizing force for the US economy, with policymakers focusing on data and economic fundamentals while maintaining a calm, neutral stance," Lü Xiang, a research fellow at the Chinese Academy of Social Sciences, told the Global Times on Sunday.

Under Powell, each rate adjustment was carefully considered within its historical and economic context, but when economic issues become politicized, such judgments become more difficult, the expert said.

Graphics: GT