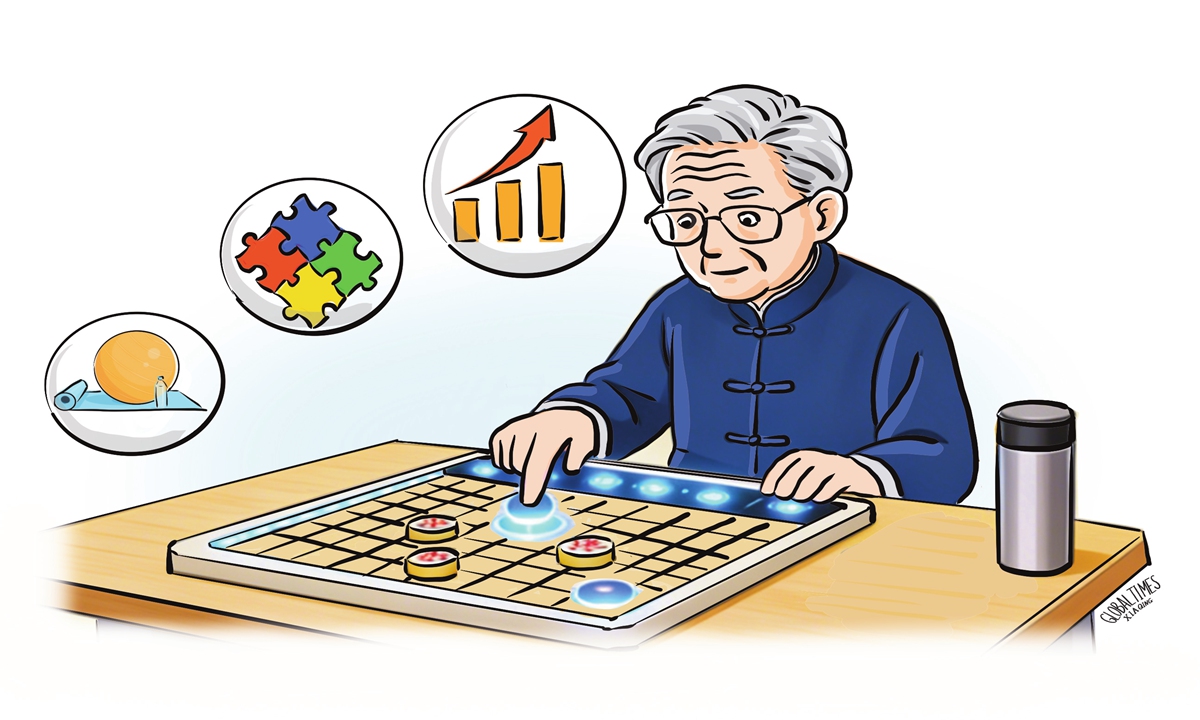

Illustration: Xia Qing/GT

As China's silver economy emerges as a new blue-ocean market amid the broader trend of national consumption upgrading, one niche segment - elderly-friendly toys - is drawing increasing attention from the market. Following senior education and tourism, another consumption trend related to the elderly population is on the rise.Citing media data from July 2025, Xinhuanet reported on Monday that in the previous year searches for elderly-friendly toys on a major e-commerce platform rose 124 percent year-on-year, while transaction volumes increased by more than 70 percent. The share of buyers aged 55 and above has been steadily rising.

This surge in niche demand reflects a broader expansion of senior-oriented consumption, underscoring the growing momentum of the silver economy as a whole. As China's aging process deepens alongside its consumption upgrading, the silver economy has become an important driver of consumption growth.

According to the National Bureau of Statistics, China's population aged 60 and above reached 323 million as of the end of 2025. Within the elderly population, the younger-old group aged 60-64 accounts for a relatively large share. Most of them are in good health, show a strong willingness for social participation, and continue to play an important role in economic and social development.

According to the Blue Book of Silver Economy: Annual Report on the Development of Silver Economy in China (2024), the country's silver economy is valued at about 7 trillion yuan ($1 trillion), accounting for roughly 6 percent of GDP. By 2035, it is projected to reach 30 trillion yuan, or about 10 percent of GDP.

Unlike the traditional elderly-care model centered on basic living needs, more seniors are now seeking spiritual and psychological fulfillment. As living standards rise, demand has shifted toward physical well-being, psychological health, and emotional satisfaction - a transition well-matched by the growing range of elderly-friendly toys.

Current product development largely centers on functional categories such as physical exercise, leisure activities, and entertainment, while demand for dementia intervention, rehabilitation, and emotional companionship remains consistently strong.

Highly differentiated needs lie behind the term "elderly." For example, a healthy and active 65-year-old and an 85-year-old facing cognitive impairment risks have vastly different requirements. Truly original designs in today's market that start from seniors' physiological, psychological, and emotional needs remain limited.

Although the elderly-friendly toy market has not yet entered an explosive growth phase, its development space is enormous. As products continue to improve, market awareness deepens, and standards gradually take shape, elderly-friendly toys are expected to become a new growth driver within the silver economy.

Industrial clusters for such toys are rapidly developing in China. A September report by the China News Service highlighted Yunhe County in Lishui City, East China's Zhejiang Province - known as the "Hometown of Wooden Toys" - which launched a "wooden toys + elderly care" model, generating more than 20 million yuan in annual sales and boosting the local silver economy.

In 2025, many local toy companies began diversifying into "wooden toys + elderly health services," producing hundreds of products designed to improve seniors' hand-foot coordination and slow their memory decline.

For foreign enterprises, China's elderly-friendly toy industry remains an early-stage blue ocean. In sub-segments such as cognitive intervention, rehabilitation, and intelligent companionship, overseas firms hold clear first-mover advantages through their technology, branding, and experience in medical-care integration, positioning them to capture long-term growth from the expanding silver economy.

Foreign companies can leverage their expertise in medical assistive devices, rehabilitation equipment, and educational toys. Intelligent companion robots represent another high-potential area, driven by a large number of empty-nest seniors and the resulting emotional companionship gap.

While China's senior consumer market offers an under-explored "gold mine" for foreign investors, success for domestic and foreign enterprises will depend on understanding and addressing the specific needs of the elderly through innovative products, customized services, and targeted marketing strategies.

The author is a reporter with the Global Times. bizopinion@globaltimes.com.cn