HOME >> BUSINESS

China's e-finance boom may kick brick-and-mortar banks to the curb

Source:Globaltimes.cn Published: 2014-2-10 19:51:00

| Editor's Note |

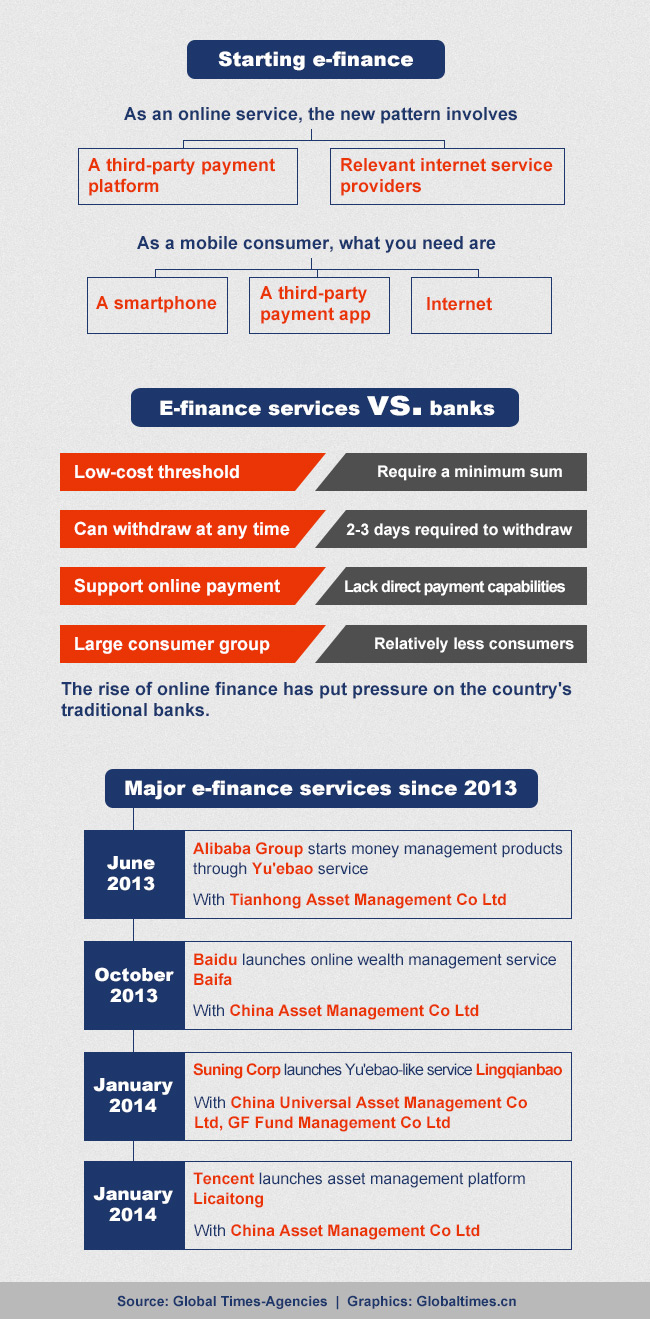

China's e-finance boom was heralded by the recent launch of major online and mobile phone finance platforms designed to reach a wider customer base of first-time investors. The services, such as Alibaba's Yu'ebao and Tencent's Licaitong, have managed to attract new customers by offering high returns and easy entry into the world of finance. But how do these services stack up to banks, and what are the risks?

| Knowing E-finance |

| Returns with Risks |

|

High returns |

When Yu'ebao was first introduced in June 2013, it claims to offer 14 times the then interest of banks.

When Yu'ebao was first introduced in June 2013, it claims to offer 14 times the then interest of banks. The first monetary fund product released by Licaitong Wednesday, which is from China AMC, offers a 7.338 percent seven-day annualized return, 18 times more than the banks' one-year fixed deposit rate.

The first monetary fund product released by Licaitong Wednesday, which is from China AMC, offers a 7.338 percent seven-day annualized return, 18 times more than the banks' one-year fixed deposit rate. Baifa claimed to offer an annual yield of up to 8 percent.

Baifa claimed to offer an annual yield of up to 8 percent.Read more here:

Higher returns

Cashing in

|

High risks |

Unstable and insecure internet service

Unstable and insecure internet service A minor fault in the industry chain could lead to disastrous consequences

A minor fault in the industry chain could lead to disastrous consequences Lack of laws and supervising authorities

Lack of laws and supervising authorities Hard to track down its whereabouts and claim compensation once the money is transferred

Hard to track down its whereabouts and claim compensation once the money is transferredRead more here:

Pitfalls of China's e-finance services

| Commentary |

Guo Tianyong, a professor at the Central University of Finance and Economics

Although the rate increase might not bring back deposits that had gone to the Internet, it is still attractive to clients who make daily capital demands on banks.

In the short term, banks might face liquidity problems due to the competition from Internet finance. This would also serve as a wake-up call that there are no more easy profits for banks in China, solely on deposits, loans and remittances. They must promote intermediary business and wealth management and provide all-round service to clients.

Yang Yifu, Vice President of Finance at Renrendai, an online financing company

The action of Internet giants in finance is not a bad thing, as they will help people better understand this form of finance.

The financial industry has many market opportunities...The future of finance must have the spirit of the Internet, which is easy, simple and efficient. The Internet also plays an important role in finance.

Xiang Zheng, a media personality

Given the nature of the Internet, confidential banking and personal details can quickly spread online if they are ever leaked. The absence of a paper trail when investing online could also expose service providers and their users to fraud. Securities and financial authorities need to extend their supervision into this new environment to ensure the safety of users. Several other countries have already introduced policies to protect investors' rights and China needs to do the same.

Wang Weidong, an industry analyst with iResearch

Losses can occur in any investment product, and investment products targeted to online shoppers may come with more risks, since the country's mechanism for risk management of Internet finance still has a good deal of room for improvement.

Dai Weigao, a Beijing-based financial service researcher

Domestic private fund firms are likely to ask for capital from banks and securities traders to scale up their newly issued funds so as to attract investors quickly. And if the capital is withdrawn, the rate of return will be negatively affected.

Doug Young, former company news reporter from Reuters

Central authorities need to keep mindful watch on these new ventures and quickly step in to regulate them when they grow too quickly or make inflated claims. By doing so, the country can avoid any controversy in this sensitive area that involves large sums of money from both consumers and smaller private enterprises.

| Related News |

Alipay

Yu'ebao deposits exceed 250 bln yuan

Yu'ebao warned on paperwork

Alibaba helps make China's largest fund

Tencent

Tencent launches new Licaitong product offering high returns

Tencent becomes the latest online platform to launch fund product

Tencent to launch its own fund products

Baidu

Baidu’s Baifa launches, gets over 1b yuan

Baidu to launch its second investment product Baizhuan

Bank profit growth could miss 10-pct target: analysts

Return rate guarantees are illegal

Web editor: pangqi@globaltimes.com.cn

Posted in: Business, Industries