HOME >> SOURCE,SPECIAL-COVERAGE

Wuhan manufacturing brakes

By Li Xuanmin and Yin Yeping Source:Global Times Published: 2020/2/3 21:43:40

Semiconductor, panel, auto industries impacted

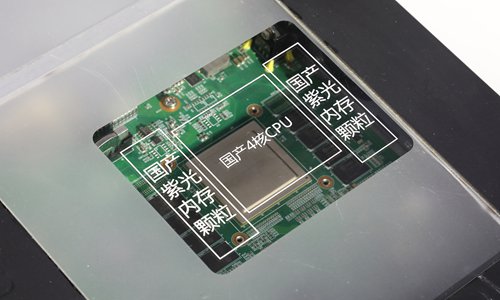

A view of the 32-layer 3D NAND flash chip developed by YMTC Photo: IC

The outbreak of the coronavirus in Wuhan, a major manufacturing hub in Central China's Hubei Province, could inflict a slew of effects on various high-tech and heavy industries where Wuhan plays a pivotal role, such as semiconductor, panel and auto sectors, industry insiders said.

In the short term, a delay in product delivery, coupled with logistics issues brought about by the lockdown of Wuhan, could cut supplies for smartphone and computer makers in urgent need of chips and displays to assemble electronic devices.

The spillover effect may also weigh on the global supply chain, according to observers.

"Thus far, the impact is limited because we have stockpiles of chips to sustain shipments for another two months. But we're concerned about the restricted transportation network, which may pose hurdles [for on-time delivery]," a manager surnamed Duan at Wuhan-based Mengxin Technology Co told the Global Times on Monday.

Mengxin specializes in chip production for China's self-developed BeiDou Navigation Satellite System. The company has resumed some research and design work in Wuhan via telecommunications. Duan said the company plans to restart its Guangdong factory in mid-February to speed up chip production.

Unlike labor-intensive industries, chip production is highly automated, which means recruiting workers won't be a big problem. But logistics will.

Wuhan is in the 12th day of its lockdown, with outbound routes blocked as local authorities enforce stringent measures to contain the spread of the virus.

Home to $24-billion-invested Chinese chipmaker Yangtze Memory Technologies Co (YMTC), the city has risen in recent years to become an important production center for storage chips in addition to Shanghai and Shenzhen. Wuhan's annual production represents about 10 percent of China's storage chip output, industry insiders told the Global Times.

"If restrictions on transportation persist for months, how could we source necessary materials such as wafers into Wuhan? And vice versa, how could we ship products out of Wuhan?" a Wuhan-based industry insider surnamed Li said to the Global Times.

Li himself is now anxious, as he does not know when his chip-processing factory will be able to resume production.

Li is worried that his smartphone clients in Shenzhen will face a supply standstill. He is also worried that Chinese chipmakers will give their market share to US and South Korean rivals such as Samsung, LG and Micron Technology.

The storage-chip supply void is just one example of how the deadly virus could shake up not only China's supply chain, but also the global one.

Wuhan, with a population of 11 million and a GDP of 1.48 trillion yuan ($210 billion), has attracted leading panel display-makers such as BOE and Shenzhen CSOT to set up production lines in the city. It is now China's largest base for new displays, with its industry valued at over 100 million yuan.

BOE's high generation TFT-LCD production line in Wuhan entered mass production in December 2019. Its designed monthly capacity is 120,000 panels.

A spokesperson for the firm told the Global Times on Monday that due to pressure securing raw materials, BOE will cut the Wuhan line's monthly capacity and work with downstream and upstream partners to minimize the impact of the virus.

"The adjustment may worsen the strained supply-and-demand relationship further in global large-sized panel market in 2020," the spokesperson said.

Auto is another industry in Wuhan that is lagging under the fallout from the virus. The impact on the sector is also slated to be amplified through the industrial chain.

An industry observer told the Global Times that although some vehicle factories have inventories which will see them beyond the Spring Festival holidays, a delay in restarting production will not only affect vehicle delivery domestically, but also the supply of components to foreign partners.

But Li believes supply chain disruptions are only short-term and will only be evident in the first quarter.

"Chinese manufactures are very flexible. As the virus is gradually brought under control, most roads will reopen and everything will back on the right track," Li noted.