Macao in throes of epic transformation

Shift away from reliance on gaming on track but will take time

A general view of Macao Photo: VCG

As one of the two special administrative regions (SARs) of China and one of the four pivotal cities in the Guangdong-Hong Kong-Macao Greater Bay Area, Macao is embracing an epic transformation that will shape and shake the future of the gaming-centric city, as major policy announcements aimed at diversifying the local economy are expected on the 20th anniversary of its return to China falling on Friday.

In recent interviews with the Global Times, local influential figures and average people alike have voiced a staunch belief in the city's integration into the national economy. They have also shown interest in capitalizing on the push for the city's moderate economic diversification.

"Judging by what Macao looks like today, it's impossible to imagine what Macao was like 20 years ago," Kevin Ho King Lun, president of the Industry and Commerce Association of Macau (INCA), told the Global Times in an interview on Monday.

The changes over the past two decades are attributed to the central government's support and efforts by the local people to energize the economy, Ho said.

With a population of 672,000 as of the end of June and a land area of 32.9 square kilometers, according to local official data, Macao is arguably one of the most densely populated regions in the world.

Over the past two decades, the SAR -- in the single-minded pursuit of economic and social prosperity -- has seen its GDP increase seven-fold. The city, according to an IMF forecast released in mid-2018, is poised to leapfrog oil-rich Qatar as the richest place on the planet by 2020 as measured by per capita GDP.

Behind the enviable numbers is the city's rise to prominence as the world's gaming capital. Gaming revenues collected by the city far outstrip the figures for the western US state of Nevada, home to Las Vegas, according to publicly available data.

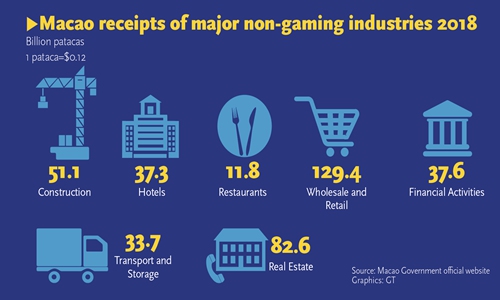

Graphics: GT

More growth engines

While the city's gaming sector has contributed the lion's share to local finances, some other industries -- including tourism, retail, exhibitions, finance and technology innovation -- although they're a much smaller part of the economy, have gained an increasingly high profile amid the city's drive toward a wider set of growth engines, local entrepreneurs said.

The local exhibition sector grew almost out of nowhere prior to Macao's return to China to rank now among the world's leading markets, and that shift shows the city's potential in diversifying its economy, Keyvin Bi, president of the Youth Association of Returned Overseas Chinese Macau, told the Global Times on Tuesday.

Months of social unrest in Hong Kong, traditionally a regional hub for exhibitions, has inevitably weighed on Hong Kong's attraction as a favored place to host such events, even for the finance sector, said Bi, also managing director of a local advertising and exhibition company.

Some of the event organizers eventually shifted toward the neighboring Macao and were impressed with the city's relaxed and friendly atmosphere, he went on to say, voicing his optimism about the outlook for the city's exhibition sector. He said Macao is unlikely to take on Hong Kong in the foreseeable future in the arena, however, as Macao is much smaller and can't compete with Hong Kong in terms of economic sophistication.

Reonna Cheong, business director of the Macao Franchise of Mr. Collection, a Hong Kong brand focusing on tailor-made men's fashion, now runs nine outlets, one in Hong Kong, one in Macao, and the rest spanning Guangdong.

Cheong, hailing from Macao, attributes her successful business expansion to the city's closer ties with the neighboring Guangdong Province.

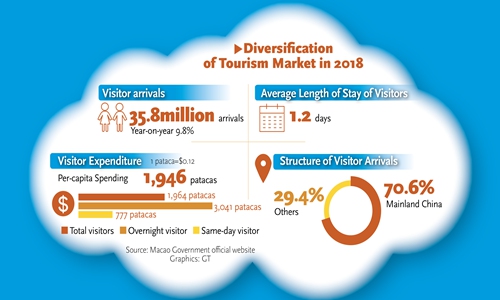

Graphics: GT

Coordinating policies

In an interview with the Global Times on Monday, she suggested efforts to simplify paperwork required to register businesses and operate them in the Chinese mainland, and to coordinate policies regarding taxes, border controls, and other issues, should be on the Greater Bay Area's policy agenda.

In another noteworthy sign of the city's gradual shift away from the gaming business, job options for local people, which have long revolved around casinos, hotels, and government positions, are seen as changing, according to local industry insiders.

An increasing number of locals have chosen to work full- or part-time as delivery staff, Chan Kei Ioi, head of a dispatch hub for local mobile takeaway app Aomi, told the Global Times.

Riders can earn as much as 30,000-40,000 patacas ($3,737-$4,983) per month, according to Chan, and some casino dealers have quit their jobs to join the ranks of delivery staff. Local university students often do the work on a part-time basis.

The starting salary for casino dealers stands at more than 15,000 patacas per month, a dealer working at a local casino said on condition of anonymity. The pay is not bad, but it pales comparison with delivery staff, said the dealer. In addition, casino jobs require employees to work different shifts, prompting many young people in particular to seek other options, according to the dealer.

Graphics: GT

Still, the shift away from gaming won't happen any time soon. The gaming sector will continue to underpin the local economy in years to come, said Ho.

Diversification takes time

The city's standing in the Greater Bay Area will give momentum to its economic diversification move, but that will take time. Also, Macao's gaming business is building the groundwork for its own diversification push, stressed Ho, also a Macao deputy to the National People's Congress, the country's top legislature.

An annual report gauging the progress of the city's moderate economic diversification was released by the SAR government last week. The findings showed that gross gaming revenues went up 14 percent last year, outpacing 4.7 percent aggregate economic growth. Non-gaming activities generated 9.97 percent of gaming concessions' revenue in 2018, a marginal drop from the prior year.