Coronavirus impact on Q1 economy bigger than SARS

Tourism, consumption, transport hardest hit

Photo taken on Jan 28 shows employees working at a medical products firm in Wuhan, Central China's Hubei Province. Photo: Xinhua

The coronavirus outbreak could deal a heavier blow to the Chinese economy than the Severe Acute Respiratory Syndrome (SARS) from almost two decades ago, weighing up to 2 percentage points on China's Q1 GDP growth for 2020 due to a steep decline in consumption, a key driver for the Chinese economy, said industry insiders and observers.Service industry sectors, including tourism, transportation, restaurant and retail will be the first to reel from the impact. As Chinese authorities have extended the Spring Festival holidays to February 2 and with factories having delayed work in an effort to stop the virus from spreading, the new epidemic will take a chunk out of the nation's manufacturing industry and disrupt the global supply chain.

"I'm anxious and worried. This is a battle for survival, but I'm losing territory," a manager of a small robotics company in Shenzhen, Guangdong Province surnamed Yang told the Global Times.

Yang's factory employs about 500 people, but has suspended operations due to concerns over the spread of the coronavirus. Yang does not have a date when his factory will resume operations and said it depends on when the epidemic will be under control.

"Our spending, mostly in factory rental cost and employee salaries, is amplifying day by day. But we don't have an income source. If production does not resume before mid-February, the direct and indirect economic loss could be millions of yuan," Yang said.

"Our spending, mostly in factory rental costs and employee salaries, is amplifying day by day. But we don't have an income source. If production does not resume before mid-February, direct and indirect economic losses could be in the millions of yuan," Yang said.

Across Guangdong, known as China's manufacturing base and trading hub, a mixed mood of sobriety and anxiety is spreading among entrepreneurs. Some pointed out that if the disruption is extended, many small- and medium-sized manufacturers would be mired in a capital crunch and could even face bankruptcy.

The Global Times learned that many Guangdong factories will resume operations on February 10, which industry insiders said was due to an order from the Guangdong government mandating that companies not begin production before that date.

"It will take more time for us to see productivity bounce back to normal levels. Manufacturing is a labor-intensive industry, but the outbreak of coronavirus will reduce the number of migrant workers coming to Guangdong," a manager of an electronic component supplier in Dongguan, who spoke on condition of anonymity, told the Global Times on Thursday.

Exports could also experience setbacks from a production slowdown.

The manager said the uncertainty over the volume of electronic component shipments could also make the firm fail to catch up with orders from India, Southeast Asia, Japan, and South Korea - its main export destinations - in the short term.

Chen Lianjie, general manager of the Zhejiang-based KANGLIDI Medical Articles which makes medical products, told the Global Times the firm has had difficulty in meeting export orders, which were placed last year, due to a lack of raw materials and employees.

Chen's factory resumed production on Spring Festival Eve as domestic demand soared, with production capacity reaching its largest daily output of 40,000 masks.

Half of the company's wound dressing orders were from Russia, Peru, and Southeast Asia, Chen said, noting the company now has prioritized domestic orders.

Photo: Yang Hui/GT

Waning consumption

Spring Festival is traditionally a peak holiday travel time, during which Chinese make inbound and outbound trips and embark on shopping sprees, providing a robust stimulus to the nation's economic output at the beginning of the year.

This year, as Chinese authorities imposed travel restrictions and millions of Chinese canceled travel plans in an effort to combat the epidemic, the contribution of consumption to the Chinese economy is likely to wane significantly, industry insiders said.

Xu Xiaolei, marketing manager of CYTS Tours, said the number of travelers who booked trips on the platform plunged to almost zero on Wednesday.

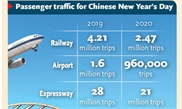

China Railway data revealed that rail services transported 2.93 million passengers on Wednesday, down 73.8 percent year-on-year.

Xue Qingde, a department store owner in Fuzhou, capital of East China's Fujian Province, told the Global Times that his store's daily turnover has dropped 50 percent as residents have curbed shopping activities.

"Consumption-related industries received a great shock due to the virus, with the consumption growth rate during this Spring Festival dropping to negative 3 to 5 percent," said Tian Yun, vice director of the Beijing Economic Operation Association. By comparison, China's consumption growth for the festival season in previous years was in the double digits.

Some analysts predicted the impact of the coronavirus could be bigger than SARS in the short term, as consumption contributed 57.8 percent to China's GDP growth last year compared to a 37 percent contribution rate since 2003.

Tian estimated that China's GDP growth in the first quarter may drop to 1 or 2 percent.

A closer examination of the 2003 Chinese economy during the SARS outbreak could provide a clue on how the resilient Chinese economy can withstand short-term headwinds.

During Q2 2003, when SARS hit, China's real GDP growth plunged by almost 2 percentage points to 7.9 percent due to subdued demand in consumption and reduced transportation. But it rebounded in Q3 and Q4 as consumption revived, driving the annual GDP growth rate to 9.9 percent in 2003.

Tian stressed the economic impact of the epidemic on China will not last after Q1 and won't change larger trends, as the Chinese will consume, eat, and shop more to make up for suppressed demands once the epidemic fades.

Analysts also expect the central government will consider macroeconomic policies to cushion short-term disruptions.

"In the longer term, as long as the trade tension between China and the US won't escalate this year, China's GDP growth will improve gradually during the next three quarters and remain steady between 5.7 to 5.9 percent this year," Tian predicted.