SOURCE / INDUSTRIES

China-Australia friction wreaks damage to Australia’s property market

Bilateral friction damages Australia’s property market

File Photo of Melbourne

Graphics: GT

House prices in Australia fell slightly in June amid a new virus outbreak and its deteriorating ties with China, as more Chinese choose not to buy properties there due to an increasingly unfriendly atmosphere.

According to data released by property data provider CoreLogic Inc, property values in major Australian cities dropped 0.8 percent last month, the sharpest decline since February 2019.

"A decline in the range of 0.5-1 percent is within expectations, mainly because of the COVID-19 outbreak. Recently, the number of Chinese coming to buy properties in Australia has also dropped for reasons such as Australia raising the threshold for foreign buyers and China tightening supervision over capital flight," Huang Kun, a partner at Melbourne-based property development consultancy firm Mezzanine Property Group, told the Global Times on Thursday.

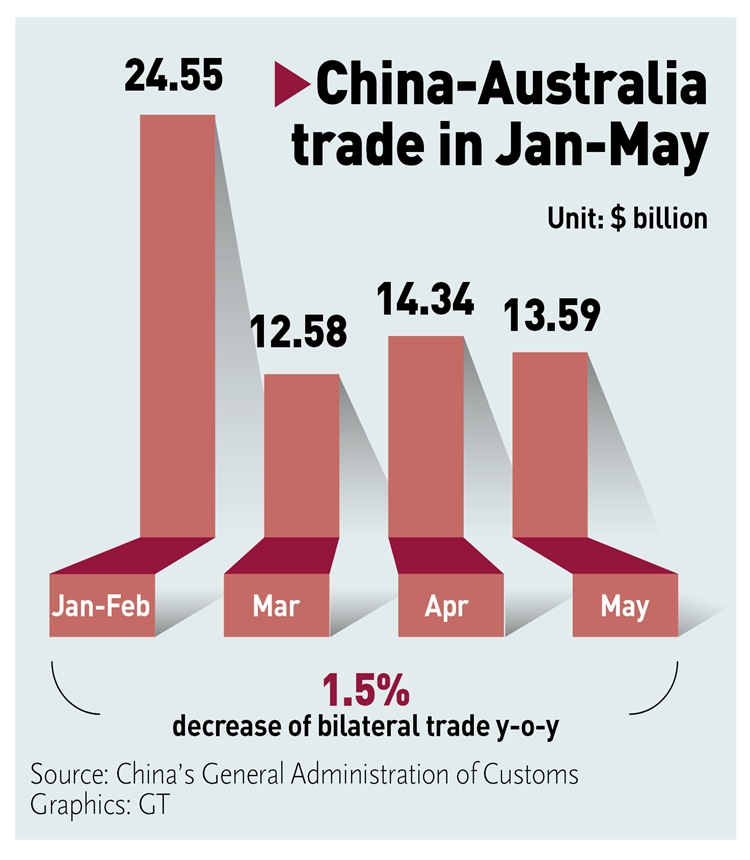

Australia's souring diplomatic ties with China and unfriendly domestic atmosphere are playing a role in the decline in property investments made by Chinese as well as bilateral trade, Ruan Zongze, executive vice president of the China Institute of International Studies, told the Global Times.

A Brisbane-based real estate agent servicing Chinese buyers who asked for anonymity told the Global Times on Thursday that Chinese had snapped up properties in Australia primarily so their children could attend school there or as a safe haven for capital, but worsening ties between the two countries may see a downturn in the trend. The market is unlikely to recover in the short term.

According to a survey by Chinese property portal Juwai in July 2018, of the 1.2 million Chinese tourists visiting Australia annually, a quarter could be looking to buy a property there.

However, "a surge of racism in Australia toward Chinese may frighten Chinese from studying in or traveling to Australia and therefore impact the local real estate market," the agent said, noting that many Chinese students that planned to study in Australia may shift to other destinations such as the UK and the Hong Kong Special Administrative Region.

After a spate of racially motivated incidents targeting Asians in Australia, the Chinese Ministry of Education issued its first warning this year in June for students preparing to study overseas, urging Chinese students to evaluate the risks involved if choosing to go to or return to Australian schools.

"If Australia continues to launch unreasonable attacks on its most important trading partner over groundless things and push ahead with decoupling, its economy will be directly affected," Ruan said.

According to ABC News, Australia's economy shrank 0.3 percent in the first quarter of this year, and economists expect a negative growth in the second quarter.

Ruan said that Australia should adopt foreign policies that are less affected by the US and rethink its ties with China, as China-Australia economic and trade cooperation has great potential.

The two countries maintained a sound relationship for a long time in the past. In 2015, the China-Australia Free Trade Agreement came into force, bringing enormous benefits to Australia. Only a year after the agreement took effect, Australia's exports of wine to China soared 33 percent year-on-year, making China its largest wine export market, official data showed.

"After the 2008 financial crisis, Australia was the only developed economy that maintained growth, to which Chinese mineral buyers made a crucial contribution. Currently under a global decline in growth, Australia should cherish its economic ties with China more," he said.