The new flagship branch of Apple in Beijing Photo:Zhang Dan/GT

Amid a trade war that has seen huge amount of money lost on both sides of the Pacific, and persistent attempts by the Donald Trump administration to decouple with China in the technology sphere, Wall Street placed the laureate of the world's most valuable listed company on Apple Inc, the giant that is most reliant on the Chinese mainland market among the four largest US tech giants.

Analysts said this reflected the close relationship between the robust Chinese market and US multinationals which they said will step out to impede Trump's re-election if their business in Chinese mainland is adversely impacted.

Apple Inc doubled its market value in just over two years to become the first American firm hitting a market capitalization of $2 trillion on Wednesday. That of Amazon and Microsoft stood at around $1.6 trillion, followed by Google's parent company Alphabet Inc's nearly $1 trillion and Facebook at around $760 billion.

Analysts said the fact that Apple became the first US company to make history as the world's first $2 trillion firm and the company's deep integration with China is in itself worth appreciating.

"Apple's all-time high valuation is proof of Wall Street's confidence that the deteriorating China-US relations can be contained, despite all that's going on," said Chen Da, an executive director with Shanghai-based Anlan Capital. "Money doesn't lie."

Observers said Apple's relationship with the Chinese market is one of mutual accomplishment, like the one in an ideal marriage.

Despite often being criticized for the lack of innovation when compared with his predecessor - the legendary Steve Jobs - Tim Cook has actually done a remarkably good job in growing Apple's fortune and influence, and a huge chunk of Tim Cook's success comes from his well-played China card.

While serving as Chief Executive Officer, Cook has largely moved Apple's production to original equipment manufacturers (OEMs) based in the Chinese mainland, which, together with Hong Kong and the island of Taiwan, is Apple's third largest market. He has also greatly expanded Apple's market penetration in China.

During the past decade, Apple has successfully integrated itself within the world's factory floor and what's soon to be the largest consumer market, commanding $44 billion.

Apple has also been improving its relationship with Chinese local suppliers such as Warren Buffett-invested Chinese battery maker BYD, as its traditional partnership with Taiwan-based OEMs faded.

The Chinese market is so important to Apple that it is applying China's home-developed BeiDou Satellite Navigation System in its iPhone 11 models as part of its location data system.

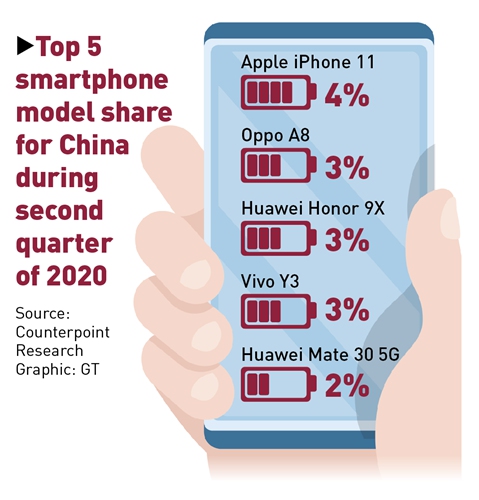

Attention paid to the Chinese market has paid off. Latest figures from market research firm Counterpoint Research showed that the iPhone 11 is the most popular model of all smartphone brands sold on the Chinese market in the second quarter.

As Apple's capitalization touches a historic milestone, US-based investment bank Morgan Stanley further injected confidence with a research note on Wednesday saying that Apple will have a "significant iPhone upgrade potential in China," the largest in at least four years, and accordingly the company's iPhone shipment growth could meaningfully accelerate in the 2021 fiscal year.

Top 5 smartphone model share for China during second quarter of 2020.

Making a fortune in China

Apart from Apple, a bunch of other US companies such as Tesla, Qualcomm, Boeing, Starbucks and Nike have been extremely successful in the Chinese market despite the ongoing trade conflicts between the two countries.

Betting on China becoming the world's largest market for the Tesla Model 3, the US electric vehicle (EV) maker built a gigafactory in Shanghai with a miracle speed in only 10 months in 2019. In a few months' time, the Model 3 has become the top selling EV in China with 45,800 units sold in the first half of this year.

In the quarter ending on June 30, Tesla's revenue in China climbed 102.9 percent year-on-year to $1.4 billion, according to its financial result filing to the US Securities and Exchange Commission. During the quarter, China accounts for 23.3 percent of Tesla's total revenue, compared with only around 11 percent for the same period last year.

American businesses are not leaving the Chinese market. Five-year projections from US companies doing business in China are bullish, with nearly 70 percent expressing optimism about the market's prospects and 87 percent saying they have no plans to shift production out of China, a recent report from the US-China Business Council showed.

It said 83 percent of companies counted China as either the top or among the top five priorities for their global strategy.

Wall Street has a say

Li Haidong, a professor at the Institute of International Relations at the China Foreign Affairs University, told the Global Times on Thursday, "As US policies and many key politicians are connected with Wall Street, the US would see an undesirable result if their rhetoric and policies go against capitals."

He pointed out that to cushion the impact brought on by the global pandemic, the Trump administration granted government emergency aid to publicly traded companies that already had enough money to cover basic expenses for months instead of small businesses.

Observers warned that the US authorities should think twice when formulating policies about China and Chinese companies, if American politicians that have close ties with Wall Street don't want to let their donors down as well as slow US economic growth.

Li Yong, deputy chairman of the Expert Committee of the China Association of International Trade, told the Global Times that American companies have raked in handsome profits in China amid the country's reform and opening-up over the past 40 years, and the last thing they want to see is economic decoupling between the two economies and an abandonment the Chinese market.

A multinational company cannot really vindicate itself if it has no presence in China - a huge market of 1.4 billion consumers, Li said.

In the wake of Trump's executive order aiming to ban WeChat from next month, more than a dozen major US multinational companies, including Apple, Ford, Walmart and Disney, have raised their concerns with White House officials over the adverse impacts of the order, according to a Wall Street Journal report on August 13.

If Trump insists on going against the interests of the US corporate community and Wall Street by flaring up tensions with China, American tycoons may do everything to impede Trump's re-election bid in November, said Liang Haiming, chairman of the China Silk Road iValley Research Institute.