Huawei to survive under US pressure

US ban severely disrupts global supply chain, causes huge losses: industry insiders

Huawei Photo: Deng Zijun/GT

At Huawei's research and development center in Dongguan, South China's Guangdong Province, though very few employees spend much time talking about September 15, the date when the latest US ban takes effect, some consider it the moment that China's semiconductor industry should always remember, as it has paid a heavy price for relying on US technologies.

Wearing nerdy shirts with backpacks, young engineers at the R&D center appeared to be calm, though the company has officially entered its darkest moment when its major chipset suppliers have gradually suspended providing supplies under the US export ban. With no palpable anxiety felt at Huawei offices, the crackdown by the US government on the private Chinese company in the past two years taught many Huawei staff one important thing: Be focused, make maximum efforts, and prepare for the worst.

September 15 (Tuesday) was the date set by the US government for curbing high-end chipset supplies to Huawei, which would deliver a heavy blow to the company's Kirin chips, and further weigh on its high-end flagship smartphones. Several industry representatives from the supply chain told the Global Times that major chipset manufacturers such as Samsung, MediaTek, Qualcomm and Micron have stopped shipments to Huawei, while some reportedly began applying for new export licenses in accordance with the US rules.

We are at a very difficult moment, some Huawei employees told the Global Times. They preferred not to be identified as they were not allowed to talk to the media. However, instead of just complaints about the difficulties, such a crisis could also be turned into an opportunity, some said. "We'll survive, eventually."

Influenced by the military theories of late chairman Mao Zedong, Huawei founder Ren Zhengfei has also brought military-style discipline to shape Huawei's corporate culture, often known as "wolf spirit": Never give in or yield to pressure. It's normal for Huawei staff to work from early morning to late night, especially at such a difficult period. It has become a battle cry to race up against the escalating US crackdown.

"Today is an ordinary day, but it's also a special day for the global tech industry. No need to complain about it, and the Chinese tech industry needs to be strong," said Huang Haifeng, an independent telecom industry insider.

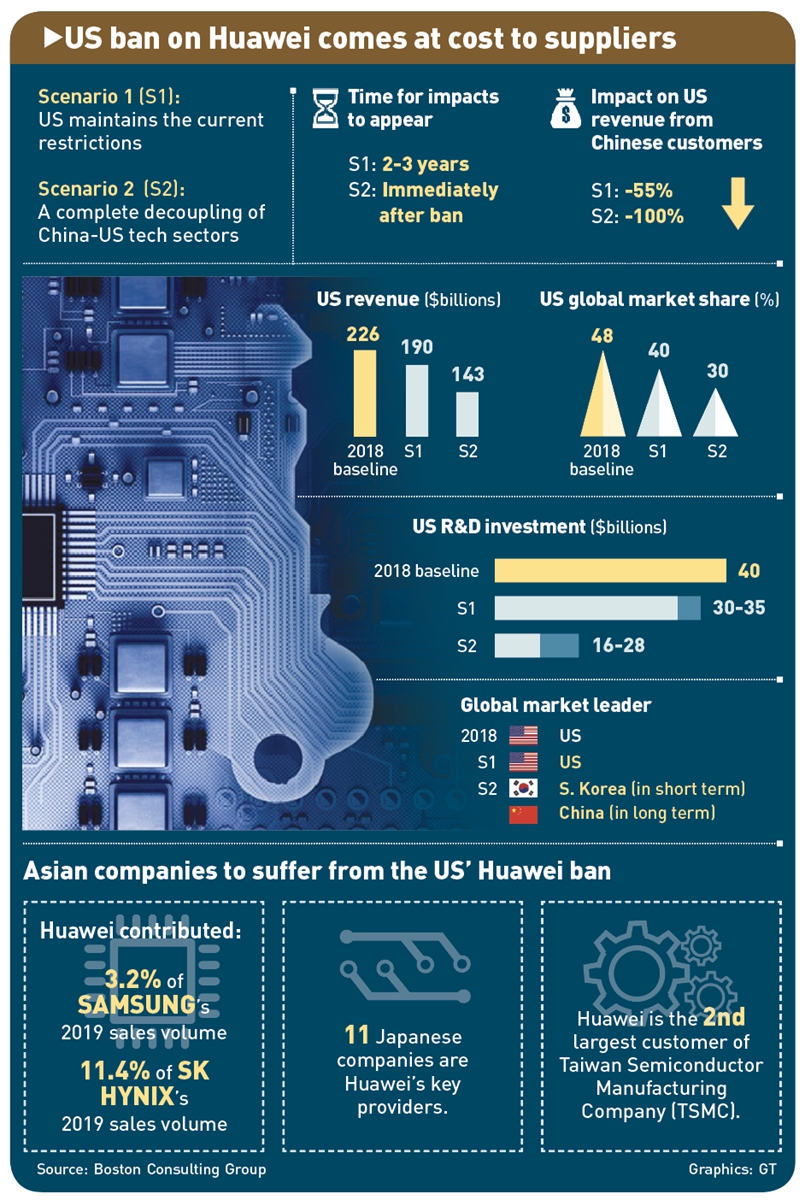

Infographic: GT

Plan B?

Richard Yu Chengdong, CEO of Huawei's consumer division, warned in August that after September 15, the high-end Kirin chipset could not be produced anymore, and the overall shipments of smartphones would shrink to below 240 million units.

The upcoming Huawei Mate 40, equipped with the Kirin 9000, could be the last generation of Huawei phones powered by its self-developed chipset. Some industry representatives speculated on whether Huawei would abandon its high-end smartphone business as the worst scenario under the US ban. But the Chinese tech giant has been diversifying its business from its core sector, including its telecom carrier business and smartphones, to the Internet of Things, hoping to build up a new ecosystem to support various smart devices such as tablets, watches, cars, earphones and laptops. Some industry analysts believe that the company may not have any plan B.

It has been also investing heavily in other business sectors such as artificial intelligence and cloud computing, finding new ways to offset the impact of the US sanctions.

Guo Ping, Huawei's rotating chairman, recently said during an internal meeting that he is confident Huawei can eventually find a solution, especially for high-end smartphones, amid the US crackdown on its Kirin chipset. "It's very hard for a smartphone manufacturer to forge an ecosystem [referring to Huawei Mobile Services], but we've achieved results beyond our expectations," Guo said.

In the short term, the ban will affect Huawei's business deployment and the confidence of its downstream partners. But from a long-term perspective, Huawei will come up with solutions to deal with cut-off supplies, Ma Jihua, a veteran industry analyst, told the Global Times on Tuesday.

"In less than a year, such a dilemma will be fixed," he said.

Huawei will not run out of chips despite the US attempt to kill it, as China has realized independent innovation on chips with a "Chinese system," Ni Guangnan, an 81-year-old academician with the Chinese Academy of Engineering in Beijing, told the Global Times on Monday.

He said, "Even if our country purchases fewer or no new US CPU chips in the next few years, it will not have a significant impact on China's new infrastructure."

Even if our country's chip industry is stuck, conventionally made domestic CPUs or a large number of old Intel CPUs, or even the readily available CPU chips for ordinary PCs, can be used to ensure the operations of our key information infrastructure and general data centers, the academician said.

Shockwaves across industry

For those who remain cautiously optimistic toward Huawei's future and see US decoupling from China in high-tech unlikely, they see US restrictions on Huawei as a greater impact on the entire industrial and supply chain, which would severely disrupt it, and cause American companies tremendous losses.

"As far as we know, major chip manufacturers have been applying for new licenses, as they understand how important the Chinese market is," an industry insider who refused to be identified told the Global Times on Tuesday.

Suppliers like TSMC, MediaTek and Samsung also applied to the US in line with regulations, which are now awaiting approval, financial news site yicai.com reported.

Chinese chip giant SMIC also confirmed with the Global Times that it has applied to the US for continuing supplying Huawei in accordance with regulations.

Industry insiders told the Global Times on Monday that Huawei recently chartered a cargo flight to transport chip products made by suppliers such as TSMC and MediaTek.

At the same time, Huawei still owns a sufficient inventory of key raw materials, while some devices have been replaced to ensure a steady pace of shipment. "We won't see any negative impact on the overall business in next one to two years," Jiang Junmu, chief writer at telecom industry news website c114.com.cn, told the Global Times. Still, the firm is facing a long-term strategic adjustment and supply chain restructuring.

Seeking decoupling from China in high technology would also be painful for the US.

Over the next three to five years, US semiconductor companies could lose 8 percentage points of global share and 16 percent of their revenuesif the US maintains current restrictions on access to products containing US technology by Chinese companies included on the Entity List, a Boston Consulting Group analysis said in March.

"We can't run away from the storm, but we believe we'll see the rainbow after the storm," a Huawei employee told the Global Times, as a rainbow appeared after a heavy downpour during the recent Huawei Developers Conference in Dongguan.