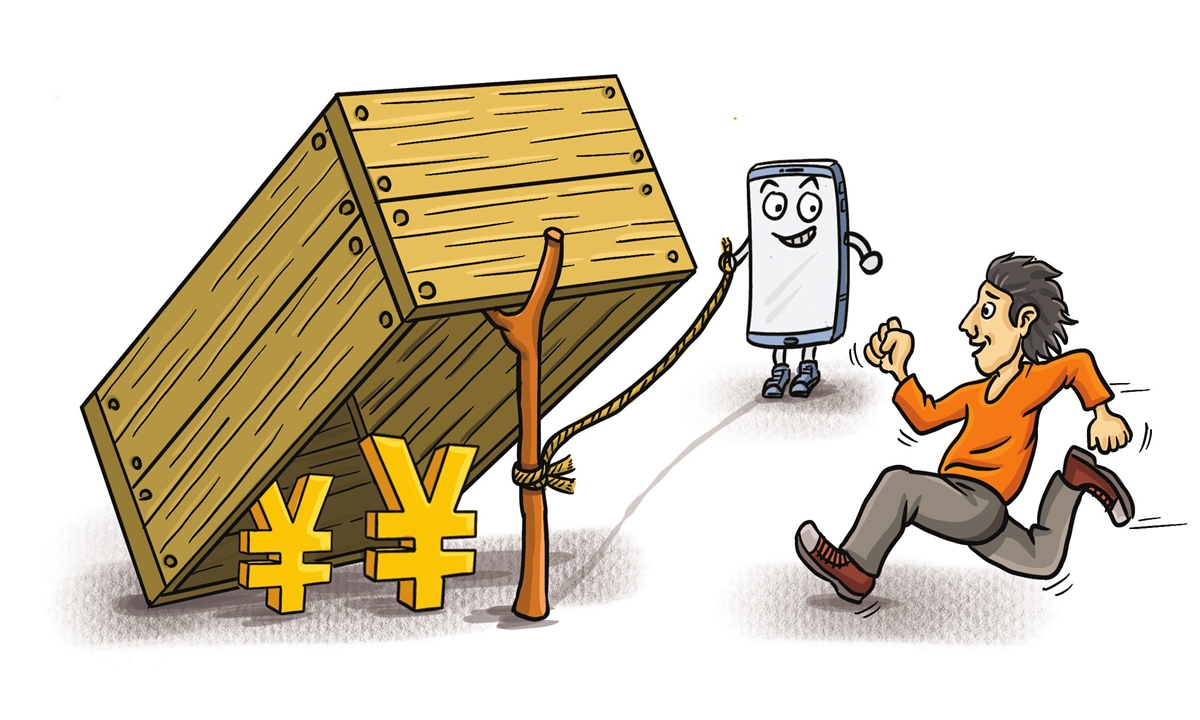

Illustration: Xia Qing/GT

As the year end approaches, a group called "debtor alliance" on social media is seeing more and more desperate young debtors swarming in. They share stories about how they built up high debts through online loans. They are eager to huddle together and find useful advice from each other. According to a 2019 Report on the debt status of young Chinese consumers, 44.5 percent of young people in China are in real debt. Overall, internet loans can be attractive due to its low threshold, quick money inflow and high quota. This is especially true for young people who have less self-discipline and more desire to consume. But it can also create nightmares if one overdraws the "money from tomorrow" to fill one's bottomless temptations. Whether internet lending can be a helpful tool to solve one's urgent needs or instead cause a black hole that absorbs everything one owns really depends on how one can efficiently control spending. They should wisely use credit products instead of squandering away future savings.