Chinese smartphone vendors eye global markets

5G, IoT and bottoming out will be key words for 2021: analysts

A view of a Huawei store in Central China's Henan Province in November 2020 Photo: cnsphoto

The sluggishly growing smartphone industry, both domestically and globally, was expected to bottom out in 2021, however, with the market further rocked by the spread of a global pandemic.

With 5G networks being applied in a broader range and innovative technology and design including foldable phones and internet of Things (IoT) accelerating, this year is expected to witness the smartphone sector strengthen, going against pandemic fallout despite looming uncertainty, industry experts told the Global Times.

According to market intelligence provider Trend Force, the output for global smartphones is forecast to reach 1.25 billion devices in 2020, 11 percent fewer compared to 2019, the record largest drop.

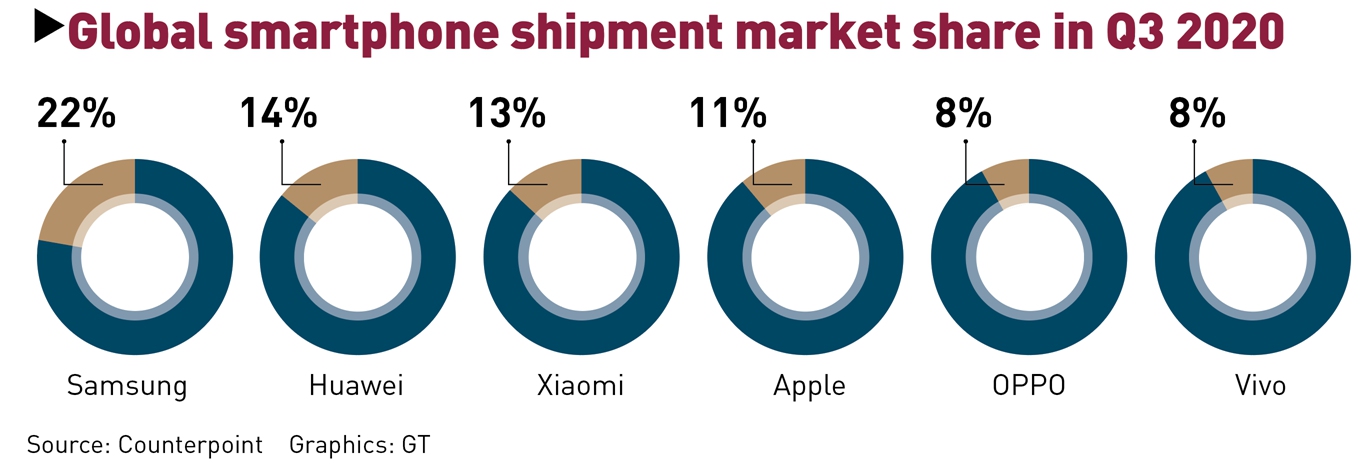

The top six brands were Samsung, Apple, Huawei, Xiaomi, OPPO, and Vivo, with Huawei suffering the most due to the restricted access to chips using US technology under the Trump administration.

According to a report by industry analyst Counterpoint's addressing the market share and growth of smartphone shipments for the third quarter of 2020, Huawei's smartphone shipments in global markets were 50.9 million units, a decrease of 7 percent on a quarterly basis and down 23.8 percent year-on-year. Its smartphone market share slid to 14 percent, compared with 18 percent in the third quarter of 2019.

Graphics: GT

As US President-elect Joe Biden's inauguration draws closer, the question of whether Huawei's chip supply curb will be lifted is still uncertain, Xiang Ligang, director-general of the Beijing-based Information Consumption Alliance, told the Global Times.

"But one thing to note is that after the US ban on Huawei, chips produced by American firms will be affected by fewer and slower sales. In addition, with domestic independent research and development (R&D) on chips advances, American manufacturers may lose the Chinese market," Xiang noted.

It seems Huawei has now dropped any illusion for obtaining any US greenlight on its chip issue, instead it is making all-out efforts out of the public sight on its big projects to realize self-rescue, Sun Yanbiao, head of Shenzhen-based research firm N1mobile, told the Global Times on Tuesday.

For the year of 2021, however, the prospect of Huawei smartphone's global performance is grim as illustrated in the Trend Force report, saying that the company will be pushed out of the Top 6 and comes in the seventh spot in terms of global market share even surpassed by Transsion, the little-known Chinese phone-maker yet taking a dominant share in Africa.

Apart from the chip dilemma which remains without a short-term solution, the spinning-off of its sub-brand, Honor, will also contribute to Huawei's further shrinking market share in 2021, said the report.

However, as Sun pointed out: although Huawei's market share is at risk of sliding further downwards, its position as a top major player remains safe.

"The rapid development of Huawei's Hongmeng operating system (OS) has become a key driver in the rise of China's OS. Huawei's HMS mobile ecosystem has also alleviated the pressure on its phones in overseas markets," said Huang Haifeng, an independent telecom industry insider.

Racing for global markets

Chinese smartphone vendors are the most capable players in swift adjustment amid the pandemic disruptions and turned the health crisis into an opportunity. They are racing for a larger share of overseas markets, analysts said.

"Huawei's overseas share dropped 30 percent in the third quarter of 2020 from the same period in the previous year, continuing to give up space. Xiaomi is the biggest beneficiary, with a substantial growth of more than 50 percent in overseas markets through radical channel strategy and competitive product strategy, filling in the space left by Huawei," said Jia Mo, an analyst at market research firm Canalys.

In the third quarter, Xiaomi's smartphone shipments increased 45.3 percent year-on-year to 46.6 million units, surpassing Apple to rank third in the world, with a market share of 13.5 percent, the first time that the Chinese vendor returned to the top three global smartphone rankings after six years.

The company unveiled its first premium smartphone Mi 11, the latest flagship model in its Mi line-up in December, marching forward to the high-end segment.

The market value of Xiaomi Group exceeded the HK$800 billion ($103.2 billion) threshold and reached HK$900 billion for the first time on Tuesday's trading in the Hong Kong Stock Exchange.

Since it will take about half a year for Honor to resume chip purchase orders, Xiaomi, OPPO, and Vivo are expected to seize part of domestic market and mid- and low-end markets overseas, according to a report by CITIC Securities.

In 2020, OPPO achieved growth against an overall downward trend. In Southeast Asia, it maintains the leading position in the market; while expanding sales in India, OPPO brand preference in the country increased by 33 percent; in western Europe and Japan, its shipments have more than doubled, data showed.

Analysts of Trend Force expected a strong wave of device replacement and demand growth in emerging markets in 2021, boosted by which, the annual global smartphone production for 2021 is predicted to be 1.36 billion units, an increase of 9 percent from 2020.

"5G, IoT, foldable models and bottoming out will be the key words for the smartphone sector in 2021," Sun estimated.

"Major domestic vendors will ramp up R&D investment, which will promote innovations such as mobile phone connection, interaction and screen. And they are also expected to invest more in innovation such as chips," Huang told the Global Times.

Market competition in 2021 will not focus on smartphone as a single product, instead it will be a full-scenario competition. "The interactive and collaborative capabilities of all-scenario products such as mobile phones, personable computers, watches, and smart screens will greatly affect consumers' choices," Huang added.