China’s infrared thermal imagers thrive globally amid pandemic

Self-developed technology becomes a pillar in virus prevention

An infrared thermal imaging device measures people's temperatures in an electronic goods mall in Shenzhen, South China's Guangdong Province in March, 2020. Photo: VCG

After years of staggering under the shadow of a Western dominance, Chinese infrared thermal imaging device producers have finally walked into the spotlight, with global market share increasing by up to a quarter in 2020, following a timely response to explosive needs worldwide, while other countries, such as the US, have been plagued with production halts and capacity inadequacies due to the uncontrolled epidemic.

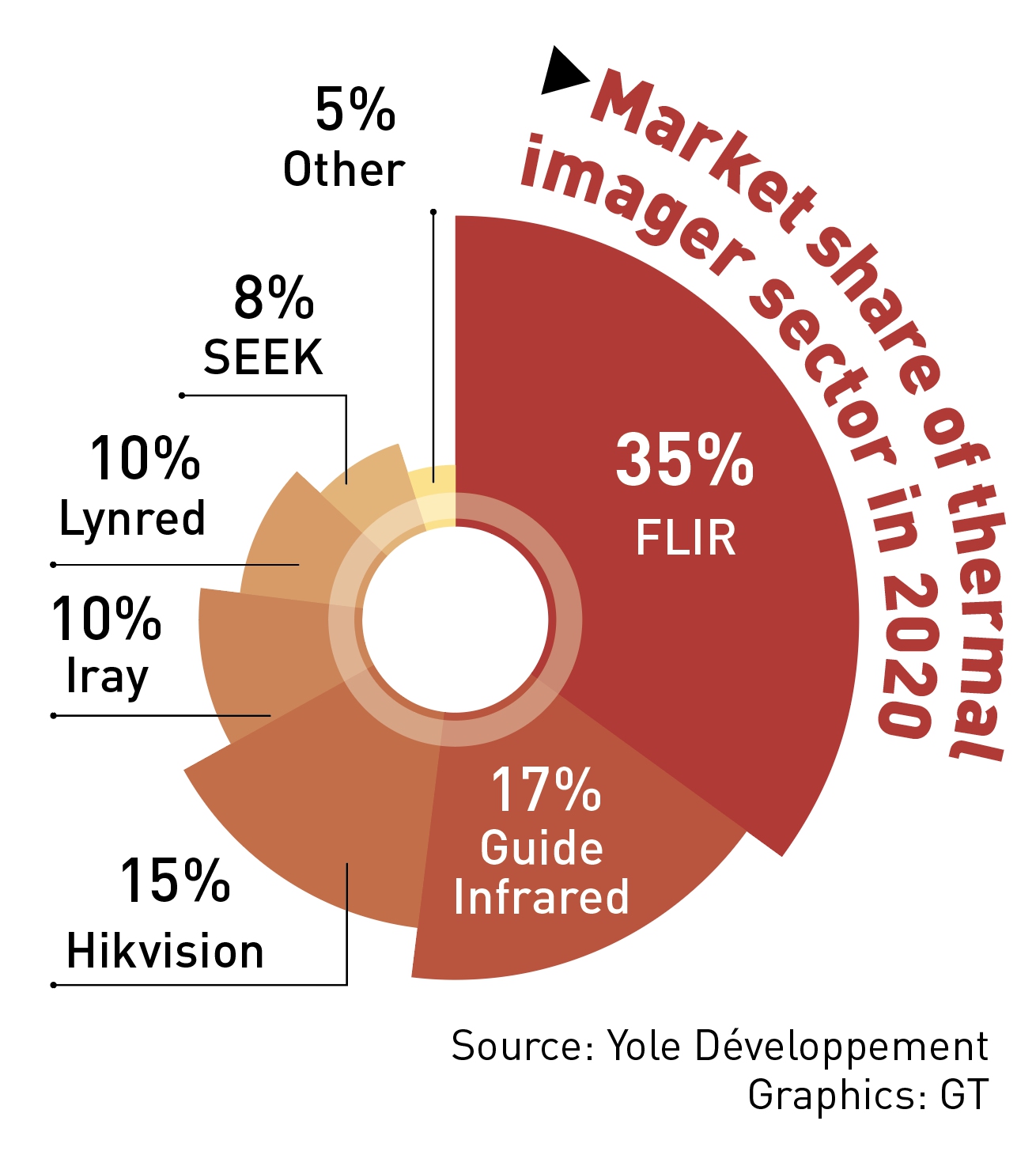

Data by international market research company Yole Développement shows that four out of the top ten infrared thermal imaging companies are now Chinese, covering 44 percent of global market share in 2020, an increase of 29 percent year-on-year.

Such extensive growth has led the company to issue a new forecast: by 2025, China's share of the global infrared thermal imaging market will reach 64 percent.

The rise of Chinese manufacturers is due not only to China's timely production resumption after a swift response to the virus outbreak, but also comes following China's breakthrough in the research and development as well as mass production of the sensor, which is the core technology of the device, despite constant blockades from the US and some European countries, industry insiders said.

Thermal imaging systems have been widely used in public spaces to detect high body temperatures during the COVID-19 pandemic for screening potential infections.

Against all odds

The infrared thermal imager, also used primarily for night observation and thermal target detection, was first utilized in military applications. With the demand for infrared products continuously rising in recent years, especially following the SARS outbreak of 2003, during which infrared thermometers became urgently needed overnight, the need for high-end infrared products for civil use has been constantly growing, with COVID-19 further igniting demand.

The infrared thermal imaging detector chip is the core of the infrared industry, and its performance directly determines the resolution and sensitivity of infrared thermal imaging equipment.

However, for a long time, Western developed countries have adopted strict technology blockades and product embargo policies for infrared imaging, substantially limiting the growth of global high-end infrared product markets.

Before 2018, the North American market accounted for more than 60 percent of the global share of infrared thermography products, with US companies accounting for seven of the world's top 10 suppliers, industry research network Chinairn.com reported in March, 2019.

Development and production of the core chip was mastered by a few Western countries for a long time, and if domestic enterprises wanted to produce infrared thermal imagers, the core equipment could only rely on high-priced imports, Xiang Ligang, an industry expert, told the Global Times on Friday.

The situation began to change in 2018 when Chinese companies broke free from the cycle with the independent development and mass production of infrared detectors.

In 2018, Chinese firm Guide Infrared launched its self-developed megapixel infrared sensor, improving the spatial resolution of the infrared thermal imager system, with the main technical performance index exceeding the international similar product index, according to media reports.

This important milestone in China's infrared industry has rapidly promoted the Wuhan-based firm in the global market.

In global infrared thermal imaging unit shipments in 2020, Guide Infrared become the world's second-largest thermal imaging manufacturer, with a global market share of 17 percent, following US' FLIR, ranking first with a market share of 35 percent, according to the latest report by Yole Développement in February.

In addition to Guide Infrared, other Chinese companies, including Hikvision, Raytrontek and Dali Technology, have also made it onto the global top ten list, the report showed.

Tech breakthroughs

The growing market share is another reflection of China's contribution to global epidemic prevention.

Thanks to the self-developed core chips, Chinese manufacturers are able to produce the products to satisfy worldwide demand without relying on imports, making China an indispensable provider for screening devices in enormous capacity and reasonable prices amid the production halt in many other countries caused by the epidemic, experts said.

Meanwhile, although FLIR is the world's largest supplier of infrared thermal imagers, its capacity expansion was hampered by the COVID-19 outbreak and it experienced a huge backlog of orders, with many US companies turning to Chinese suppliers with surplus production capacity in order to strengthen prevention and control for their internal staff, according to media reports.

Dali Technology, based in Hangzhou, East China's Zhejiang Province, exported 20,000 infrared temperature measuring systems last year, a multi-fold increase from 2019, including in the US market.

"In the past, our core technologies, including chips, were all imported. However, with the strengthening of self-research and development, we began to reduce the import of foreign chips, and gradually fully realized the self-research and development of chips," a manager with Dali Technology, surnamed Xue, told the Global Times on Friday.

With the independent development and production of the sensor chip, the company has guaranteed production capacity and price stability, which enabled them to respond quickly to global demand last year and grab more global market share, Xue said.

Graphics: GT

Guide Infrared has also achieved significant growth in production capacity, which was expanded by 50 percent last year, the highest annual production capacity in recent years, with workers working in three shifts a day from February to September to meet the booming orders, according to sources.

"Since the outbreak last year, we have expanded exports to over 70-80 countries around the world, mainly Europe and the US, with a total of 30,000 sets of infrared temperature measurement systems exported in 2020," a source with Guide Infrared told the Global Times in a previous interview.

Chinese producers were leading the export trend for the products, said Li Kuiwen, spokesperson for the General Administration of Customs, at a press conference in January.

China's customs inspected and released 119 million infrared thermometers from March 2020 to the end of last year.

The growing trend for export is expected to continue this year following US President Joe Biden's announcement of stricter policies on epidemic prevention and the occurrence of second-wave outbreaks of the virus in many other countries, industry insiders said.

The global thermal imaging market is expected to grow by 8 percent from 2019 to 2025 in terms of compound annual growth rate, reaching a market value of approximately $7.5 billion by 2025, according to Yole Développement.

"In 2021, it is expected to increase turnover by 40 percent, of which exports will account for 50 percent," said the source with Guide Infrared.