Beijing court vital to protect investors' interests overseas, part of push for extraterritorial application of Chinese financial legislation

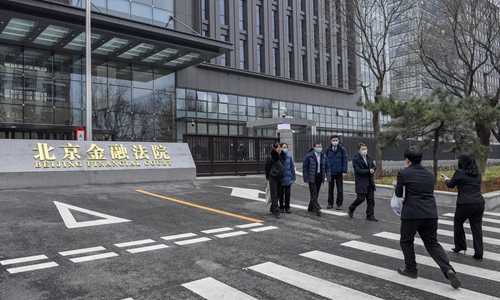

Citizens take photos in front of the Beijing Financial Court on Thursday. Photo: cnsphoto

China's second financial court was officially launched in Beijing on Thursday, setting in motion a specialized tribunal to take up cases that relate to damage to domestic investors arising from overseas listings or overseas financial institutions' offerings.

A case involving an asset management firm's litigation against a bank, an accounting firm, an asset credit rating firm and a law firm over liability in securities fraud, filed online on Thursday, became the first case to be accepted by the new court, Beijing High People's Court announced on Thursday at a press conference.

The Beijing Financial Court is initially seated with 25 judges, with an average age of 41.7, including 11 with doctoral degrees and 13 with master's degrees, according to Cai Huiyong, president of the court.

The launch of the Beijing Financial Court, the second after the creation of the Shanghai Financial Court in 2018, came on the heels of rules unveiled by the Supreme People's Court that crystallized the new court's jurisdiction.

The Beijing Financial Court will have cross-regional jurisdiction over lawsuits related to damage to the rights and interests of domestic investors by overseas firms, as well as securities disputes concerning companies listed on the selected layer of the National Equities Exchange and Quotations, the country's over-the-counter market known as the "new third board," according to a statement on the website of the Supreme People's Court on Tuesday.

The new court's jurisdiction also includes administrative lawsuits and non-litigation administrative enforcement cases resulting from the undertaking of financial oversight duties by the country's financial authorities.

The Beijing court's jurisdiction over damage to domestic investors arising from overseas securities listings, trading activities or futures trades, and financial products or services provided by overseas financial institutions, is based on the country's revised Securities Law, the top court said in a question-and-answer also released on Tuesday.

The centralized jurisdiction of such disputes in the Beijing court bodes well for the implementation of the extraterritorial application of the revised Securities Law, according to the top court. The draft futures law and commercial bank law, which are under revision, also include clauses about their extraterritorial application.

There are already plans for case filing with the new court, China Business News reported on Thursday, citing an attorney from a law firm in Beijing representing a suit by domestic investors against an overseas-listed firm, which wasn't identified.

Hao Junbo, chief lawyer at the HAO Law Firm in Beijing, told the Global Times on Thursday that the new court might fill a judicial void involving some companies that swindle Chinese domestic investors.

In practical terms, for the extraterritorial application of domestic financial laws to genuinely flex its muscle, the country will need to enhance judicial cooperation - notably with the US, Dong Dengxin, director of the Financial Securities Institute at Wuhan University of Science and Technology, told the Global Times on Thursday, calling for more legal paperwork to ensure the enforcement of the new court's judgments regarding overseas trading activities or overseas financial agencies.