Illustration: Xia Qing/GT

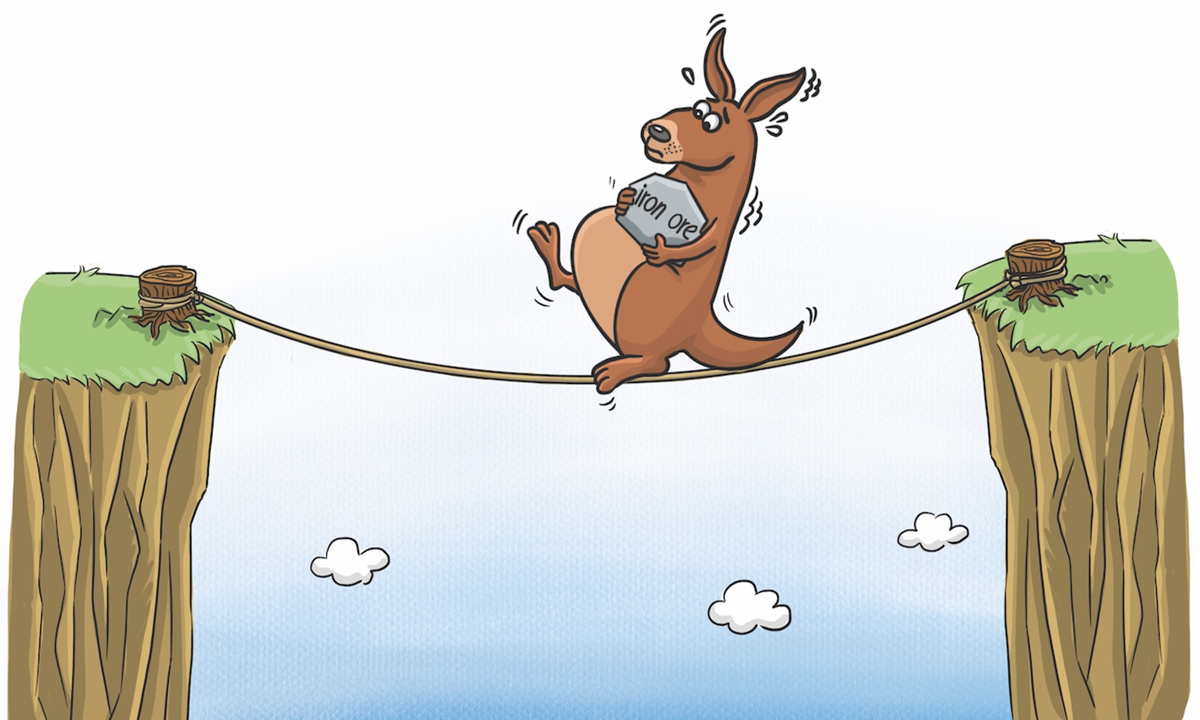

The prospect of declining iron ore prices may offer an opportunity for Australia to reflect on its structural economic challenges.

Chinese iron ore futures tumbled on Monday as market players were concerned about the weak demand for the commodity. A notice issued last week by China's top steelmaking city of Tangshan, North China's Hebei Province, on production cuts is now widely seen by observers as the beginning of China's efforts to clamp down on steel output for environmental protection purposes in line with its carbon neutrality agenda.

This downward pressure on iron ore may serve as a heavy blow on Australia, the world's largest exporter of iron ore, which has been smug when it comes to the "irreplaceability" of iron ore supplies to China.

Over the past months, despite the deteriorating China-Australia relations, bilateral trade, particularly Australian exports to China, didn't show the sharp drop many had expected. And an important reason behind the phenomenon is the remarkable gain in iron ore prices, which saw surging export value of the commodity from Australia. This has even led some in Canberra to boast that Australia can fully recover the economic loss from China's trade tensions by exporting high-priced iron ore.

Yet, the rise and fall in iron ore prices are based on supply and demand relationship in the market, which is apparently undergoing a fundamental change.

China accounts for more than half of the world's steel output, while Hebei accounts for about a quarter of China's steel output, and Tangshan half of Hebei's steel output. Therefore, China's declining steel production for environmental protection purposes as well as efforts to promote the scrap reutilization will likely lead to a drop in demand for iron ore, which in turn will result in a slump in global iron ore prices.

In the past, the surge in iron ore prices has covered up the structural problems in China-Australia trade, which could be all exposed once the prices fall. The Australian economy's over-reliance on the flourishing mining industry has weakened Canberra's ability to properly assess its economic strength and improve its economic situation. And a distorted perception about itself and its major trading partner may also explain why its government chose to recklessly poison relations with China and damage its national brand in the eyes of many Chinese consumers.

It would probably be a good thing if after the fall in iron ore prices, the China-Australia trade data could more accurately reflect the true problems with Australia's economy. Only when real pain is felt by the Australian economy will Canberra be motivated to seek structural changes to its economy, creating a better environment for trade.