Huawei’s revenue and profits grow in 2020, but test goes on with US chip ban

Smartphone business still at risk with US semiconductor ban

Richard Yu Chengdong holds Huawei MateX2 series at a launch event in February Photo: Courtesy of Huawei

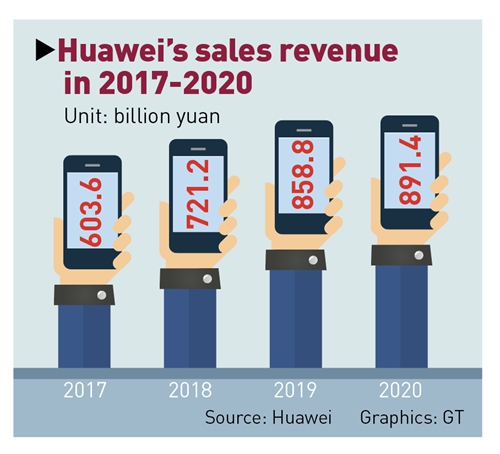

Chinese technology giant Huawei said its revenue and net profits both grew in 2020 and met targets, despite losses inflicted by the US government's blacklisting on its traditionally strong businesses.

Revenue stood at 891.4 billion yuan ($135.93 billion), up 3.8 percent year-on-year, while net profits rose 3.2 percent to 64.6 billion yuan, the company announced at a press conference titled "Riding Through the Night" at its headquarters in Shenzhen, South China's Guangdong Province on Wednesday.

The consumer business sector's revenue reached 482.9 billion yuan, up 3.3 percent, the company said, with growth coming from other terminal products such as smart watches and laptops.

Huawei's growth was mainly driven by the domestic market, with sales revenue from the Chinese market increasing 15.4 percent to hit 584.9 billion yuan - more than 65.6 percent of its total revenue.

Business in all regions outside of China declined. Sales revenue from Europe, the Middle East, and Africa fell 12.2 percent to 180.8 billion yuan, and that from the Americas fell 24.5 percent to 39.6 billion yuan.

"Over the past year, we've held strong in the face of adversity," said Ken Hu, Huawei's rotating chairman, adding that the company's business performance was largely in line with its forecast.

"In 2020, our enterprise business group grew rapidly, and the telco business remained stable, while the consumer business sector's growth slowed," Hu said.

Graphics: GT

The strong 2020 report came after Huawei was put on an export blacklist by former US president Donald Trump in May 2019, and US trade restrictions on the company intensified over the past year.

Analysts said the growth indicated that Huawei's "survival strategy", which included prompt adjustment of its business lines, had an initial effect, while warning that the tech giant will continue to be tested.

"The coldest point of winter has not come yet, and the impact from the US semiconductor ban will gradually be seen in its financial reports this year," Jiang Junmu, chief writer at Chinese telecom industry news website c114.com.cn, told the Global Times on Wednesday.

In response to questions concerning its chip supply, Hu told reporters at a question-and-answer session after the annual report's release that Huawei has enough stockpiles to meet demand from enterprise consumers, but "the improvement of global chip supply depends on the repair of the global semiconductor supply chain."

Jiang, the analyst, cautioned that the biggest impact will still be seen in Huawei's consumer division, which accounted for 54.2 percent of the company's total sales in 2020. The consumer group overtook Huawei's core networking equipment business to become the biggest business department in 2018.

Huawei's consumer business revenue in 2020 managed to grow 3.3 percent - a stark turnaround from growth of 34 percent in 2019.

The firm also disclosed on Wednesday that it's ready to use its self-developed HarmonyOS on smartphones - a system that may serve as a replacement for Google's Android system and enable it to reclaim market share that was lost overseas.

"Flagship smartphone models will still be launched on schedule," Hu said, adding that he believes Huawei will maintain a leading position in the global smartphone market.

"The year's performance really depends on whether Huawei can find new and powerful growth points that can make up for the drop in the mobile phone business," Jiang said.

Huawei has been looking at other sources of revenue as smartphone manufacturing and sales waned. Along with artificial intelligence technology leased to pig farmers, Huawei is also working with domestic coal miners and automakers with its state-of-the-art technologies.

But analysts cautioned that these operations, in which Huawei mainly provides technology, may not be able to generate similar levels of revenue and profits as its mobile phone business, at least in the short term.

The company said that it moved forward with more than 3,000 5G-enabled innovation projects in more than 20 industries like coal mining, steel production, ports management and industrial manufacturing in 2020.

For the year ahead, Huawei said it will continue to scale up investment in research and development (R&D), also one of the main reasons for its revenue growth in 2020.

In 2020, the company invested more than 15 percent of its revenue - or 141.9 billion yuan - back into R&D, up 7.8 percent from 131.7 billion yuan in 2019.