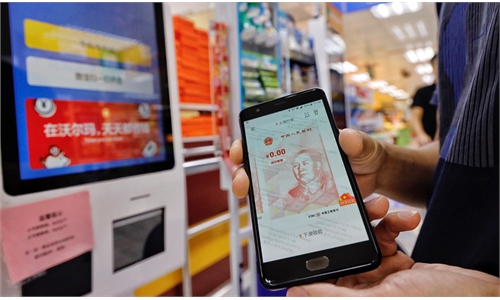

digital currency Photo: VCG

The digital currency world is entering a new phase with the closely watched listing of Coinbase - the largest US cryptocurrency exchange - on the NASDAQ on Thursday (US time), as the milestone move is expected to draw the rapidly expanding crypto ecosystem to the US.

While China has banned initial coin offerings (ICO) to fend off financial risks and focused on its own digital currency, it may need to step up efforts in the area to bolster its capabilities in blockchain and other underlying technologies of cryptocurrency, which are currently led by the US, observers noted.

Coinbase is set to go public on Wednesday through a direct listing, based on trading prices in the private market - an alternative to the usual type of IPO. Ahead of the listing, the NASDAQ Stock Market announced on Tuesday the reference price of Coinbase was set at $250 a share, which would value the company at up to $65.3 billion.

Some investors predicted that the valuation could top $100 billion after the listing, making it one of the 85 most valuable companies in the US, according to media reports.

The listing is also building on crypto bull momentum that has sent the market price higher in recent days. On Wednesday, Bitcoin rose to a record high of $64,000, up more than 5 percent, while the price of Ethereum set a record of $2,400, up over 10 percent.

"The listing of Coinbase… sends a signal that the crypto world is gaining recognition in the mainstream global financial industry," Shentu Qingchun, CEO of Shenzhen-based blockchain company BankLedger, told the Global Times on Wednesday. "It will be the first major cryptocurrency company to go public."

Industry observers predicted that more crypto exchanges and other blockchain-related projects will list in the US, spurring innovation and cementing the US' leads in the crypto and blockchain sectors.

"The world-leading digital asset ventures, investment banks, consulting and media companies will gather in the US, ushering in another wave of financial revolution that spreads across the world," Cao Yin, managing director of the Shanghai-based Digital Renaissance Foundation, told the Global Times on Wednesday, expressing concern that the trend would further widen China's technological gap with the US in the crypto industry.

Cao pointed out the gap between China and the US in the non-fungible token (NFT) sector, which is part of the Ethereum blockchain, with a unique digital ledger that is not interchangeable.

"Most innovative and mature NFT projects are developed in the US, and Chinese companies are just newcomers this year," Cao said.

Shentu stressed that China - as a big producer of digital assets and mining machines as well as abundant application scenarios - still has a modest advantage.

The US leads in the underlying technology of cryptocurrencies, but China has an edge in mining machine production and the sheer size of its market, observers said.

But they stressed that solving regulatory compliance issue is still China's priority to fend off money laundering and other financial risks.

"How to explore a compliance path with regulators so as to make everything completely above board is the key in the sector's legal development in China," Shentu said. He suggested that a way to balance technological innovation with financial security should be found.

The industry is under strict scrutiny by Chinese financial regulators. In 2017, Chinese authorities banned ICO, a cryptocurrency-based fundraising process. Since then, most cryptocurrency exchanges and cryptocurrency-based projects have moved abroad.