Tourists admire the skyline view of Lujiazui area at the Bund in Shanghai, east China, Jan. 6, 2020. Photo: Xinhua

At the ongoing Boao Forum for Asia (BFA) in South China's Hainan Province, Chinese officials once again send an unmistakable signal that China's resolve to open up to the outside world and welcome more foreign investment remains unwavering, even amid the COVID-19 pandemic and a complex geopolitical landscape.Delivering a keynote speech at the opening ceremony of the BFA via video on Tuesday, Chinese President Xi Jinping said that all are welcome to share in the vast opportunities of the Chinese market. He also noted that China will take an active part in multilateral cooperation on trade and investment, fully implement the Foreign Investment Law and its supporting rules and regulations, and make a further cut to the negative list on foreign investment.

Chinese top leaders' speeches at the annual meeting are usually seen as an important window into the country's economic and foreign policy agenda. This year's forum is no exception, which has sent a clear message to the world that China will continue to improve its domestic investment environment to extend welcome to more foreign investment.

That should be a relief for global investors given the backdrop of the raging pandemic as well as rising geopolitical and trade tensions. Particularly, as the only major economy that recorded positive growth in 2020 and continues on a robust recovery path, China's commitment to further open up its market and improve business environment will undoubtedly lead to more opportunities for foreign companies.

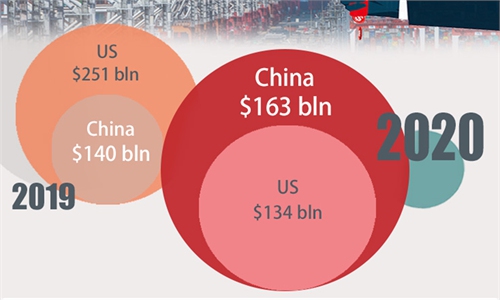

In fact, China has already become the world's most popular destination for foreign investment. In 2020, foreign direct investment (FDI) to China rose by 4 percent to $163 billion, marking the first time that China surpassed the US in terms of FDI, an important gauge of a country's economic vitality and openness. In the first quarter of 2021, China received a total of 302.47 billion yuan ($46.56 billion) in foreign investment, up 39.9 percent year-on-year.

Meanwhile, foreign companies continue to make new investments or expand their presence in China. For instance, US-based payment technology company PayPal plans to set up a cross-border payment platform in China, according to its China CEO. UK's Standard Chartered plans to expand operations in the Greater Bay Area by hiring about 1,000 new employees in the area, while HSBC also has similar plans to increase investment to tap the growing demand for wealth management services in the Chinese mainland, according to media reports.

All these point to China's increasing attractiveness to foreign investors despite malicious slander and attack by some Western anti-China forces. Foreign investment into China has not and will not be held hostage by forces instigating anti-China sentiment. Businesses know clearly that only pragmatic cooperation will yield mutual benefits.

Foreign investment has been a major contributor to China's economic miracle over the past four decades or so. Going forward, maintaining China's status as the world's leading destination for foreign investment remains imperative for the country's push for sustainable and high-quality growth in face of lingering external and internal challenges. As such, foreign companies can rest assured that the Chinese market will only open wider.

Likewise, foreign investors cannot resist the appeal of the Chinese market, especially at a time when China's growth momentum remains strong and is set to lead the global economic recovery. As long as foreign investors' enthusiasm for the Chinese market continues to rise, the world's second-largest economy will continue to grow steadily. No anti-China forces, no matter how loud they are, can stop that trend.