COMMENTS / EXPERT ASSESSMENT

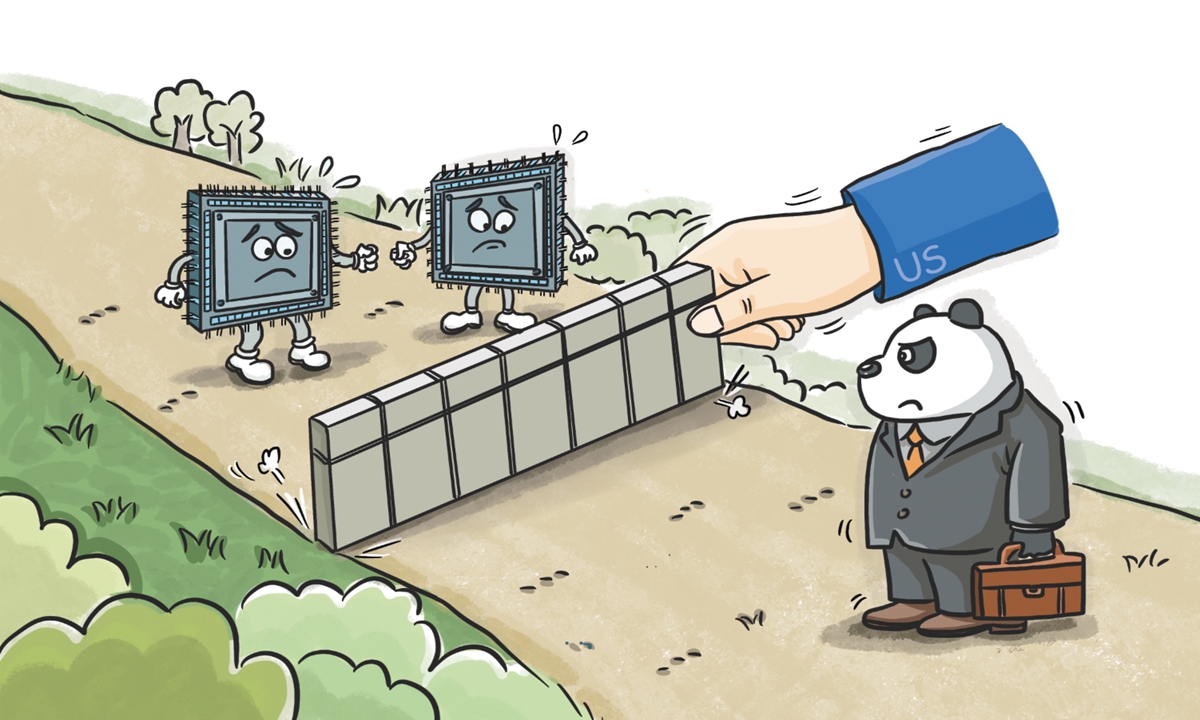

Washington’s coercion puts global chip firms at huge risk

Illustration: Xia Qing/GT

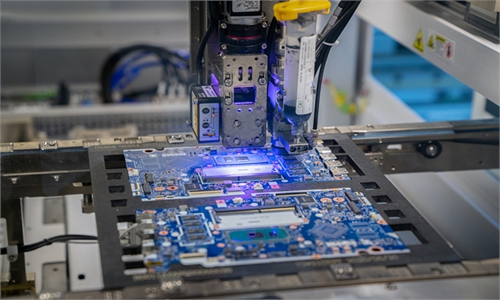

A new semiconductor industry alliance recently announced its formation in the US. Consisting of 64 global semiconductor players, such as TSMC based on the island of Taiwan, Samsung based in South Korea and ASML based in Holland, the group has a mission to "help bolster the US' economy, critical infrastructure, and national security by advancing semiconductor manufacturing and research in the US."In a statement, the new lobbying group, Semiconductors in America Coalition (SIAC), said that its primary focus is to secure funding for "the Chips for America Act," and called on congressional leaders to appropriate $50 billion for domestic chip manufacturing incentives and research initiatives.

Though US President Joe Biden has apparently adopted a different approach to confronting China from his predecessor Donald Trump's unilateral path, what hasn't changed is Washington's "American first" principle.

However, "America first" may not be the best principle for the global semiconductor industry, including the 64 major players in the SIAC that have enjoyed enormous benefits from a globalized industrial chain.

Essentially, both US-based firms, most of which have extensive presence in the Chinese market, and non-US companies, which do not bear the responsibility or have the willingness to help "bolster the US economy," has been trapped in the US' geopolitical arm wrestling match with China - which clearly runs counter to their long-term development.

As for TSMC or Samsung, planning to set up factories in the US or joining the so-called alliance to bolster the US' economy are hard choices made, to some extent, to cope with mounting pressure from Washington. It's hard to imagine that any of these firms would genuinely plan to move their capacity to US soil.

The high-end semiconductor industry, after decades of globalization, has a highly diversified industrial chain with clear division of work. Countries and companies have been developing their most competitive businesses within the industrial chain based on their own comparative advantages. Any attempt to change such a well-established industrial chain would be extremely difficult, if possible.

For example, the US' manufacturing capacity has dropped to 12 percent from 37 percent in 1990s, SIAC revealed. Reversing such a trend is nearly impossible, since, for starters, the US doesn't have industrial basis necessary for a large-scale capacity expansion of the chip industry. Moreover, it would take much more than just $50 billion of government subsidies.

Even if the firms build factories in the US, the result may not meet Washington's expectations. For instance, industry observers have estimated that a TSMC factory in the US state of Arizona may only produce about 1-2 percent of the firm's total output. Another case in point is Foxconn's recent drastic reduction of its investment in Wisconsin from $10 billion to $672 million.

Moreover, extremely divisive US politics also pose another huge risk for industry players. Major projects require large amount of investment and time, and unexpected policy shifts may be fatal for some firms.

Notably, both TSMC and Samsung are expanding their production in the Chinese mainland. Instead of a gesture under political pressure, the investments in the Chinese mainland clearly are in line with their commercial interests.

Firms are profit-oriented, and taking sides in geopolitical games would be the last choice they want to make. Under Washington's coercion, companies are apparently forced to choose between leaving the Chinese mainland or developing completely different systems of products or services for different markets - that, if carried out, would inflict huge losses for the firms, including those in the US.

Washington's disruption of the long-developed global industrial chain will only end up dragging down the development of related businesses, and the advancement of the human society. As a recent report from Boston Consulting Group and the US' Semiconductor Industry Association suggested, a hypothetical alternative with a fully self-sufficient local supply chains in each region would result in a 35-65 percent overall increase in semiconductor prices, and ultimately resulting in higher costs of electronic devices for consumers.

The article was compiled based on an interview with Ma Jihua, a senior tech industry analyst based in Beijing. bizopinion@globaltimes.com.cn