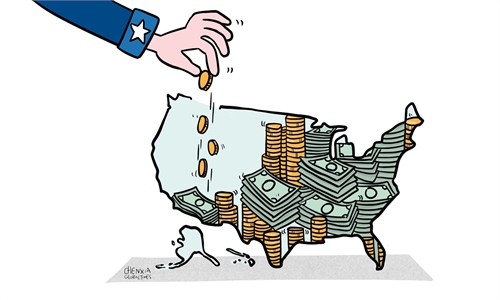

Illustration: Chen Xia/GT

While the combination of a massive fiscal stimulus and coronavirus vaccination campaign appears to put the US economy on track of a powerful recovery, several economic indicators issued recently have thrown the market into confusion, which may serve as an early warning that America's re-opening may enter an unchartered territory.Judging from recent statistics, there will be no shortage of surprises and cliffhanging moments in the coming months. The disappointing jobs report for April, which fell well short of economists' estimates of adding 1 million new jobs, already had many wondering whether generous unemployment benefits issued by the Biden administration has led to hesitancy about taking a job.

Then came the big inflation scare.

According to figures published last week by the Bureau of Labor Statistics, the US consumer price index rose by 4.2 percent year-on-year in April, a rise not seen since 2008 and much higher than the previous forecast of 3.6 percent.

And, the monthly increase of the CPI figure hit 0.8 percent, in stark contrast to the estimate of 0.2 percent. The S&P 500 dropped by more than 2 percent that day as concerns about whether the US economy will emerge directly from the pandemic to super-high inflation weighed down market sentiment.

On a micro-level, inflation is roaring back in full swing now. Used car and truck prices have increased 21 percent in April year-on-year; timber and gasoline prices are soaring; and many commodities like iron ore and copper are also rising rapidly.

Jeremy Siegel, a renowned finance professor at the University of Pennsylvania's Wharton School, issued a startling warning that US inflation could hit 20 percent within the next two to three years, as a result of the US Federal Reserve's unlimited money pumping support to the financial system.

From global investors' perspective, the US recovery has become a black box sending out mixing signals, with lingering uncertainties may explain the recent turbulence in the US capital market.

Despite market concerns, US central bank officials still appear to have firm faith in the US economic rebound. On Thursday, Fed official Christopher Waller said the inflation increase is likely to be temporary, dampening expectation that the central bank will adjust its easy-money policies.

Indeed, the US economic resilience may have led to a relatively strong recovery, but it doesn't necessarily mean that there will be no risk in the coming weeks. In fact, even a small probability of a derailed recovery is worrying, because it is not just the US, but the world economy that could be burdened with such a disturbance.

In this context, it is essential for the world's other major economies, including China, to remain highly vigilant against the risk spillover from the US market, probably one of greatest risks facing the global economy in the post-pandemic era.

For a long time, the US has enjoyed the privileges brought by the hegemony of the dollar, unleashing a flood of liquidity to relieve its debt pressure and leaving the rest of the world to shoulder the financial burden and other dire consequences.

If the Biden administration is truly serious about bringing the US back to multilateralism, it should start taking its responsibilities by properly managing its economic problems, instead of burdening the global economy with more uncertainty and volatility.