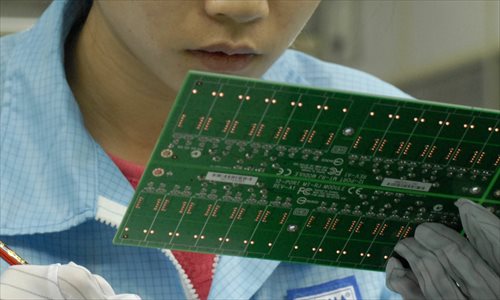

A worker checks semiconductors in an electronics factory in Dongguan, South China's Guangdong Province. Photo: IC

Tsinghua Unigroup, a chip producer and leading digital infrastructure and services enterprise, is becoming bogged down in debt due to the inability to pay off outstanding liabilities, sending a fresh warning for chip companies to strengthen ability of risk prevention and control while pursuing 'excessive' expansion.

Tsinghua Unigroup's shares opened down more than 3 percent, or 21.9 yuan, before closing up on Monday by the daily limit of 25.31 yuan.

While the debt crisis landed the company in the media headlines over the weekend, the company said in its recent statement that the incident has not directly affected the daily production and operation of the company, and currently, all production and operation activities of the company are moving ahead unaffected.

The company itself is not strong in the semiconductor industry either from research and development to design and production, and its "blind" expansion is expected to lead to this outcome, Liang Zhenpeng, an industry analyst told the Global Times on Monday.

Liang also noted that in the semiconductor field, production lines are not easily acquired due to high cost and ability to be highly profitable. "Therefore, it is not reliable for Unigroup to acquire, and such expansion via acquisition needs to be cautious in the field," said Liang.

This came as the chip company released a statement on Friday saying that it has received a notice from the Beijing No. 1 Intermediate People's Court that its creditor Huishang Bank had filed for bankruptcy reorganization of the company after Tsinghua Unigroup is unable to repay debts and its assets are insufficient to discharge all debts with apparent lack of solvency.

On Friday night, the Tsinghua Unigroup's subsidy Guoxin Micro, a listed company also involved in semiconductors issued a statement saying that a group restructure will impact the make-up of its investment structure.

Tsinghua Unigroup could not be reached for comment as of press time.

Guoxin Micro, however, said on its interactive platform on Monday afternoon that the creditor's application for restructuring of Tsinghua Unigroup has not had a direct impact on the company's daily production and operation, and their production and operation activities are proceeding normally.

However, the group company has yet to disclose its 2020 annual report and audit report, leaving many to mull how serious the company's debt problems really are.

As of the end of 2019, Tsinghua Unigroup had assets totaling 297.76 billion yuan ($43.22 billion), whilst its liabilities totaled 218.74 billion yuan, according to its 2019 annual report.

In the light of the Tsinghua Unigroup's own announcement on June 30, it is facing a number of domestic and foreign bond defaults, China Securities Journal reported, without going into details.

Industry insiders said that Tsinghua Unigroup has a long history of debt problems linked to its overly rapid expansion.

Founded in 1988, Tsinghua Unigroup has several listed companies under its umbrella. In recent years, the group has further enhanced its strength in chip design and development, as well as digital infrastructure, through acquisitions such as Spreadtrum and H3C.

In April 2019, Tsinghua Unigroup also acquired Linxens Group, a French chipmaker, for 2.2 billion euros ($2.61 billion), marking the group's largest announced overseas acquisition at the time.

The group company also looked to acquire the industry tycoon Taiwan Semiconductor Manufacturing and MediaTek, but none of those deals came through.

After large-scale mergers and acquisitions, in 2019, Tsinghua Unigroup's overseas debt reportedly experienced abnormal fluctuations. But the company soon issued an emergency statement saying that there was no default event at home and abroad, and the company has sufficient cash and sound fund liquidity, media reports.

Acquisitions are expensive and often do not deliver a return on investment over the short term, especially for semiconductor industry that requests long-term capital investment, adding up the potential risks of defaults, experts said.

While this is not the first time in the semiconductor industry, experts said that what has happened to Tsinghua Unigroup is not an isolated incident.

"In an industry in which global competition is so fierce, and the US' blockade, companies have to expand and become strong in order to survive," Ma Jihua, an industry veteran told the Global Times on Monday.

Ma noted that for many semiconductor companies, the only way out is to take a risk.

Tsinghua Unigroup's debt issue would not create any substantive damage to the company nor the industry since the chip industry is still in an attractive spot for the social capitals and the company itself has its potential for growth, experts said.

But Ma would still advise companies to do a good risk assessment before engaging in acquisitions or expansion.