Illustration: Liu Rui/GT

The future of the US' strategic focus will be to enhance its leading position in high-tech field, according to United States Innovation and Competition Act of 2021. Yet the US ultimate goal remains unchanged: consolidating and expanding US capital groups' possession of global markets.

So far, there is still a wide gap between China and the US in quite a few high-tech sectors, including semiconductor technology. But Washington has clearly pinned China as its major competitor and viewed China as stimulation to better itself.

It is anticipated that the US will boost its technological strength with major investments in the future. Reports show that $52 billion will go to semiconductor research, design, and manufacturing initiatives.

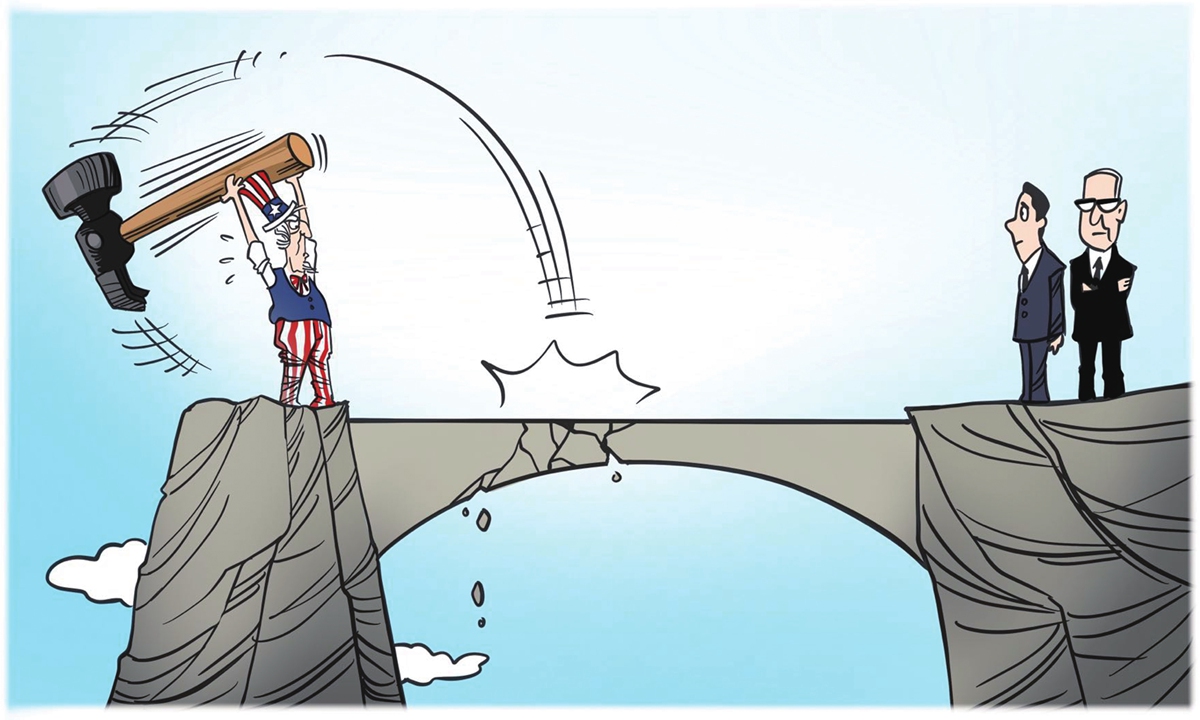

On the other hand, the US has also carried out a comprehensive ban on competitive Chinese companies like Huawei in global market, in terms of technology, talent and investment. It is also ganging up with allies to encircle China.

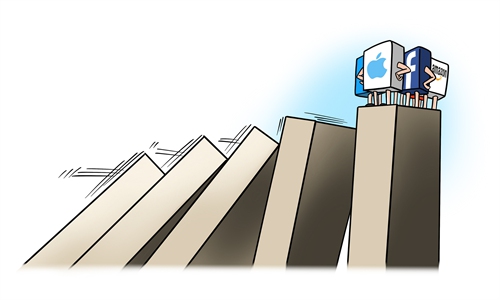

Such an approach of Washington is in the fundamental interests of major American capital groups, which have been increasingly relying on high technology to realize their global expansion goals. The groups are the ones that will obtain huge interests from the new bill.

But this strategy has an obvious weakness. It is facing a major problem: When US capital groups depend on the siege of China to gain more market share, they are also isolating themselves from a big market that has the greatest development potential in the world.

After all, capital markets can make more profits only through constant expansion of, obviously, markets. Without markets, there are no capital operations.

The US has many advanced technologies in the world. However, it is impossible for the US market to "digest" all these technologies and related products alone. The US needs markets and end products that carry these technologies.

The Chinese market is enormous, with the world's largest consumer market for high technologies and related products. Moreover, as China has a strong manufacturing industry, it is also the largest producer of end products that use high technologies around the world.

Take microchips as an example. The US leads the world in chip technology production. In 2020, the US semiconductor industry accounted for 47 percent of the global semiconductor market. And China has a huge demand for chips. Each year, China spends more than $300 billion importing chips.

One possible result of the US containment strategy may be that it will gradually lose the Chinese market, forcing Chinese manufacturers to find alternative ways and products.

The US has the greatest capital power, but today's global market and its production and supply chains have changed dramatically. The relationship between the US, global markets, and industrial chains is becoming more and more interdependent.

Ben Reynolds, a foreign policy analyst in New York wrote in a recent article: "It's not hard to see the similarities between today's protectionist shift and similar trends in the previous grand era of imperialism in the late 19th and early 20th centuries. When the response to a crisis of capitalism is the gradual restriction of markets into competing spheres of influence, there is a seemingly inherent tendency for politico-military competition to increase as well."

Reynolds's concern reflects Western scholars' views of history.

The world today is very different from that in the late 19th and early 20th centuries. If the US, like empires in the past, resorts to war to open the market for its capital, it will only witness the end of its days.

Although the collective rise of emerging economies makes it impossible for Western capital to seize the market in their traditional way, Western countries are bound to strengthen the protection of their own markets. At the same time, they are bound to take more severe measures to repress the progress of emerging economies, which are forging ahead in the global market. The game of capital power over markets will only intensify.

The author is a senior editor with People's Daily, and currently a senior fellow with the Chongyang Institute for Financial Studies at Renmin University of China. dinggang@globaltimes.com.cn. Follow him on Twitter @dinggangchina