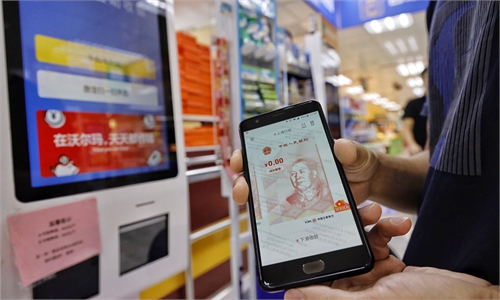

A staffer displays the digital yuan application scenarios to visitors in the World Intelligence Congress in Tianjin in May. Photo: cnsphoto

As China rolls out tests of its sovereign digital currency in multiple cities step by step with the total transaction value reaching $5.3 billion, the country's central bank has no timetable to issue digital yuan, a white paper by the People's Bank of China said on Friday.

The announcement came as many countries have been ramping up efforts on the research and plans to issue their own sovereign digital currencies as well as a robust growth and increasing popularity of cryptocurrency across the globe.

According to the Bank for International Settlements, over the past four years, the share of central banks actively engaging in some form of digital currencies grew by about one-third and now stands at 86 percent. The central banks of the US, Britain, France, Canada, Japan, Russia and Singapore have revealed their plans about sovereign digital currencies with some already finishing initial tests.

Since 2019, China has been pushing forward the trials of its digital currency in Shenzhen, Suzhou, Xiong'an New Area, Chengdu and scenarios at the 2022 Beijing Winter Olympics, said the whitepaper. Starting from November 2020, six new pilot areas including Shanghai, Hainan and Changsha were added.

Currently, the impacts of the digital yuan's trials on local monetary policies, financial market and financial stability are the key parts looked at during the tests, according to the central bank.

By the end of June, more than 1.32 million spots have taken trials of digital yuan, covering sectors such as living payment, catering, transport, shopping and public service. More than 70.75 million deals were traded by digital yuan, involving 34.5 billion yuan ($5.34 billion).

A vegetable store supports digital yuan payment in Shanghai. Photo: Qi Xijia/GT

A Beijing resident surnamed Tao was a lucky citizen who received 200 digital yuan in a lottery event. He bought snacks in a supermarket and beverages in a Beijing subway station last month.

"It is very convenient to pay by digital yuan and I felt it was even easier than paying with other payment platforms such as WeChat Pay and Alipay," Tao told the Global Times.

As many people look forward to the explorations of cross-border transactions using the digital currency, the white paper said that "digital yuan has technical conditions to support cross-border usages, but it mainly serves domestic payment in retail sectors at the current stage."

To facilitate foreigners who come to China for short stays, they could open accounts using digital yuan wallet if they don't have a bank account on the Chinese mainland, according to the white paper.

Global Times