Can US infrastructure plan aid manufacturing?

A worker does quality inspection at the Fuyao Glass America (FGA) facility in Moraine of Dayton in Ohio, the United States, Aug. 21, 2018. (Xinhua/Wang Ying)

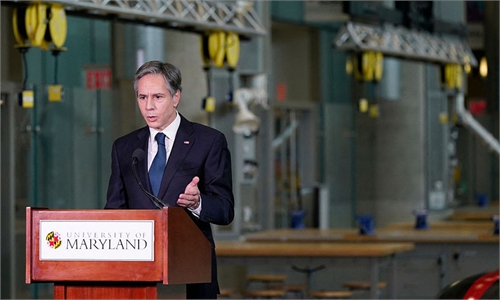

The US Senate on Tuesday approved a $1 trillion bipartisan infrastructure plan. The deal includes $550 billion in new federal investment for infrastructure in the US.If the plan is passed in the House of Representatives and takes effect, it will help rebuild the US' manufacturing sector. Of course, this will take a long time.

Apart from infrastructure, the bill will also devote funds to boost the US high-tech sectors, including the chip industry. This will be done in a bid to maintain the US' dominant position in these domains.

The US is undergoing economic adjustment. The US government will attach more importance to boost domestic economy and improve its social security system. Yet this demands a wealth of investment. It cannot be addressed even if the country accelerates its drive to print more money.

For a country where capital has the final say, what matters is not how to distribute the money. It's where to earn more money that is worthy of attention.

Statistics show that it is no longer possible for the US today to maintain its position as a global manufacturing power. It cannot continue to control global markets, or obtain the most gains as it did in the past four or five decades.

This is first reflected in the manufacturing sector. The data released by the United Nations Statistics Division estimated that China accounted for 28.7 percent of global manufacturing output in 2019, more than 10 percentage points ahead of the US. The US used to have the largest manufacturing sector across the world until China overtook it in 2020.

Germany once again achieved the highest rank in the 2020 edition of UNIDO's Competitive Industrial Performance Index. China has climbed three positions in the past six years and now ranks in second. South Korea currently ranks in third place, and the US follows.

In some significant high-tech areas, the US manufacturing is still indispensable. It still occupies a large share of global market. But the future tendency is that manufacturing sectors of other countries, such as Germany, Japan and China, will continue to erode the market owned by the US. Such a trend is irreversible. This is not a problem that Washington can solve by having more input.

The whole world's dependence on the US is also decreasing in terms of the most basic living supplies. For instance, China, India, Bangladesh, Vietnam, and Turkey are now the main global garment manufacturing countries. China, which has a complete clothing production chain, is also the largest exporter of apparel to the rest of the world.

Moreover, no US company was listed in the world's top 10 steel-producing companies for 2020: Seven out of the top 10 are from China, except ArcelorMittal from Luxembourg, Nippon Steel Corporation from Japan, and POSCO from South Korea.

The same trend applies to vehicle sales. Last year, Toyota, Volkswagen, Renault-Nissan-Mitsubishi Alliance, Hyundai-Kia, and General Motors are the world's top five car companies by sales volume. And only General Motors is an American company.

In terms of cereals production, the US is still the second largest in the world. But productions in China, which rank first in the world (as well as in India, Russia, Brazil, and Indonesia, which rank below the US), have seen a rise in recent years.

Changes in production areas certainly lead to changes in markets, even though the processes are quite slow. This is why it will be increasingly difficult for US capital to make money from the world.

Looking at the stock market, leading US companies, including Google, Microsoft and Apple, are still growing in terms of market value. But without the support of American manufacturing, their profit models cannot be solid.

Will the global markets held by these US companies, especially those in the strong industries of the US such as military and aviation, be gradually dismantled or replaced by companies of other countries? That's what Washington, and to be more specific, Wall Street, is most worried about.

Such a worry is behind almost all US policies toward China. These include the strategy of using the so-called security issue to crack down on Chinese tech giant Huawei, taking advantage of Xinjiang-related issues to contain the development of China's textile industry and strengthening military alliances against China.

The author is a senior editor with People's Daily, and currently a senior fellow with the Chongyang Institute for Financial Studies at Renmin University of China. dinggang@globaltimes.com.cn. Follow him on Twitter @dinggangchina