New technology and investment needed for virtual idols to compete with real life stars

Fans attend a Hatsune Miku concert, a Japanese virtual idol, in Shanghai in November 2019. Photo: IC

McDonald's unveiled its own virtual idol, Happy Sister, as its new brand ambassador in China in January, following the success of virtual idols in the country where young generation's purchasing power and demand for interactive entertainment experiences continues to skyrocket.

After luxury fashion brand Prada dropped Zheng Shuang, a Chinese actress, due to an ongoing surrogacy scandal, more global brands began to eye virtual idols to attract Chinese young consumers in the 6.22 billion-yuan ($960 million) market this year, based on iiMedia Research forecasts.

Recent celebrity scandals have attracted scrutiny from China's cyberspace regulator which announced new measures on Friday to counter the unhealthy growing phenomenon of "fan circle" culture across the Chinese entertainment industry as some teenagers blindly idolize celebrities.

Many believe the country is on the verge of a virtual idol era, as these digitally rendered avatars are becoming more interactive and humanlike, with technological improvements of artificial intelligence, motion capture and virtual reality coming along in leaps and bounds.

Seeing the huge business value potential, investors and capital began to raise stake in virtual idol-related industries when a spate of celebrity scandals raise awareness among famous brands on the need to manage risks.

An unstoppable trend

Virtual idols have become a type of product combining technologies, business and culture. One of the most famous virtual idols around the world is Hatsune Miku, who has won a large fan base since her debut in 2007 in Japan.

First appearing as a voice-synthesizing program, she has featured on TV, in concert and even appeared on the Late Show With David Letterman, BBC reported. Boasting around 600 million fans across the globe, Miku is able to earn at least 600 million yen ($35.35 million) a year, similar to some top pop stars in China, the paper.cn reported.

In 2012, China's well-known virtual idol Luo Tianyi achieved a significant commercial coup. Developed by Yamaha Corporation in collaboration with Shanghai HENIAN Information Technology Co Ltd, she began to attract a large number of young fans with most of them being Gen Z, or the "post-95" [born after 1995] generation.

Luo has endorsed many consumer brands including Gillette, KFC, Pizza Hut, Tide, beverage brand Vitasoy, and domestic cosmetics brand Pechoin. Last April, Luo co-hosted an e-commerce livestream show with China's online influencer Li Jiaqi.

After seeing Luo's popularity, and profitability, more Chinese internet and entertainment companies started to enter the sector.

HeZ, a Chinese virtual singer created by Tianjin Whalesong Information Technology Co, made a blockbusting appearance in 2017 on Tencent Video's reality show The Coming One, in which he reached the final eight of the content.

Tencent Holding's music unit Tencent Music Entertainment Group (TME) in November 2020 followed up. It invested in US startup Wave to bring the Los Angeles-based company's popular animated live concert technology to Chinese audiences.

"We share the belief that gaming technology will dramatically expand the breadth of possibility for creative expression and audience interaction in music, and we are thrilled to be collaborating with TME to build that future," according to reports, citing Jarred Kennedy, COO of Wave.

Chinese video streaming platforms iQiyi and Bilibili both introduced virtual idol shows and virtual idols.

"It's an unstoppable trend across the digital world: the combination of physical and virtual reality," said Chen Yan, founder of Beijing Next Generation Culture Media, the company behind Ling, a social media influencer whose appearance is computer-generated.

Ling, with 154,000 followers on her Weibo account, has partnered with US electric-car maker Tesla, milk tea chain Nayuki and Chinese online fitness program provider Keep.

Chen told the Global Times that demand from brands for virtual images has exploded since last year, when the COVID-19 pandemic brought more attention to digital assets.

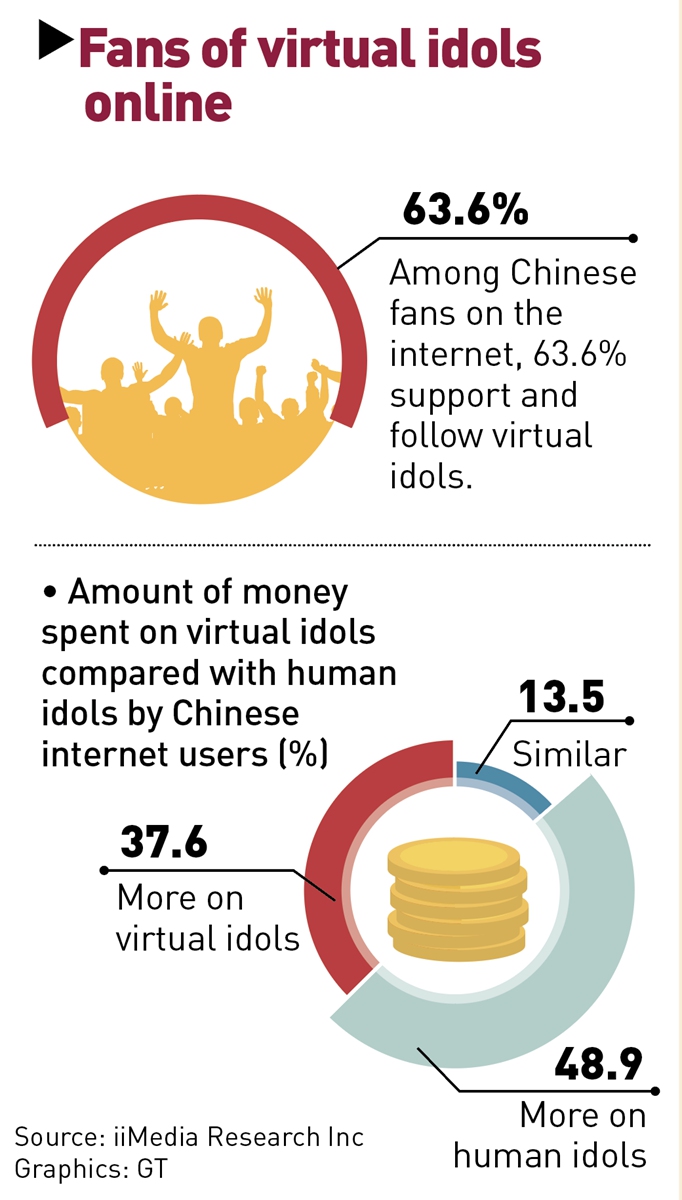

According to data from iiMedia Research, the size of China's virtual idol industry in 2020 was 3.46 billion yuan ($540 million), an increase of 70.3 percent year-on-year.

Nascent stage

Despite great potential, the current virtual idol market in China is still in its early stages with significant technical and production challenges still acute.

"Technological costs to build a virtual idol remain extremely high," Shi Wenxue, a culture critic based in Beijing told the Global Times on Sunday.

In fact, producing a song for a virtual idol usually costs 100,000 yuan, higher than licensing a singer; holding a concert for a virtual idol can cost as much as 20 million yuan, the paper.cn said.

Shi said even if celebrity scandals let fans down, it is unlikely for the massive entertainment industry to shift to produce virtual idols as this is the area technology companies specialize in.

In addition, there is no superstar-level virtual idol in China yet, and most of the fans are young people, the critic added.

"I don't think the recent celebrity news will benefit virtual idols, as for me, I like a real star, even with their flaws and shortcoming. As long as the person doesn't have a fatal flaw, I still prefer human idols," a Beijing-based fan surnamed Xiang told the Global Times on Sunday.