China should enhance bulk commodity pricing amid opening-up efforts:senior Chinese securities official

Residents pass by the Shanghai Futures Exchange, located in the Pudong District of East China's Shanghai Municipality, on August 1. Photo: IC

China should increase the its influence of bulk commodity pricing during the process of opening-up, said Fang Xinghai, vice chairman of the China Securities Regulatory Commission at a futures forum held on Wednesday in Zhengzhou of Central China's Henan Province.

In particular, Fang stressed that China should focus its effort across Asian time zones in the pricing of bulk commodities including soybeans, crude oil and palm oil.

He made the comments at a time when China's bulk commodities have experienced increased price fluctuations over recent months. The price of palm oil, for example, saw its price surge to the highest point in 10 years around mid-August, while iron ore prices have corrected sharply compared with May levels.

Fang also stressed that China should increase access to its futures market to overseas investors. For example, the range of China's bulk commodity futures open to overseas investment should be widened. China should also leverage bonded and cash delivery to facilitate the participation of international investors throughout commodity futures investment.

In addressing systematic reform, China should push the "deep-level connection" between China's futures market regulations and those of the international markets, as well as strengthen cross-border cooperation with overseas regulators, he said.

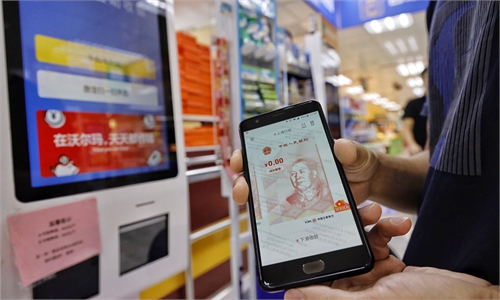

Currently, China has allowed trading of 94 futures and option products covering areas including agricultural products, steel and energy. In 2018, China launched yuan-denominated crude oil futures, marking China's first futures product that is open to overseas investment capital. To date, overseas investors can invest in nine domestic futures products.

Global Times