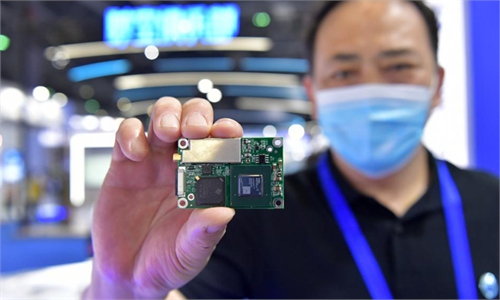

TSMC booth attracts visitors at the World Semiconductor Conference 2021 held in Nanjing, East China's Jiangsu Province from June 9 to 11. Photo: cnsphoto

The US government appears to be close to gaining access to sensitive data held by major global chip suppliers including Taiwan Semiconductor Manufacturing Co (TSMC). The move has not only gone beyond normal market regulation, but may also plunge the semiconductor industry into a new round of geopolitical backbiting amid ongoing China-US tensions.

TSMC, the world's largest contract chipmaker, said on Friday that it would hand over data requested by the US by November 8, according to local Taiwan media reports.

The chipmaker's statement came just one day after a US official hinted at compulsory measures aimed at obtaining sensitive information from uncooperative companies. "Whether or not we have to use compulsory measures depends on how many companies engage and the quality of the data shared," a spokesperson for the US Commerce Department was quoted as saying according to Reuters.

The US government made the voluntary request for information within 45 days and it is not the first time for American officials to put on pressure on chipmakers. Before that, Secretary of Commerce Gina Raimondo said that if companies did not respond to the voluntary request "then we have other tools in our tool box that require them to give us data".

While the US Commerce Department justified its request for sensitive information as efforts to boost supply-chain transparency and help resolve the chip shortage, the demand is apparently in violation of business confidentiality and beyond the scope of market supervision, which is inappropriate and alarming. It is crystal clear that obtaining the sensitive data may be just the beginning of the US wielding its hegemony stick in the semiconductor industry, and its ultimate goal is to take control of the advanced manufacturing capacity to revitalize its domestic semiconductor industry.

Moreover, there have also been concerns over the potential geopolitical risks brought by the move which appears to target China.

The data that TSMC and other chipmakers are required to provide will inevitably include a lot of order and production information specific to Chinese mainland companies, offering a glimpse into the technology progress, production capacity and other business secrets on the mainland. The fact that the US could access these data will seriously compromise the commercial interests and business secrets of mainland semiconductor industries.

In this sense, when these chipmakers offer sensitive information about Chinese clients to the US, they should be advised not to violate Chinese laws and regulations, which may mean consequences for their future operations in China.

At present, China remains the world's largest semiconductor market, with total sales of $151.7 billion in 2020, up 5 percent year-on-year, according to data from the Semiconductor Industry Association. No chip companies can ignore the demand generated by China. In fact, even for Huawei and Chinese chipmaker SMIC that are on a US trade blacklist, their US suppliers received billions of dollars' worth of licenses from November to April to sell them goods and technology, Reuters reported.

China needs to make good use of its massive market volume to increase the strategic initiative of its chip purchase. It would be deemed as too risky if China continues to purchase large quantities of chips from untrustworthy companies at the expense of its core technology security and commercial interests. Despite the current shortage, there has been warning about semiconductor overcapacity in the future. It will not be hard for Chinese clients to find alternative chip suppliers if necessary.

In addition, as a major downstream manufacturer of semiconductors, China can also pass on the problems and cost of semiconductors to its export partners such as the US.

In the long run, it is still essential for China to firmly push forward with the independent research and development of the semiconductor technologies to gain more saying in the industry.