Motorists make their way through a water-logged street amid heavy rains in Hyderabad city, India on Monday, the morning after cyclone Gulab made landfall between the coastal Indian states of Odisha and Andhra Pradesh. Photo: AFP

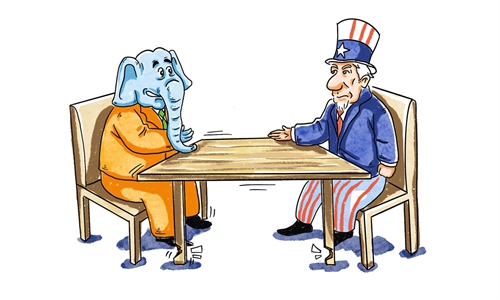

After asking Tesla to make its electric vehicles (EV) in India, the South Asian country appears to be working on new plans to target major global EV battery makers as part of its effort to promote new-energy vehicles on its bumpy roads.

India will host five roadshows starting next month in a number of countries to encourage battery makers to invest in setting up EV battery production facilities locally, Reuters reported, citing an anonymous source inside the Indian government. Major global players in the battery industry, including Tesla, LG Energy, Samsung, Northvolt, Panasonic and Toshiba, are the targets Indian officials will be trying to convince.

If the report of the plan is accurate, India deserves a degree of credit for its new initiative in hope to boost the clean transport supply chain to reduce emissions ahead of the 26th United Nations Climate Change Conference (COP26).

But hope is not enough to support a deliverable plan, which also requires coordinated support. Given the current state of the Indian economy and its manufacturing capabilities, there is too much uncertainty in its appeal to global EV battery makers.

First and foremost is that question about whether making EV batteries profitable in the Indian market. Merely 3,400 electric cars were sold in India during its most recent business year, compared to sales of 1.7 million conventional passenger cars, according to Reuters.

Also, reports continue to emerge that US automakers shut down production lines in India. Last month, Ford Motor announced plans to stop making cars in India after recording losses of more than $2 billion over 10 years. Before that, General Motors and Harley Davidson also withdrew from the Indian market. The decisions underscore the difficulties for foreign carmakers to navigate the Indian auto market, and the same may be true for makers of EV batteries and other components.

For years, the Indian government has seen the wide use of EVs as a shortcut solution to both curbing pollution and reducing its dependence on oil imports. According to a proposal by NITI Aayog, a federal think tank chaired by Indian Prime Minister Narendra Modi, India could slash its oil import bills by as much as $40 billion by 2030 if electric vehicles were widely adopted.

While there has never been a shortage of ambitious incentive plans for promoting EVs in India over the years, there are also a lot of problems still standing between tough realities in the country and its plan for broad adoption of EVs.

For instance, certain Indian industrial policies are often criticized as being at odds with the goals of promoting EVs. India has made clear that it wants to boost local manufacturing of EVs and other components, but imposing high tariffs on imports to protect domestic industries only drives up costs when there is no sound supply chain locally. That is detrimental to EV consumption.

Meanwhile, it is worth noting that global major battery makers such as Tesla and LG already have production capacity in China, which has become a leader in EV development with a lion's share in the global battery supply chain. A lesson from that for India is that whether it is for manufacturing electric cars or batteries, it needs a more pragmatic approach toward planning and cooperation, especially when its poor infrastructure and unstable market performance may stymie investment sentiment.