China's huge IC market favored by global industry leaders at CIIE

Companies show off latest technologies at premier import event

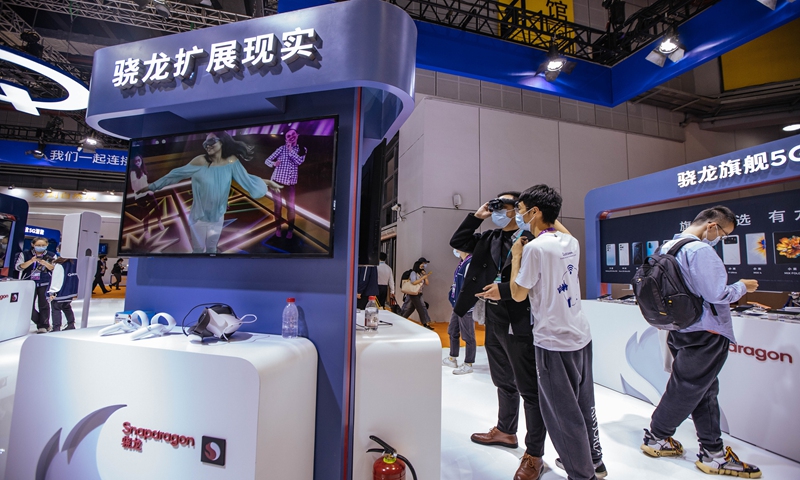

Visitors check out new products in a designated zone for integrated circuits at the 4th China International Import Expo in Shanghai on November 8, 2021. Photo: Li Hao/GT

Global companies in the integrated circuit (IC) industry have a bigger presence at the 4th China International Import Expo (CIIE) in Shanghai, where a designated display zone has been set up for ICs for the first time, underscoring growing foreign interests in China's IC market.

Despite a US crackdown on chip supplies to leading Chinese technology companies and a global chip supply chain crunch in the wake of the COVID-19 pandemic, foreign companies still fielded a strong presence at the ongoing CIIE.

Industry leaders, including Qualcomm, Intel, ASML, Applied Materials and SK Hynix Semiconductor Inc, crowded the newly set up area, displaying the latest applied scenarios for their IC products.

Shen Bo, global vice president with ASML, noted in a press release obtained by the Global Times on Monday that the setting up of the IC display area is conducive to furthering exchanges between domestic and foreign market players against the backdrop of very strong growth momentum of the IC industry in China in recent years.

Unlike energy products, the companies are saying that they don't expect immediate purchase deals, and their presence is more about brand awareness as IC deals typically involve lengthy exchanges over customized specifications.

However, there is one common factor when it comes to ICs and energy products - China is highly reliant on them. Nearly 70 percent of the crude China consumes comes from abroad, and the IC sector faces the same situation.

"Due to China's status as the world's factory with its broad range of electronic product exports, some 40 percent of all China's electromechanics imports are ICs in terms of value," Gao Shiwang, an official with the China Chamber of Commerce for Import and Export of Machinery and Electronic Products, told the Global Times on the sidelines of the CIIE.

The 4th CIIE for the first time has a designated zone for ICs, one of China's biggest import items. The country's spending on IC imports in 2020 hit $350.04 billion, double the amount it spent on crude oil.

That reliance on overseas chips has tempted the US to use it as a tool to contain China, Gao said. Through unilateral long-arm jurisdiction and export controls against China, the US has blocked the sales of some vital equipment on the IC chain, including but not limited to Dutch tech giant ASML Holding's advanced extreme ultraviolet (EUV) lithography system, to Chinese companies.

Domestic news portal thepaper.cn reported that ASML is maintaining normal product deliveries except EUV lithography systems to clients in China, citing Shen.

The company is open to the export of integrated circuit lithography machines to China and fully supports it under the framework of laws and regulations, according to Shen.

But, amid US arbitrary crackdowns, China has ramped up efforts to be more self-reliant on ICs, and it plans to achieve the goal of producing 70 percent of the semiconductors it uses by 2025.

Gao said the US' forcing of Chinese companies into developing advanced systems that they used to buy on the market will mean rising competition for foreign suppliers. The story of how China became self-sufficient in display panels, once dominated by foreign suppliers, showed Chinese companies' potential, Gao said.

However, Gao said that China's plan does not mean foreign IC companies will face dwindling opportunities in China as they are still welcome here, especially if they intend to set up advanced plants making ICs in China.

ICs are the building bricks for today's digital society and they have huge demand in China.

US company Texas Instruments (TI), which has been in the Chinese market for 35 years but has come to the CIIE for the first time, believes that there is big potential demand for ICs in China's new infrastructure drive.

"Texas Instruments is driving innovation for infrastructure digitalization with our advanced semiconductor technologies and local support," said Han Jiang, president of TI China.