Apple’s success mirrors China-US relations

Illustration: Chen Xia/GT

On January 6, Apple filed a document with the US Securities and Exchange Commission showing that Tim Cook's total compensation as CEO in 2021 reached $98.7 million. It came after Apple's market capitalization surpassed $3 trillion during mid-day US stock trading on January 3, making it the world's highest market capitalization. This amount is close to China's foreign exchange reserves of $3.25 trillion (at the end of December 2021).

Apple's growth from $2 trillion to $3 trillion took only 16 months, and this was during the height of the global epidemic.

Apple's growth lies in its technological leadership and monopoly, but it is also supported by the Chinese market and Made in China, which includes the development of complementary products by related Chinese companies. At the same time, Apple has benefited from US sanctions and curbs on China.

According to the latest China Smartphone Weekly Tracker from Counterpoint Research, Apple continues to be the top smartphone brand in terms of sales units and revenue in China for six consecutive weeks. Apple rose to first place in China right after the iPhone 13 was released.

A major reason for Apple's lead in China is that its rival Huawei has been sanctioned by the US government and its cell phone business has plummeted. Commenting on the outlook, Counterpoint Research's Research Director Tom Kang said, "Apple's only true competitor in China till now was Huawei and it is now facing serious production issues due to the US sanctions."

China's tough prevention and control of the epidemic over the past year has provided a solid guarantee of a strong upturn in manufacturing and has created the conditions for greater consumption in the cell phone market.

Without Chinese manufacturing in its supply chain, Apple's global sales could not have surpassed Xiaomi's last year to take second place behind Samsung. Apple relies on its control of the Chinese supply chain, which is constantly being dismantled by the rise of Chinese technological power.

There is no denying that Apple's growth has boosted China's cell phone industry and its related industries, while also boosting employment as well as innovation and labor levels. But how this relationship ultimately goes will depend on whether the Chinese companies involved will continue to be dictated by Apple, or whether they continue to enhance their capabilities and strengthen their domestic portfolio, and will thus have the ability to compete with Apple.

OFILM Group is an example outside of Huawei, whose main business is touch screen modules, camera modules, and fingerprint recognition modules.

Since the company joined Apple's supply chain, its revenue had been completely dictated by the situation where "Apple is good, I'm good; Apple is bad, I'm worse". It even faced the risk of Apple finding a better alternative to replace it.

In this case, OFILM began to gather more partners and expand research and development on the supply of Huawei cell phones and electric vehicles and expand its technological applications. This is not what the US wants to see.

The US government imposed sanctions on OFILM last July on so-called human rights issues in Xinjiang, and Apple kicked it out of the supply chain in the process. Of course, a replacement was found.

The good thing is that OFILM has previously established itself in the field of intelligent electric vehicles and actively participated in the domestic supply chain of Huawei and Xiaomi, so it was not beaten to death.

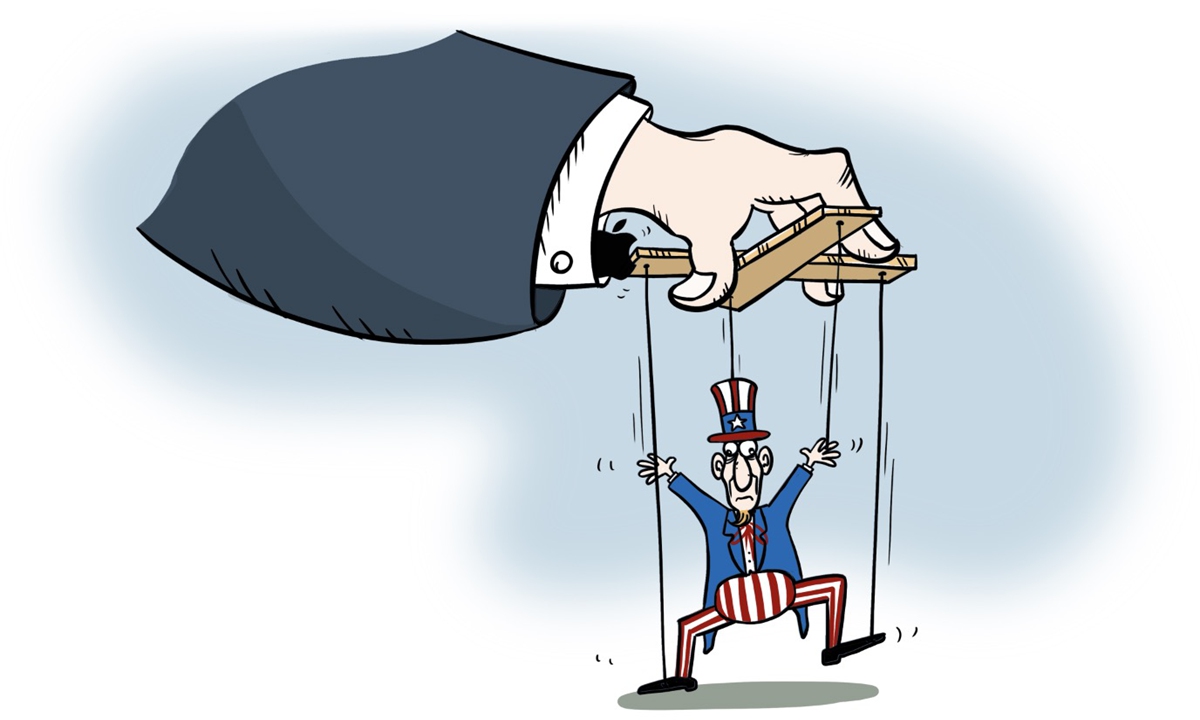

We do not know how Apple and the US government reached a tacit agreement. Judging from the changes in US-China relations over the past few years, it really seems like it was all arranged. From former US president Donald Trump's policy of decoupling trade and commerce between the US and China to the Biden administration's increasing containment in the field of high technology, the ultimate goal is to defend the greatest interests of certain capital groups.

Capital is the basic force that makes and keeps the US strong. The capital group behind Apple will not change its monopolistic nature because of China's strong manufacturing capabilities. If it is true, as the Americans themselves say, "America is a business", then this predestines the US and China to irreconcilable conflicts.

But will the logic of American power really evolve unshakably?

If we consider Apple's relationship with China as a microcosm of the US relationship with China, the next story is really about how Apple will develop and how Huawei and Chinese technology companies represented by Huawei will develop.

The author is a senior editor with People's Daily, and currently a senior fellow with the Chongyang Institute for Financial Studies at Renmin University of China. dinggang@globaltimes.com.cn. Follow him on Twitter @dinggangchina