China's fiscal revenues rise 10.7%

Status reflects mindset of sticking to stability, 'more responsible' to world

RMB Photo:VCG

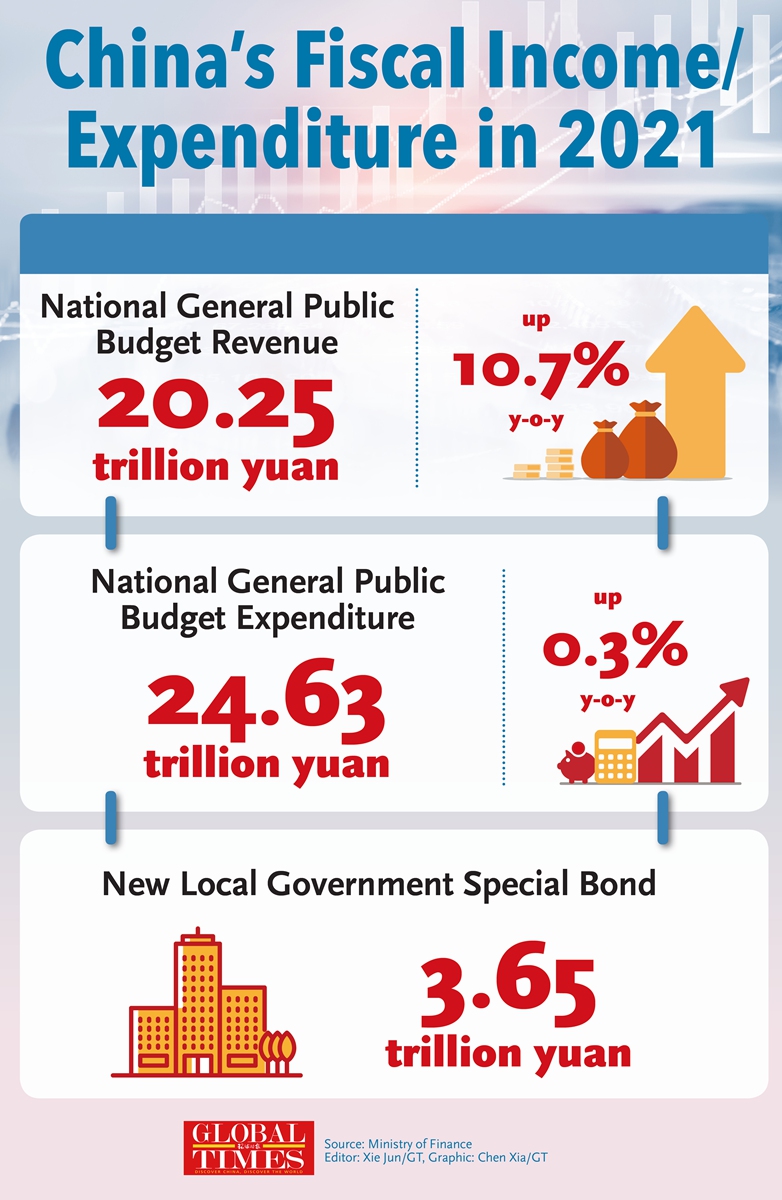

It's not easy for a country with an economy as large as China to strike a balance between the need to pump money into the coronavirus-battered economy and to keep an eye on risks like mounting local government debt. But judging from the country's fiscal data released on Tuesday, experts said China did quite a good job last year.As the world's second largest economy continued to rebound from coronavirus-triggered paralysis, growth in fiscal revenues rose 10.7 percent on a yearly basis last year, totaling 20.25 trillion yuan ($3.20 trillion), almost doubling the 11.73 trillion yuan in 2012, according to data provided by the Ministry of Finance (MOF) on Tuesday.

The Chinese government spent about 24.63 trillion yuan last year, an increase of 0.3 percent year-on-year and within the budget range approved by the National People's Congress.

Judging from the data, China is going through a turnaround from the country's financial state in 2020, which saw a drop in government revenue by 3.9 percent.

This is not easy to achieve, considering many factors of what experts called "constraints" on China's finances, such as the weak property market, mounting local government debt, and bottlenecks faced by micro businesses in China as a result of the COVID-19 epidemic.

The increase in government income was the result of the Chinese economy's "relatively fast" rebound, which was driven by exports growth, the Producer Price Index price rise, and tax cuts and fee reductions, while stable government expenses made sure that the economy received the support it needed, they said.

"China's central and local government expenditures in 2021 were on par with those of 2020, which means that the government didn't slacken in policies to stimulate growth and protect the people's livelihood. This created a positive impact on economic growth last year," Lin Jiang, a professor of economics at Sun Yat-sen University, told the Global Times on Tuesday.

On top of 7.6 trillion yuan in tax cuts and fee reductions during the 13th Five-Year Plan period (2016-20), China made another cut of more than 1 trillion yuan in 2021, Xu Hongcai, deputy head of MOF, said at a press conference on Tuesday.

On the other hand, China's fiscal status also reflected the mindset of the government to stick to stability, by refraining from a largely widening financial deficit and keeping an eye on mounting government debt. This is different from the policy direction of other countries like the US.

The central government had planned to set its 2021 budget deficit at 3.2 percent of GDP, lower than the previous target of above 3.6 percent.

"China's financial deficit goal is mild and stable, which echoes the country's policy of stressing stability," Lin said, adding that the government is cautious about pumping revenues through bonds, as it is watching out for a possible default, considering many local governments have already accumulated debts.

Data Xu revealed shows that China approved 3.65 trillion yuan in new local government special bonds in 2021. This was lower than the 4.73 trillion yuan quota in 2020.

Xu said that the government would strike a balance between stable growth and risk prevention to allocate a special bond quota "scientifically" in different regions. It also noted that China would rein in new government bonds in high-risk regions to prevent risk accumulation.

China's cautious approach to fiscal spending is also contrary to the methods taken by the US government to stimulate the virus-affected economy by purchasing massive amounts of debt securities.

"China's cautious attitude can prevent high inflation and the appreciation of global currencies. It is a more responsible move to the world," Bai Wenxi, chief economist of IPG China, told the Global Times on Tuesday.

On the other hand, experts stressed that China's finances are still far from being healthy, considering the challenges brought by the pandemic and the impact of the uncertain world geopolitical situation to China's economic prospects.

"China's financial status has not walked out of a difficult period yet, as the coronavirus-triggered economic downturn raises the requirements for extra government expenditure to support the economy. But the space for government revenue growth is suppressed," Xi Junyang, a professor at the Shanghai University of Finance and Economics, told the Global Times on Tuesday.

Bai also said that China's finances face pressure such as the need to increase spending to combat the pandemic, as well as lower-than-expected land transfer fees.

Xu said China will carry out greater tax cuts and fee reductions in 2022, with a special focus on micro businesses and push for manufacturing upgrades.

"We are analyzing the situation for 2022's fiscal income budget. Aside from economic growth, we will factor in the influence of uncertainties as well," Xu said.

Bai predicted that China's budget deficit might widen by an acceptable level in 2022, as loose fiscal policies will lead to an expansion in government spending.

Graphic:GT