oil Photo: CFP

With the outbreak of the Ukraine crisis, Europe seems to have never been closer to a self-made energy crunch which threatens its future.The US and its Western allies condemned Russia's latest move to recognize the two breakaway regions in eastern Ukraine as independent states while pledging to impose new sanctions on Moscow.

Russia's UN representative Vasily Nebenzya said during an emergency UN Security Council meeting held on Tuesday that Russia remains open to a diplomatic settlement to the Ukrainian issue, but the US and its allies have repeatedly played up the situation, warning that Western powers not to worsen the situation in Ukraine.

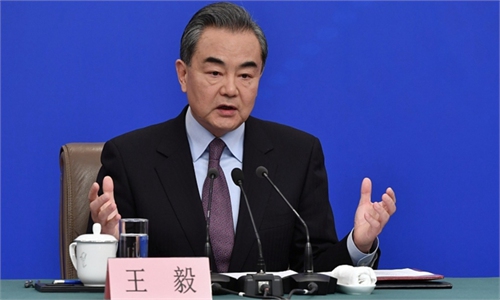

In a Tuesday phone call with US Secretary of State Antony Blinken, Chinese State Councilor and Foreign Minister Wang Yi said the evolution of the Ukraine issue so far is closely related to the delay in the effective implementation of the new Minsk agreement. China once again calls on all related parties to exercise restraint, ease the tense standoff and resolve differences through peaceful negotiation.

The latest development unsurprisingly sent jitters throug global financial markets, with a litany of international stock indexes plunging sharply and oil prices surging on potential energy supply disruption concerns. This is because if the Russia-Ukraine situation continues to escalate, it could cause a severe turmoil in global energy supplies, with European countries bearing the brunt of the shocks.

EU officials previously said that there is general agreement that economic sanctions would be ready within 48 hours of an "invasion". While it remains unclear what the EU sanctions will contain, given Russia's economic significance to Europe in terms of energy cooperation, there are loud voices calling for European sanctions to avoid disrupting important oil supplies from Russia.

For instance, Italian Prime Minister Mario Draghi told reporters last week that any sanctions that may be imposed on Russia by the EU should not hit energy imports. His remarks, to a certain extent, underscore European countries' dependence on Russia for supply of energy.

Therefore, any potential Western sanctioning on Russia's energy exports is likely to be double-edged sword. Some may argue that US gas exports to Europe has been on the rise recently, which may become a potential source of energy supply to European countries, but even if the US can increase its production capacity to fill the supply gap, the high transportation costs of LNG from the US means that the EU's energy costs will rise significantly.

Similarly, oil has also been facing considerable pressure lately. Once the situation worsens, it is inevitable for oil prices to go off the roof.

It is not just Russia and the EU that will be hit by the turmoil in global energy supplies caused by the geopolitical conflict. Once the global energy supply and demand pattern has to change, China, which relies heavily on oil and gas imports, could also feel the effect.

Historically speaking, military conflicts, especially those among major powers, often have a serious impact on oil supplies.

China should further strengthen economic and trade cooperation with Russia, Saudi Arabia and other oil exporting countries. China should also be prepared to ensure the security of its oil supplies. In the long run, the country needs to increase the use of green and renewable energies as much as possible to consistently support China's economic growth.