Illustration: Chen Xia/GT

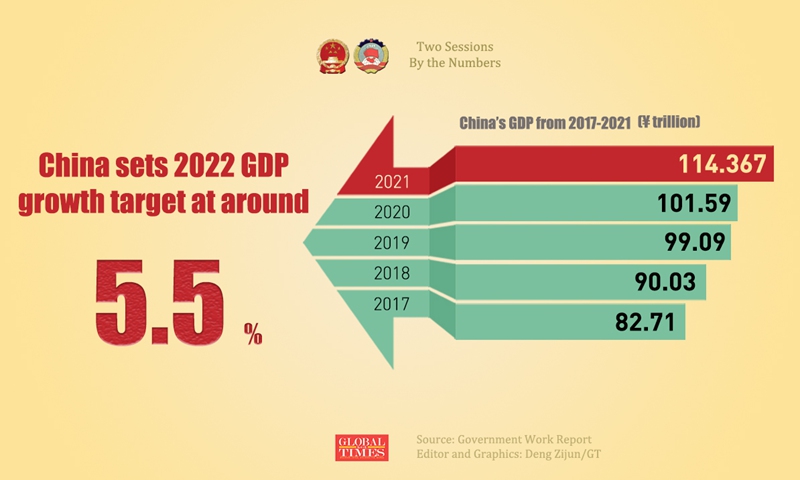

China has planned to pursue a set of proactive fiscal and monetary policies in 2022 to guarantee its economic growth to reach around 5.5 percent over last year, according to the annual government work report delivered to the opening of the annual session of the National People's Congress (NPC) on Saturday. It vowed to vigorously develop advanced manufacturing, high-tech innovations and ramp up another wave of infrastructure investment.

It is not an easy task for the country's policymakers as the world is still facing the pandemic and an emerging geo-economic divide caused by the US and the West's confrontation with Russia.

With so many perplexing uncertainties, misting the human eyesight, it is important for China, an emerging powerhouse, to keep its perseverance and resilience to staunchly support globalization and oppose protectionism, trying the best to prevent the de-integrating forces in the world from splitting the globe.

By all metrics, maintaining a relatively fast economic development is the main job of the decision-makers in Beijing, in order to continue improving the livelihood of 1.4 billion Chinese people, and at the same time, aspire to act as a leading force for upholding global dialogue, integration and reconciliation.

Graphics: Deng Zijun/GT

Thanks to the government's tough policy to contain COVID-19 that has seen daily infection cases mostly kept below 100 nationwide, China's economy staged a stellar recovery in 2021. The country's GDP grew 8.1 percent last year to $18 trillion, helped by the consistent strengthening of its currency, the yuan.

And China is endowed with more good conditions to shore up growth. Unlike the US, Europe and most other major economies, China's central bank has been implementing a prudent monetary policy so that the country's inflation is maintained at around 1.5 percent. In sharp contrast, the US and many Western nations were seen flooding their financial system with too much liquidity in the past two years, or "raining money from helicopters in the sky," and the result is sky-rocketing inflation in those countries.

As a result, throughout 2022 the world will witness the US Federal Reserve and central banks in Europe raise interest rates and use other monetary tightening measures to thwart runaway inflation, while China's central bank is trimming interest rates and releasing liquidity to effectively support its economy. Some call it "counter-cyclical policy readjustment," which is to be envied by other major economies.

In order to achieve the 5.5 percent GDP growth target in 2022, China's central government plans to appropriate 2 trillion yuan ($316 billion) to support the three-thronged development, back up investment on new and high-tech innovation and basic infrastructure, boost domestic consumption, and beef up foreign trade.

Also in the government work report to the NPC, Premier Li Keqiang asked officials in all provinces and regions across the country to work harder, smarter and more diligently to make sure their respective local GDP growth targets will be fulfilled. He suggested they should vigorously develop the private sector, such as encouraging private capital to invest in infrastructure projects in order to support local growth and create jobs.

In the coming months, a wide range of pro-growth policies will come out from local governments in China, such as reducing down payments to boost mortgages and home sales. As the real estate sector continues to be a significant driver of the economy, it's widely believed that the government will ease up last year's sweeping regulatory measures to cool down property speculation. In addition, new loans to support indebted property developers will likely rise.

The government is expected to enhance fair competition among the country's giant internet platform companies to strengthen the digital economy, provided they give up market manipulative activities to stifle competition, or using their big data-based algorithm to classify customers to price-gouge and profiteer.

Also, China will continue to fuel up a new engine to power its economy - the emerging new and high technology-enabled industries. These sectors include electric vehicles (EVs), semiconductor microchips, artificial intelligence, industrial robots, and 5G-facilitated mining, manufacturing, catering and remote work. In 2021, the output value of these sectors rose a staggering 42.6 percent over the previous year.

Take the EV sector as an example, China is now on the cusp of an explosive EV boom. Last year, it sold 3.6 million EVs, the world's largest. By 2025, EV sales are likely to top 8.5 million units when 30 percent of autos running on Chinese streets will be EVs, contributing to the country's great plan to go green and slash carbon dioxide emissions.

Foreign trade is also set to continue supporting China's GDP growth in 2022 and beyond. Last year, imports and exports reached $6.05 trillion, the highest in the world. If not for China, the backbone behind the stability of the global industrial chain, the world would have seen many manufacturing plants in tatters and millions of workers rendered jobless.

So, those forces in the US, who hope to undo China's manufacturing capability by imposing punitive tariffs and a slew of other sanctioning measures on Chinese companies or coercing its allies to engage in a zero-sum gamble against China, are blindfolded by their selfish egos, which are poised to bring self-inflected wounds on their own countries.