File photo: Xinhua

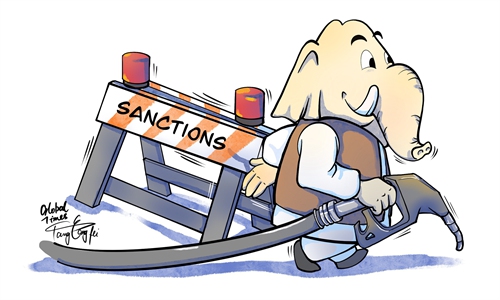

Global financial markets could be on the verge of suffering another shockwave as the US and its allies are attempting to crush Russia's economy with sweeping sanctions.

US credit rating agency Fitch Ratings claimed on Tuesday that Russia's sovereign bonds may default, if it doesn't pay $117 million in US dollars for coupon interest payments that are due on Wednesday with a 30-day grace period.

Russia has sufficient foreign reserves to service its external debt, but the problem is that half of the country's gold and foreign exchange reserves were frozen due to sanctioning measures imposed by the US and its allies over the conflict in Ukraine. In response, Russian President Vladimir Putin ordered repaying foreign currency debts to "unfriendly" countries in rubles.

But still, servicing external debt with rubles will most likely still be viewed by Western rating agencies as a default. If Moscow is unable to use the frozen funds of its foreign exchange reserves by the end of the 30-day grace period, the likely outcome could be that Russia would default on its liabilities for the first time since 1998, which may cause a new round of turmoil or even a crisis across international financial markets.

At a time when the world economy is still struggling to recover from the pandemic, the shock from a potential Russian default on global markets should not be underestimated. If any foreign bank that is of considerable importance to the global financial system has significant exposure to the Russian debt, then a default could trigger major financial turbulence.

And judging from the past experience, in the event of a global financial turmoil or crisis, a global liquidity squeeze may emerge, triggering capital withdrawal from the emerging markets that will go to the US equities market.

If a financial crisis that could be even partly attributed to a Russian debt default does occur, then the US and its allies are to blame. The US-led Western governments have not only imposed unprecedented heavy sanctions on Russia to destroy its economy, but also forced many other countries to take sides and bear the consequences of another global financial crisis.

With the US and its allies leveraging their dominance within the global trading and financial system, the global economic and financial consequences as a result of their sanctioning measures that are being imposed on Russia, is prompting a growing awareness among that emerging market economies that they need to think more about how to maintain their own financial security.

In fact, the unilateral sanctions imposed on Russia by the Biden administration and the Western governments are bound to hurt many countries around the world. Now it is time for the emerging market economies like China and India, to consider establishing an international trading system that is independent of Western impact, in order to better protect their own national interests.

All the emerging market economies should have the right to make their own foreign economic and trade policies in accordance with their actual development needs, and they should not be subject to the pressure from the US and its allies.

The Indian government is reportedly considering taking up a Russian offer to import crude oil and other commodities at a considerable discount, according to a recent Reuters report. New Delhi is drawing criticism from the West. But it is totally legitimate for India and China to maintain normal trade relations with Russia.

The US and its allies may want to use sanctions against Russia to strengthen their rein over the global financial system. But, with the rise of the emerging market economies, there is a growing awareness and necessity that they should avoid being hijacked by the Western financial hegemony, and that the West should no longer be left unchecked in influencing their economies.