GT Voice: By joining in US’ reckless sanctions, EU may have shot itself in the foot

Russian ruble banknotes are seen with the U.S. dollars in the backdrop on March 2, 2021.(Photo: Xinhua)

After Russia demanded that "unfriendly" countries pay for Russian gas with rubles, officials of the G7 agreed on Monday to reject Russian President Vladimir Putin's demand, with German Economy Minister Robert Habeck calling it "a unilateral and clear breach of existing contracts," Reuters reported.

But such statement will probably be to no avail as long as the EU still needs Russian gas. Also, since it is the EU that imposed unilateral sanctions against Russia in the first place, without the support of international law, Russia's demand for ruble payment may only be regarded as a countermeasure.

It is worth noting that Russia's requirement for payment in rubles only covers natural gas, and excludes oil, coal and other raw materials, clearly a calculated move targeting the EU. At present, the EU gets 40 percent of its gas from Russia, and there are no alternative gas supplies available in the short term. So there is no way for the EU to fight back. The stakes are just too high. If the EU doesn't pay in rubles for Russian gas, Russia will likely cut its supply, plunging the EU into an immediate energy crisis.

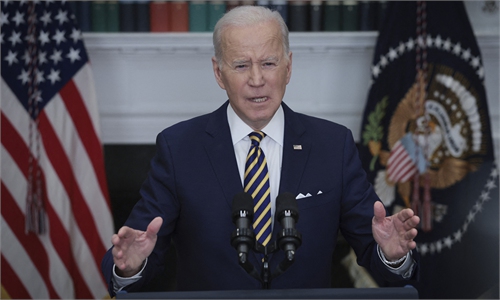

The irony is that the US, always keen to meddle in European affairs, chose to play down the huge difficulty and loss the EU is facing in a potential energy crisis. US President Joe Biden said on Friday in Brussels that "I know that eliminating Russian gas will have costs for Europe. But it's not only the right thing to do from a moral standpoint, it's going to put us on a much stronger strategic footing."

Contentious sanction Illustration: Liu Rui/GT

Yet, the hard truth behind Biden's remarks is that the US cannot help the EU wean itself off Russian energy supplies even though they are close allies. If anything, the EU, by recklessly joining in the US' economic campaign against Russia, shows the world what it is like to shoot yourself in the foot. In fact, the price for the EU to "dance to the US tune" on Russia is not just limited to its comprised energy security but will also include long-term damages to its currency.Generally speaking, major energy trade is settled in the US dollar or the euro. Once European companies have to pay for gas in rubles, the new settlement currency will change the global landscape in terms of energy trade, which may support the ruble and trigger a fall in the euro.

This is because the EU doesn't hold significant volumes of ruble for settlement, and it will have to buy the currency in the foreign exchange market or trade with the Russian central bank if it wants to continue gas trade with Russia. In other words, in order to buy Russian gas, the EU will likely have to partially lift sanctions in the SWIFT international financial messaging regime.

Given all the risks and potential damages, the EU needs to reflect on its abuse of financial hegemony in siding with the US on sanctions against Russia. Any hegemonic monetary system has its day of collapse, and its unbridled abuse is often the root cause.

For instance, SWIFT is supposed to serve as a financial tool to facilitate globalization, but the West has sought to weaponize this system to impose unilateral sanctions against Russia. The disruption to the global payment system is unprecedented, which also serves as a wake-up call for all countries that currently use the trade settlement system. Though the US dollar may be able to maintain its dominant position in the near future, the euro will face the biggest losses.