China's foreign trade mirrors stable start in Q1 despite Omicron outbreak, Ukraine crisis

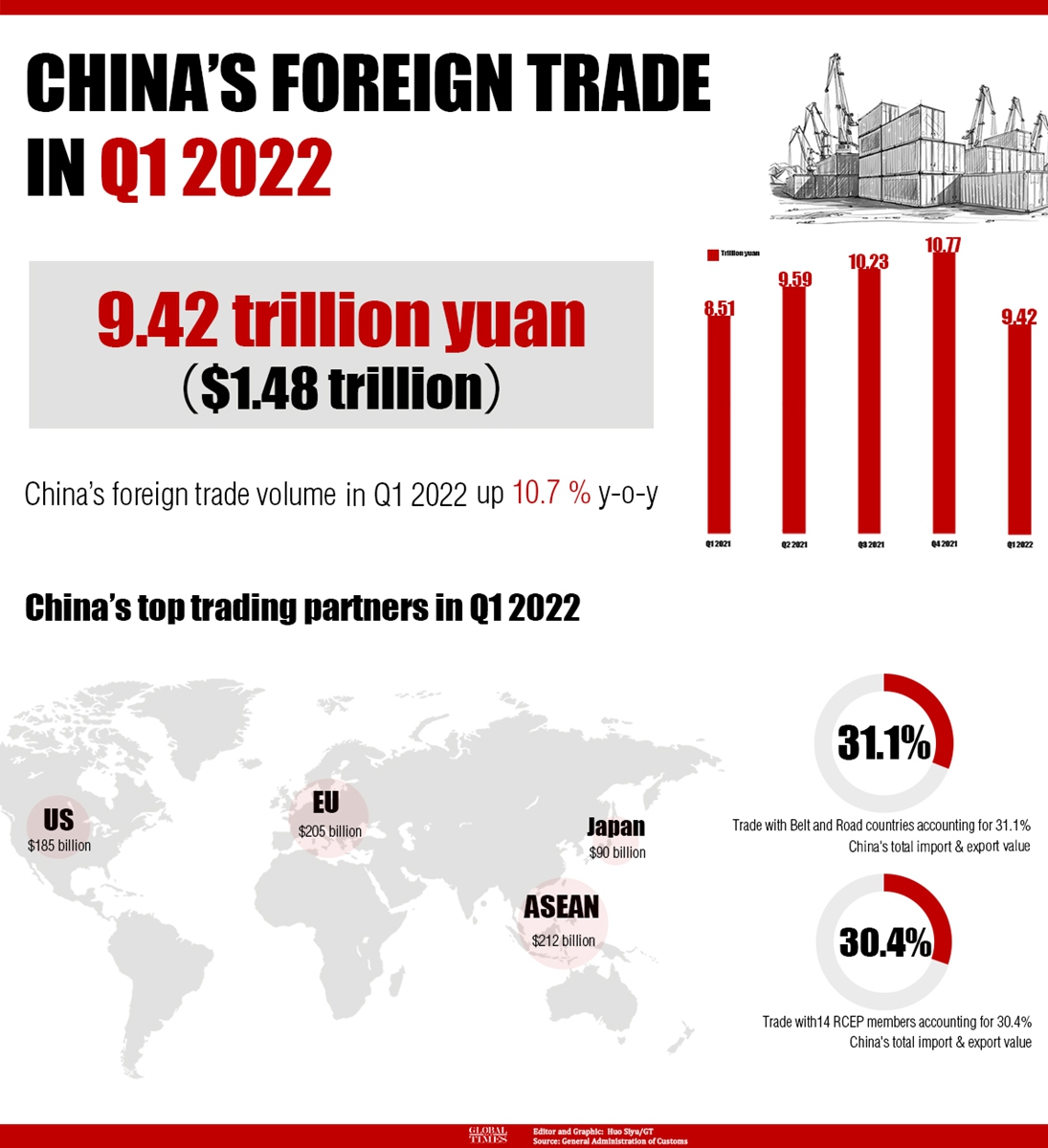

China's Foreign trade in Q1 2022.Graphic:Huo Siyu/GT

A busy Qingdao port in Shandong Province on February 6, 2022. China's container shipping sector registered steadfast growth despite headwinds from the COVID-19 pandemic and container shortages, indicating the country's robust foreign trade and economic resilience. Photo: cnsphoto

China's foreign trade was up 10.7 percent year-on-year at 9.42 trillion yuan ($1.48 trillion) in the first quarter of 2022, maintaining a growth momentum for seven quarters and getting off to a stable start for the year despite mounting challenges ranging from the Ukraine crisis and domestic Omicron outbreaks.The solid trade data again demonstrates the resilience of the global manufacturing powerhouse - which has been shipping everything from daily necessities to medical gear as the world grapples with uncertainties in the past two years. But economists warned the impact of the recent domestic COVID-19 resurgence might extend the next few months, exert pressure on exporters, and further drag the GDP performance of the first half.

Observers also pointed out that an unexpected drop in imports in March, the first decline since August 2020, also indicated a weakened demand at home, predicting more policy stimulus might be rolled out in the rest of the year as "measures are still abundant" in the central government's toolkit in dealing with the "deepest challenges."

In the first quarter, China's yuan-denominated exports reached 5.23 trillion yuan, up 13.4 percent, while imports rose 7.5 percent, reaching 4.19 trillion yuan, data released by the General Administration of Customs showed on Wednesday.

"China's foreign trade achieved a stable start in the first quarter of the year, laying a good foundation for achieving the annual goal," said Li Kuiwen, an official with the General Administration of Customs, noting that while facing difficulties and challenges, the Chinese economy is resilient, the fundamentals of long-term improvement will not change, and foreign trade is expected to maintain stable development.

Trade with major trading partners all achieved growth. Trade with ASEAN, the European Union, and the US amounted to 1.35 trillion yuan, 1.31 trillion yuan, and 1.18 trillion yuan, up 8.4 percent, 10.2 percent, 9.9 percent, respectively. Trade with countries and regions along the Belt and Road Initiative gained 16.7 percent, well above the average growth.

The first quarter trade figure, which fell in market expectations, once again underpins the country's rapid economic rebound, industrial chain resilience and its role as a stabilizer of the global economy since the pandemic outbreak, Li Chang'an, a professor at the University of International Business and Economics' School of Public Administration, told the Global Times on Wednesday.

The quarterly data may have provided a positive picture. But March trade data highlighted the difficulties and challenges faced by the world's second-largest economy ahead.

In US dollar terms, imports fell by 0.1 percent in March from a year earlier to $228.7 billion, compared with a growth of 15.5 percent in combined figures for January and February. Exports grew 14.7 percent compared with a growth of 16.3 per cent in combined figures for January and February.

Li explained the fall in imports in March was due to "some unexpected factors" in the international and domestic environment, combined with factors such as last year's high base, noting that the external environment for China's foreign trade is becoming more severe and complex.

"The inbound shipment drop was also due to the virus situation, which has dragged the process of customs clearance and logistics," Zhou Maohua, a macroeconomic analyst at Everbright Bank, told the Global Times on Wednesday.

Industry players warned the coronavirus impact, which is now happening in China's most important economic zones such as East China's Zhejiang Province and South China's Guangdong Province may extend to May and even June.

In terms of exports, the shipment time at Shanghai ports has been delayed by one to two weeks, noting that if the supply chain is disrupted by more than two weeks, many of the country's exporters will be struggling to cope with the impact, a Shanghai-based agent at a foreign trade company told the Global Times on Wednesday.

"It is not likely the situation will be eased in May," the agent said.

Analysts predicted that a 5.5 percent GDP growth might be hard to achieve in the first quarter given the slowdown in trade, calling for "greater" policy stimulus to stop a downward trend and weakened domestic demand - of which the central government is already working on.

According to a State Council Executive Meeting chaired by Premier Li Keqiang on Wednesday, the country will cut the banks' reserve requirement ratios (RRR) "in a timely way" to further increase financial support for the real economy, especially industries severely affected by the epidemic, as well as small, medium and micro enterprises, and individual industrial and commercial households.

Premier Li Keqiang on Monday also stressed speeding up rolling out support measures, ranging from tax cuts and special-purpose bond issuance to ensuring a stable energy supply, in a bid to stabilize economic growth.

At a forum with some local government officials and economists on Monday, Li urged officials to "increase the sense of urgency" in speeding up the implementation of various policy measures, stressing that all localities and government departments should remain confident, while also highly vigilant against unexpected challenges, rising downward pressure and resolutely respond to new challenges.

"Many problems have already been grasped by the senior leadership, and they are studying the rolling-out of measures," Guan Tao, BOC International's global chief economist who also attended the forum, told the Global Times.

In response to the logistics and supply chain disruptions amid the most recent wave of COVID-19, agencies from the Chinese central government are doubling down on efforts to unclog transport and logistics.

"The epidemic is now happening in China's most dynamic cities. The impact would be huge but once the coronavirus ends, firms and factories in these areas will also recover faster than others with their supply chain strength," Li Chang'an said.