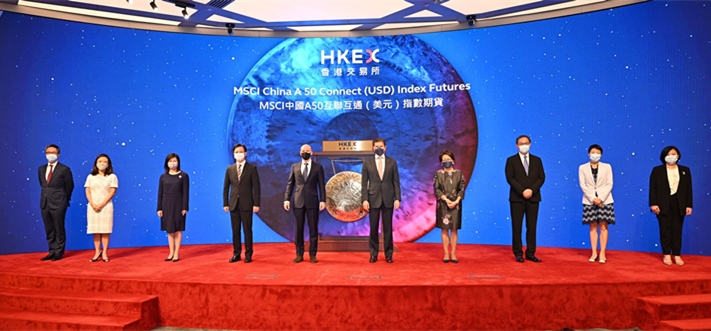

The launch ceremony of the first A-share derivatives product by HKEX based on MSCI China A 50 Connect Index Photo: Courtesy of HKEX

Hong Kong Exchanges and Clearing (HKEX), the operator of Hong Kong's stock exchange, on Wednesday reported a 21 percent decline in first-quarter revenue, as the local market navigated multiple headwinds.

The bourse operator recorded HK$4.69 billion ($597.65 million) in revenue and other income for the first quarter, down 21 percent from a record first quarter in 2021, according to its quarterly fiscal disclosure.

HKEX's shares in the Hong Kong market edged down 0.12 percent to close at HK$321.4 on Wednesday. By comparison, the benchmark Hang Seng Index was up 0.06 percent.

Its core business revenue fell 16 percent, a reflection of lower trading and clearing fees due to lower average daily turnover (ADT). Lower depository fees as a result of lower IPO service fees also put a drag on quarterly revenue.

The Hong Kong market's headline ADT jumped 16 percent to HK$146.5 billion quarter-over-quarter, but on a yearly basis, the first-quarter ADT shrank 35 percent.

"Global geopolitical uncertainties, elevated inflation risks, and the higher interest rate environment affected overall market sentiment," said HKEX.

The Hang Seng Index shed 5.99 percent during the first quarter. As of Wednesday's market close, the benchmark had lost 14.75 percent so far this year.

HKEX tallied net profits of HK$2.67 billion during the past quarter, a slide of 31 percent from the prior year.

On the bright side, the northbound leg of the bond connect between the Chinese mainland and Hong Kong exchanges reported a record quarterly high of 33.9 billion yuan ($5.17 billion) in ADT terms.

In addition, HKEX's IPO pipeline remains robust with more than 150 active applications, the bourse operator disclosed, including 10 applications for special purpose acquisition company (SPAC) listings, as of the end of the first quarter.

Shares in Aquila Acquisition Corp debuted on March 18, the first SPAC listing on the Hong Kong exchange.

Throughout the first quarter, "HKEX demonstrated its robustness and resiliency despite ongoing market volatility and geopolitical fragility," HKEX CEO Nicolas Aguzin said in a statement detailing the financial results.

"However, we were not immune to global market sentiment, which resulted in some softness in the IPO market, reduced valuations in our investment portfolio and pricing volatility in our commodities market," he remarked, retaining confidence that the bourse operator remains well-placed with broad-ranging opportunities.

Global Times