US seeks to rope in South Korean EV firms during Biden’s visit

Move unlikely to shake China’s key role in supply chain: experts

A Hyundai Kona electric sport utility vehicle (SUV) in a cradle on the assembly line at the Hyundai Motor Co. plant in Nosovice, Czech Republic, on Wednesday, April 7, 2021. Photo: VCG

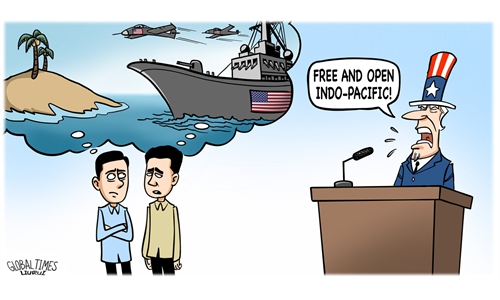

Though the US is expected to launch its so-called Indo-Pacific Economic Framework, aiming to isolate China from key technology supply chains such as semiconductors and electric vehicle (EV) batteries, Chinese analysts said that the move will fail to shake China's crucial role in the global supply chain.The deal, which is ideologically motived, is not in line with the rationality of the global economic division of labor, and is not likely to yield concrete results as Washington expected, given the US' bullying behavior in dealing with other countries, experts added.

South Korean carmaker Hyundai Motor Group said on Sunday it would invest an additional $5 billion in the US by 2025 to strengthen collaboration with US firms in advanced technology. The carmaker on Friday announced plans to invest $5.5 billion in the US state of Georgia to build EV and battery facilities.

The investments were announced during a three-day visit to Seoul by US President Joe Biden.

"Thanks to Hyundai, we are being part of this transformative automobile sector and accelerating us on a road where we're going to be handing to the US all-electric future," Biden told a press conference.

Biden's meeting on Sunday with Hyundai's chairman came after he made an earlier stop at a computer chip plant of Samsung, the South Korean electronics giant, which plans to build a $17 billion production facility in the US state of Texas.

After Biden took office, he launched stimulus policies to boost the development of automobile batteries to shift the country away from gas-powered cars to EVs, attracting a batch of overseas battery makers to invest there, including the three battery giants from South Korea: LG Energy Solution, Samsung SDI and SK On, which account for around one-third of the world's EV battery market.

The partnership, however, has shown signs of discord as the US automakers want more sharing of battery technology, but the South Korean suppliers are unwilling to part with their trade secrets, according to a Nikkei report in March.

"From semiconductors to automobile batteries, the US wants to remain at the top of the supply chain and is trying to make the supply return domestically or to control the chain in all respects, so discord is highly likely to emerge, which also reflects its 'double standards'," Bai Ming, deputy director of the international market research institute at the Chinese Academy of International Trade and Economic Cooperation, told the Global Times on Sunday.

The South Korean-US battery supply chain alliance is of no concern, Chinese analysts said, as it is competitive products that speak in global markets instead of such a small-scale effort.

It is hard to shake the dominance of the Chinese EV battery manufacturing sector, represented by leading companies such as bellwether CATL, which has had a comprehensive and forward-looking layout in the industrial chain for many years, Cui Dongshu, secretary general of the China Passenger Car Association, told the Global Times on Sunday.

Batteries constitute about 30 percent of an EV's total manufacturing cost and are pivotal in improving vehicles' safety.

China has created advantageous conditions for the sourcing of basic raw materials for processing batteries as well as technology research and development, Cui said, while in terms of technology innovation and management, Japan and South Korea still have the upper hand due to their years of experience.

"That's the direction where we need to ramp up efforts: gradually shifting from low-cost lithium iron phosphate batteries, where we have gained a pretty large global market share, to batteries with more density," said Cui.

Despite rising raw material prices, China's battery firms have strengthened their position in the global market.

China, South Korea and Japan are the major players in the global EV battery market, and their battery shipments stood at 53 gigawatts, 25 gigawatts and 9.4 gigawatts, respectively, in the first quarter this year, according to Seoul-based SNE Research.

Chinese battery companies continued to chip away the market share of South Korean and Japanese makers by securing six spots of the top 10 global makers with a combined market share of 55.7 percent, and CATL alone had 35 percent.