Sliced meats are displayed at Eataly NYC Downtown in New York, the United States, on March 10, 2022. Photo: Xinhua

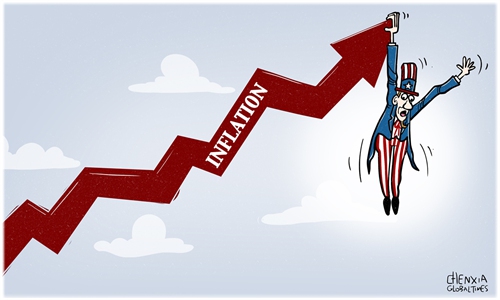

The US inflation problem worsened in May as widely forecasted. US consumer inflation hit a 40-year high at 8.6 percent in the 12 months through May, with gasoline marking a record high and the cost of food soaring, US Labor Department data showed. US President Joe Biden admitted the inflation could last "for a while."

Speaking at a Democratic fundraising event on Friday, Biden said this inflation is "going to come down gradually," but the politically sensitive price pressures are not expected to alleviate automatically unless his administration can roll out right policy set to bring prices down.

The elevated prices on daily necessities have been worsening domestic economic woes that trigger grievance among US ordinary consumers. The University of Michigan's consumer confidence index, released on Friday, fell to 50.2 in June from 58.7 in prior month, the lowest since 1980. If the Biden administration could not take effective measures to curb the rising prices, the Democratic Party risks to lose its domination of Congress in the November midterm elections, political analysts warned.

This time, Biden is once again trying to shift the blame to other factors, including the Russia-Ukraine conflict, for high food and energy prices. Yet, it seems like a tactic that will unlikely work, as Republicans are trying to make sure voters do not forget inflation has been rising in the country for six months, well before the Russia-Ukraine conflict.

In the global economic landscape, the impacts of the soaring inflation in the US have also become a major risk. In order to curb inflation, the US Federal Reserve (Fed) in May raised the interest rate by 50 basis points. Recently, the Fed sent signals that it will take similar actions in June and July. As the US is expected to move faster on tightening policies, an increasing number of economists believe that the risks for the US to be stuck in recession are rising. The recession will hit in the first half of 2023, a survey by CNBC CFO showed last week.

The Fed has been slow to act in the early stage. Now, in order to curb inflation risks, it has to take fast tightening actions. This drastic policy shift has not only increased the risk of a recession in the US, but also caused negative spillover effects that impacted global financial markets and exacerbated stress in emerging markets.

In the past, an important reason for the long-term low inflation in the US was that in the context of globalization, emerging markets continued to export commodities at lower price levels. Today, the US pursues unilateralism, arbitrarily "cutting off supply" and "decoupling," seriously undermining the global supply chain and dragging the global economic growth.

While US Treasury Secretary Janet Yellen admitted that some China tariff cuts may help the US to ease the "unacceptable" inflation, US Trade Representative Katherine Tai on Monday said that fighting inflation is a more complicated issue than can be addressed with a "singular focus" on China tariffs. As a matter of fact, US tariffs on China have cost US companies more than $1.7 trillion and added $1,300 a year to US household spending. It is plain for all to see it is a simply right choice for the US to take if it removes its geopolitical calculations away.

A report from the World Bank on June 7 warned that the Russia-Ukraine conflict, supply chain chokeholds, and dizzying rises in energy and food prices are exacting a growing toll on economies all along the income ladder. These problems are "hammering growth," David Malpass, the bank's president, warned.

Bloomberg in March quoted former US Treasury Secretary, Lawrence Summers, as warning that the US is suffering from the "least responsible" macroeconomic policy in 40 years. The US should be wary of the measures it takes to ease the worsening inflation and avoid further spillover impacts to cause more impacts on global economy.

The author is an editor with the Global Times. bizopinion@globaltimes.com.cn