Photo taken on July 15, 2021 shows the US Federal Reserve in Washington, DC, the US. Photo:Xinhua

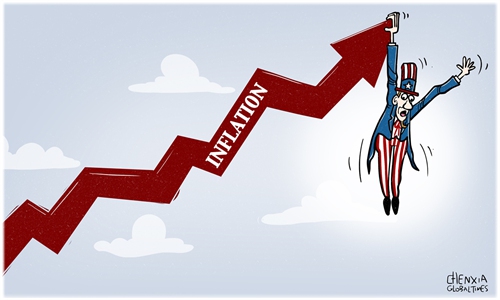

If the US wants to contain its runaway inflation wildfire, which reached 8.6 percent in May and is set to go even higher, the Federal Reserve should act decisively and even more bravely to raise the federal funds rate by at least 75 basis points on Wednesday.The world's largest economy is on the cusp of a serious crisis, because the 8.6 percent inflation rate is truly agonizing and frightening - forcing American households to buy less with rapidly shrinking numbers on their pocketbooks, and businesses constantly raising prices to offset production and service cost.

An economy can never operate smoothly under the weight of such extreme inflation. The economic situation in the US is absolutely dire, which may cause another financial crisis no less than the destructive level of 2008-2009, if the Wall Street stock index keeps bloodletting and the voracious sell-off is not stopped.

The policymakers at the US Federal Reserve, the central bank, is proportionately responsible for compounding a series of errors since last year by being too timid is upending its notorious QE (quantitative easing) policy, and too tentative is raising interest rates to stifle the country's inflammatory inflation.

The Fed's response to the pandemic-induced recession in the first half of 2020 by slashing the interest rates to around zero is a big blunder in hindsight, made worse by its purchase of approximately 50 per cent of the country's newly-issued Treasury debt and massive amounts of mortgage-backed securities. In comparison, China, which witnessed a 6.8-percent GDP downturn in the first quarter of 2020 because of pandemic lockdowns, did not cut its interest rates to below 2.75 percent - viewed as the neutral rate for most economies.

And, the Biden administration is to blame for the 41-year high inflation rate too. Its $1.9 trillion fiscal spending bill easily passed Congress where Biden's fellow democrats hold the majority, and the fiscal splurge is a primary trigger of inflation. Biden's economic team, for a prolonged time, refused to admit that huge fiscal stimulus is inflationary in essence. Even after inflation started to raise its ugly head in last July and August, the White House wrongly defined it as "transitory" or temporary.

And, the Biden administration failed to get a grip on people's inflationary expectations, as it did little to distinguish the surging price hikes. For an example, till today, the administration is debating whether to scrap the punitive high tariffs imposed on $360 billion imported goods from China - because it is simply clear the tariffs are actually taxes on American households and businesses, contributing approximately 1.3 -1.6 percentage points to overall inflation.

Strangely, the Biden administration is still seeking to cast the blame of inflation on bad luck, or the paralysed global supply chains - which the US government's trade and technology war against China is non-excusable. Recently, the White House also blamed Russia for steadily rising energy and food prices, although the US government had been tempting Ukraine to become a NATO member.

Now, it is impressive for the US Federal Reserve to take aggressive monetary tightening measures, to bring the US inflation quickly to below 3 percent to quell inflationary expectations, even though it may bring a short-term recession. Otherwise, the organization's inflation-fighting credibility will be seriously wounded, and the US economy will continue to reel under prolonged inflation.

It's the Federal Reserve's duty to fight inflation, whose policy mistakes got the country into the current mess. Now, it must dispel market anxiety over ever-growing price levels through aggressive actions. Raising the federal funds rates by 75 basis points on Wednesday and stating that more will come in the coming weeks and months would send a loud and necessary message. Of course, short-term economic pain is inevitable, but healthy longer-run economic performance requires strictly-tamed lower inflation and a credible central bank sitting at the wheel.

The author is an editor with the Global Times. bizopinion@globaltimes.com.cn