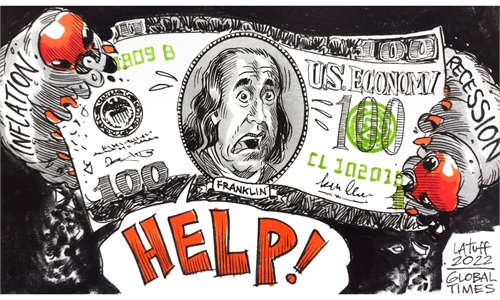

Illustration: Tang Tengfei/Global Times

China's holdings of US Treasury bonds shrank in April to their lowest level since June 2010, new data revealed on Wednesday. The US economy is headed for a sharp downturn, and its sovereign debt is losing its appeal to investors. The rate hike by the Federal Reserve on Wednesday will probably speed up this process.According to data from the US Treasury Department, China's holdings of US Treasury bonds dropped to $1.003 trillion at the end of April, down $36.2 billion from the previous month. The cutting is not a strategic move but a market-based decision. It's the result of multiple reasons such as a plunge of US Treasury prices, a gloomy economic outlook and aggressive interest rate hikes in the US.

China is not the only country to trim its US Treasury holdings. Japan, the biggest foreign holder of US treasury securities, reduced its holdings by $13.9 billion to $1.22 trillion in April, the lowest amount since February 2020. Overall, foreign holdings of US Treasury bonds dropped from $7.613 trillion to $7.455 trillion, the lowest since April 2021.

The overall reduction is only part of the story that global investors are losing confidence in US dollar-denominated assets. The logic behind it is that the risk of a sizable recession is growing. The US economy declined at an annualized pace of 1.5 percent in the first quarter of 2022, the worst annual performance since the pandemic-induced recession in early 2020. The Financial Times reported on Monday that the US economy will tip into a recession next year, according to nearly 70 percent of leading economists polled by the media outlet.

If the GDP growth continues its downward spiral and drags the world's largest economy into a recession, there is a high probability that global investors may lose interest in dollar-denominated assets and pull their capital out of US markets.

On Monday, Wall Street's S&P 500 tumbled by 3.9 percent to a new low this year and the Dow Jones fell more than 875 points. A number of signs are beginning to suggest that dollar-denominated assets are less valuable than ever with the country's increasingly gloomy economic outlook.

The consumer price index increased 8.6 percent last month from a year earlier, reaching a 40-year high. High inflation prompts the US Federal Reserve to announce a 75 basis points hike of its benchmark interest rate on Wednesday. The rate hike may lead to a decline in securities prices and force investors to further reduce their holdings of US Treasuries.

CNN reported in May that the US public's view of the nation's economy is the worst it's been in a decade. A majority of US adults say the government's policies have hurt the economy, and 8 in 10 say the government isn't doing enough to combat inflation, according to a CNN Poll conducted by SSRS. The reduction of US Treasury bonds offers a window to observe global investors' view of the US economy, suggesting pessimism is being instilled into the minds of most investors.

If the Biden administration fails to take effective measures to tame the runaway inflation and the US economy continues to deteriorate in the coming months, it is very likely more countries will dump their holdings of US debt.

The author is a reporter with the Global Times. bizopinion@globaltimes.com.cn