Premier Li makes latest avowal of opening-up, reasonable growth in reassuring message to foreign business community

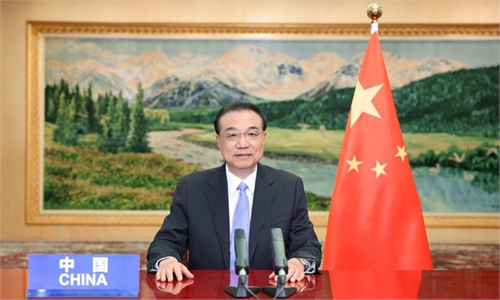

Reaffirming opening-up as China's fundamental national policy, Premier Li Keqiang on Tuesday assured the foreign business community that the country will efficiently coordinate COVID-19 containment and economic and social development, and strive to get the economy back on track.

The latest official avowal of wider market access and reasonable economic growth delivers a reassuring message to the foreign business community, a vibrant part of the world's second-largest economy, market observers said, arguing against unfounded Western media hype that multinationals are rushing to relocate in other markets.

That the economy managed to withstand varied headwinds to record an expansion during the second quarter on the back of a raft of timely and effective pro-growth measures, reinforces market belief that the country is heading toward benign growth even though meeting the official growth target of around 5.5 percent appears challenging, experts said.

Fresh message of reassurance

Li met virtually with Executive Chairman of the World Economic Forum (WEF) Klaus Schwab on Tuesday, saying that China will stay committed to the fundamental national policy of opening-up, and will work with all parties to intensify dialogue and communication to create conditions for win-win cooperation of mutual benefit, the Xinhua News Agency reported.

"China's market is also the world's market. China will continue to pursue all-round opening to both developed and developing countries, work with other parties to uphold the multilateral trading regime with the WTO at its core, and promote free trade and fair trade," the premier said in remarks to the Special Virtual Dialogue with Global Business Leaders hosted by the WEF late Tuesday, according to Xinhua.

"In growing trade, frictions and disputes are inevitable. We need to seek common ground and properly handle differences, to keep industrial and supply chains secure and stable," Li said.

Nearly 400 business executives from more than 50 countries took part in the virtual dialogue, according to Xinhua, which did not name any multinationals.

The premier vowed continued efforts to create a market-oriented, law-based and globalized business environment, and to guarantee foreign businesses legitimate and equal access to opening areas.

The country will aim for more precise and scientific COVID-19 prevention and control on the basis of ensuring virus control safety, and continued improvement of visas, testing and other containment policies, he went on to say, pledging to recover and increase international passenger flights and steadily push for outbound business and cross-border work activities.

The fresh message of reassurance apparently ratchets up optimism about multinationals playing a more vibrant part in revving up the economy, experts and market participants believe.

Foreign investment is an indispensable part of China's industrial upgrading, and the country still needs to further attract foreign investment and promote a higher level of opening-up, Tian Yun, a Beijing-based veteran macroeconomic analyst, told the Global Times on Wednesday.

In terms of confidence, Tian said that foreign direct investment grew by double digits this year, even on a high basis of last year's substantial growth, and now foreign trade is clearly better than expected.

In the first five months of the year, the country's actual use of foreign investment rose by 17.3 percent year-on-year to 564.2 billion yuan, equivalent to $87.77 billion, an increase of 22.6 percent year-on-year, data from the Ministry of Commerce (MOFCOM) showed.

A breakdown of the MOFCOM data reveals that South Korea's actual investment in China soared 52.8 percent year-on-year during the period. The reading in the case of the US jumped 27.1 percent and that from Germany grew by 21.4 percent.

One of the latest examples of foreign investment in China is the BASF Verbund site in Zhanjiang, South China's Guangdong Province.

BASF SE gave final approval for the construction of the planned Verbund site in Zhanjiang on Tuesday Germany time. BASF will invest up to 10 billion euros by 2030 to build the new Verbund site, according to a statement sent from BASF to the Global Times on Wednesday.

In 2020, BASF started construction of the first plant at the planned integrated Zhanjiang Verbund site, which, after completion, will be BASF's third-largest Verbund site worldwide after Ludwigshafen in Germany and Antwerp in Belgium, read the statement.

The Zhanjiang site will be built in several phases and is expected to be fully operational by 2030. The project is currently on schedule. The first plant for the production of engineering plastics is currently starting up and a plant for the production of thermoplastic polyurethanes will come on stream in 2023, said BASF.

Multinationals' sustained interest in the Chinese market despite disruptions, among other woes, as explained by Moody's Investors Service in a research note sent to the Global Times on Wednesday, is attributed to the country's "large domestic market, supply chain resilience, advanced infrastructure, rich labor supply and vibrant innovation ecosystems."

Foreign capital will drive the recovery of high-tech manufacturing and the services industry, and foreign financial institutions will continue to expand their positions in yuan assets due to the strong performance of the currency and the low inflation environment in China, Wang Dan, chief economist of Hang Seng Bank China, told the Global Times on Wednesday.

Aerial photo taken on April 15, 2022 shows a view of Shanghai's Yangshan Port in east China. Photo:Xinhua

Reasonable growth

Executives at multinationals attending the special dialogue were briefed on the country's efforts to reverse course in economic activity in the latter part of the second quarter, which analysts said typify the economic resilience that points to reasonable growth for the whole of 2022.

The economy came under greater sudden downward pressure at the start of the second quarter amid a new round of virus fallout. Major economic indicators dived in April and the government responded with a decisive and timely fine-tuning that put economic stabilization on the front burner, the premier said.

A downturn in major indicators was seen moderating in the wake of a slew of policy efforts before the economy stabilized and staged a comeback in June, Li continued, citing a conspicuous decline in the urban surveyed unemployment rate and an economic expansion recorded for the second quarter.

Urging sobriety toward a yet-to-be-solid foundation of economic recovery, the premier stated that endeavor remains a must for stabilizing the economy.

China will keep macro policies consistent and targeted, and strive for fairly good results in economic development for the whole year, according to the premier.

As long as employment is relatively sufficient, household income grows and prices are stable, slightly higher or lower growth rates are both acceptable, he added.

The economy expanded by 0.4 percent in the second quarter, read official data and its first-half growth tallied 2.5 percent.

"A growth of 4.5-5 percent annual economic growth should be acceptable, which at least means that China's economy has recovered to a level that shows potential growth power in the second half of the year," Tian remarked.

According to Tian, the priority for China is to maintain a dynamic balance between epidemic prevention and economic growth, which means to prevent the spread of the epidemic in a timely manner, and at the same time help to facilitate the flow of people and logistics.

"Meanwhile, the deterioration in the housing industry during the second quarter must be reversed as soon as possible, which is very important for the recovery of investment and consumption in the second half of the year. In particular, we must not let developers pass on bad debts to buyers because of unfinished, stalled housing projects," Tian said.

In the words of Wang, this year's economic growth target is no longer a rigid constraint, and the primary goal is to prevent large-scale spread of the epidemic and ensure employment.

"Steady growth in the second half will largely rely on monetary easing, which will help lower the borrowing costs of the private sector, reduce debt and improve balance sheets," said Wang.