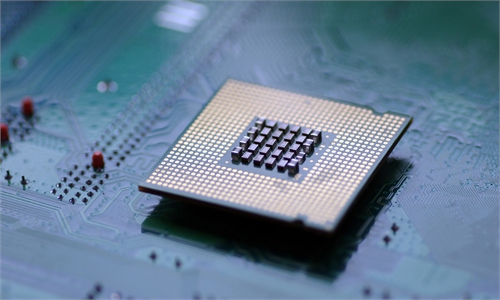

Photo: VCG

Samsung Electronics, the world's largest memory chip maker, said on Thursday that it expects mobile and PC chip demand would continue to weaken as macroeconomic uncertainties persist, according to Reuters. Earlier, US chipmaker Qualcomm Inc forecast lower-than-expected sales revenue for the current quarter as a slowdown in smartphone demand hit its mainstay handset chip business, Reuters reported.As global chipmakers frequently warn of waning chip demand, a down cycle appears to be just around the corner amid the growing risks of a recession in the world economy.

The relatively weak demand outlook by the two high-profile chipmakers, to a certain extent, could be seen as a sign that demand may fall faster than expected, mirroring the growing concern that the global chip industry could be turning toward a glut cycle after recent booms.

In a world where chip demand is expected to lag behind supply, China's importance as the world's largest market for chip application will be a bulwark in the face of US artificial barriers in the global chip industry.

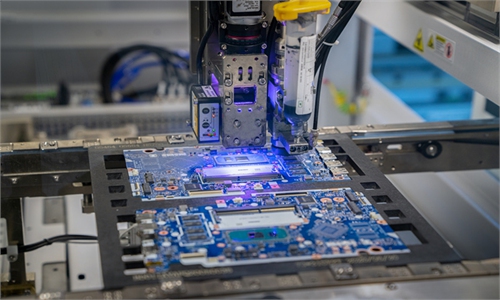

It is no secret that global chipmakers have been splurging on new plant projects amid a chip shortage that hobbled producers of almost everything from smartphones to electric vehicles in the past two years. Major chipmakers, including Taiwan Semiconductor Manufacturing Company, Intel and Samsung, have all announced plans to spend billions of dollars on setting up new plants or expanding the existing ones for the next few years.

But there is the potential that demand may change much more quickly by the time a chip factory is built, especially at a time when the global economy is facing risk of slipping into a recession. In fact, demand may be shrinking faster than expected. The clearest sign is that sales of almost all major consumer electronics, such as PCs and smartphones, are poised to weaken, leading to waning demand for chips.

Financial markets have already started to react to the reversal in the chip business cycle, with share prices of global chipmakers slumping by about a third this year, according to The Economist.

Against this backdrop, China's strength in having the world's largest chip application market is likely to help the country cement its position in the global chip industry chain. The past few years saw the US use various sanctions to suppress Chinese high-tech companies, and the semiconductor industry is a priority for the US containment of China. The US Senate on Wednesday just passed a chip bill that aims to offer about $52 billion of funding for companies making computer chips and seceding their chip supply chains from China.

Yet, the US move to restrain China's technology development has actually boosted production and sales of Chinese domestic chipmakers. Moreover, with the backing of Chinese market demand, China's low- and mid-end chips have begun to achieve import substitution, as reflected in the decline of chip import volume this year.

Domestic chip manufacturers can currently mass produce 14 nm chips, which are sufficient to meet the majority of market demand for chips. China's rapid development in 5G and other digital sectors will all become important cornerstone to support its domestic chip industry.

At present, China is accelerating the development of its domestic chip industry, with a target of achieving 70 percent chip self-sufficiency by 2025. To achieve the target, it is important for China to further integrate chip development with consumption needs and product development so as to hold a grip of the production chain and supply chain.

Of course, despite China's strong manufacturing capability in low- to mid-end chips, there are still some shortcomings for China to address in the long run to really overcome US sanctions.

It is a long and arduous task for China to build its own self-reliant chip industry chain, and there is no shortcut. We need confidence, patience, and most importantly, determination to adhere to long-term investment in research and development.