US falls into 'isolationist mentality' by pushing Inflation Reduction Act to curb China's new-energy rise

Illustration: Chen Xia/GT

US President Joe Biden is about to sign another "massive" law entitled the Inflation Reduction Act of 2022 (IRA) on Tuesday, but the soon-to-be law, demonstrating Washington's desperate yet isolationist mentality, unsurprisingly has a more obvious intention of curbing China's influence in the new-energy sector, may ironically end up only inflaming its runaway inflation, further disrupt the global industrial chain, and deter achieving climate goals, analysts said.

Industry observers noted the bill, followed the just-passed CHIPS Act, underscores how Washington felt it has been "intimidated" by China's rising tech prowess and its own incompetence in maintaining its supremacy in new-energy vehicle (NEV) technology amid a lingering tech war it has launched against the world's second-largest economy.

The series of moves targeting China signal that Washington now is embracing protectionism, rather than confidently participating in international competition amid the sense of loss, reminding some people of the arrogant and closed Qing Dynasty (1644-1911) - the last imperial dynasty of China that fading from the heights of its power over protectionism policies and isolationist mentality, observers said.

The IRA, passed by the US House on Friday and the Senate on Sunday, is now awaiting US President Joe Biden's signature to become law. The bill unlocks over $300 billion in spending on green energy and climate reform, including funding for consumer tax credits to offset the costs of electric vehicles.

However, the bill points out that to qualify for the tax credit, NEV makers must complete vehicle assembly in North America and source a significant percentage of major battery components, including metals like lithium, nickel and cobalt, from the US or countries that have free trade agreements with the US.

Yet, China, the world's largest producer of those vital components, does not have a free trade agreement with the US.

"Most terms attached to subsidies for carmakers stipulate the places of NEV assembly, but it is a rare case in a global sphere to also include places where battery minerals and units should be processed. Such overreach lays bare the US' malicious intention to suppress the whole high-tech industrial chain in China," Feng Shiming, an auto analyst with Shanghai-based Menutor Consulting, told the Global Times on Tuesday.

Feng said the US' offensive is in stark contrast to China's open-minded and inclusive industry policy, under which all NEV carmakers in China, regardless of homegrown or foreign peers such as Tesla, are entitled to industry subsidies as long as they meet criteria.

The bill actually makes it more clear that the long-lasting true intention of the US is to strangle China's new-energy rise, in case it was not obvious enough when the US cracked down on Chinese solar panel makers in Northeast China's Xinjiang Autonomous Region with the allegations of the "forced labor," Lin Boqiang, director of the China Center for Energy Economics Research at Xiamen University, told the Global Times on Tuesday.

Under the eye-catching name of fighting inflation, and putting all those mixed hodgepodge policies together, the contradictory and confusing bill again indicates that the only consensus the Democrats and the Republicans have reached is to crack down on China's tech rise, Gao Lingyun, an expert at the Chinese Academy of Social Sciences in Beijing, told the Global Times on Tuesday.

It is not clear how much determination the US has to defend itself against inflation - but not quite as much as legislators want to crack down on China and maintain its technology dominance, Gao said.

"The discriminatory rules also put it at a risk of violating WTO rules," Gao said.

"With this legislation… the CHIPS and Science Act, and a range of executive actions, the US is in a stronger position to maintain our global competitive edge for years to come," US Trade Representative Katherine Tai said in a statement following Congressional passage of the IRA on Friday.

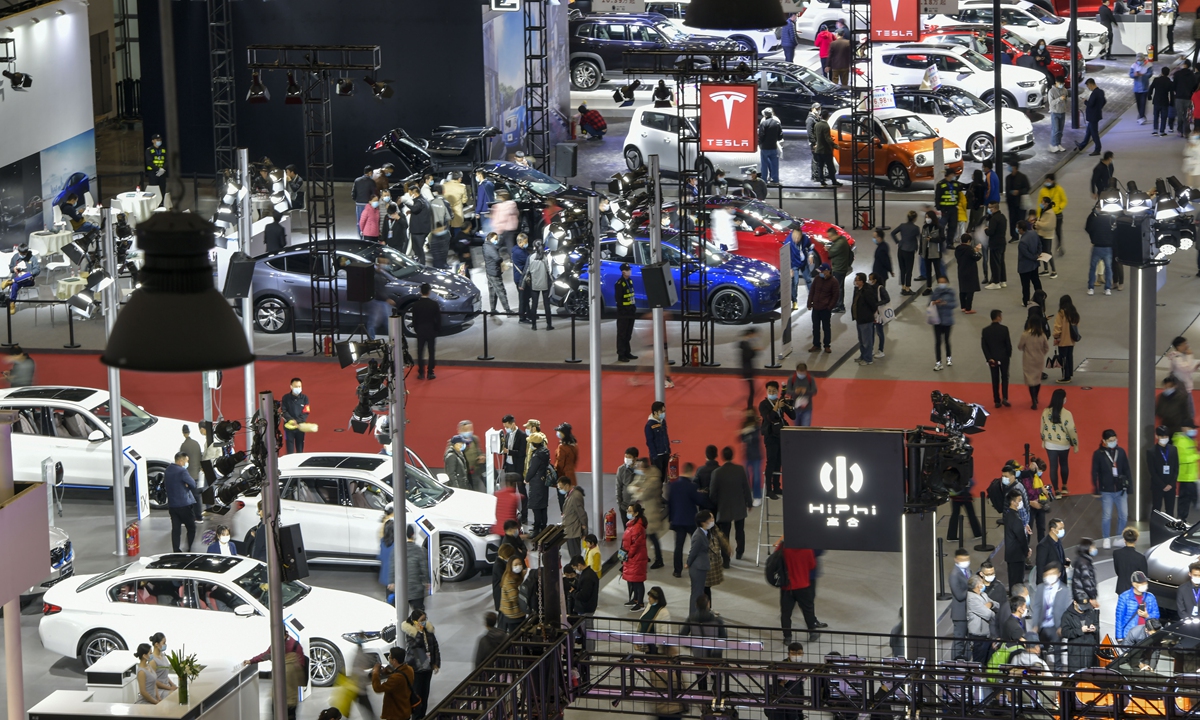

Haikou hosts the new energy vehicle (NEV) show in South China's Hainan Province on Friday. Close to 300 new energy and intelligent connected vehicles are on display at the fair. Officials said China will raise the proportion of NEV sector to 20 percent of total new auto sales by 2025. Photo: cnsphoto

Unrealistic plan

Describing the bill as political grandstanding that fully demonstrates Washington's isolationist mentality, industry observers said the bill could inflict drastic harm on the US as well as the global NEV industry and further inflame its runaway inflation, while its impact on the rise of Chinese NEV-makers is "negligible and within control."

Currently, 70 percent of the 72 EV models on sale in the US market would not qualify for subsidies when the bill is signed, according to a report by industry website autosinnovate.org. Virtually none would be able to access the financial incentive in the next few years when additional sourcing requirements come into effect, which could further exacerbate US consumers' woes.

"Unfortunately, the NEV tax credit requirements will make most vehicles immediately ineligible for the incentive. That's a missed opportunity at a crucial time and… will also jeopardize our collective target of 40-50 percent electric vehicle sales by 2030," John Bozzella, president and CEO of the Alliance for Automotive Innovation said in a blog published on the official website of the alliance on August 5.

"It is almost impossible that any Fair Trade Alliance countries could fill China's raw material gap for the USA's NEV demand between now and 2024," read a Fortune report, citing Simon Moores, chief executive of lithium market analyst Benchmark.

Leading Chinese battery-makers including CATL and BYD jointly account for about half of global market share. For carmakers in the US, Europe, Japan and South Korea ranging from Tesla, BMW, Toyota, Kia and Hyundai, cutting ties with Chinese suppliers could drive up cost by "a significant percentage" in terms of purchase and delivery, Feng explained.

And while the US has put severe strains on its allies, aiming to loop them into a small clique to exclude China from the global supply chain, analysts also predict few companies would buy into such scheme considering the sky-high costs.

"We have no plans to build a factory in the US yet. Apart from subsidies, we need to assess the market situation and resource endowment," a representative from a global- leading solar panel maker told the Global Times on Tuesday, indicating the firm has to weigh whether these so-called incentives can make the cost of building a brand-new industrial chain in the US.

"Localization always comes with huge front-loaded expense. For example, yield is key to battery making, and it may take years of adjustment and accommodation to achieve a relatively high yield rate in the US, not to mention building a NEV supply chain from scratch," Feng said, while also questioning whether the market in the US is "big enough" to draw in NEV car makers.

"It is undeniable that if foreign carmakers drift away from Chinese suppliers, the latter's sales would tumble. But that loss could soon be made up with China's prodigious and booming home market," Feng noted.

Industry players also questioned whether the bill can be carried on given the US' heavy reliance on Chinese components, mounting debt, and severe domestic economic problems. Moreover, in the US, policies are normally not sustainable amid the rotating political parties.

"The bill, if it comes into effect, will also bring up the cost and delay the progress of achieving global climate goals," Lin warned.