Will the US start a war against China?

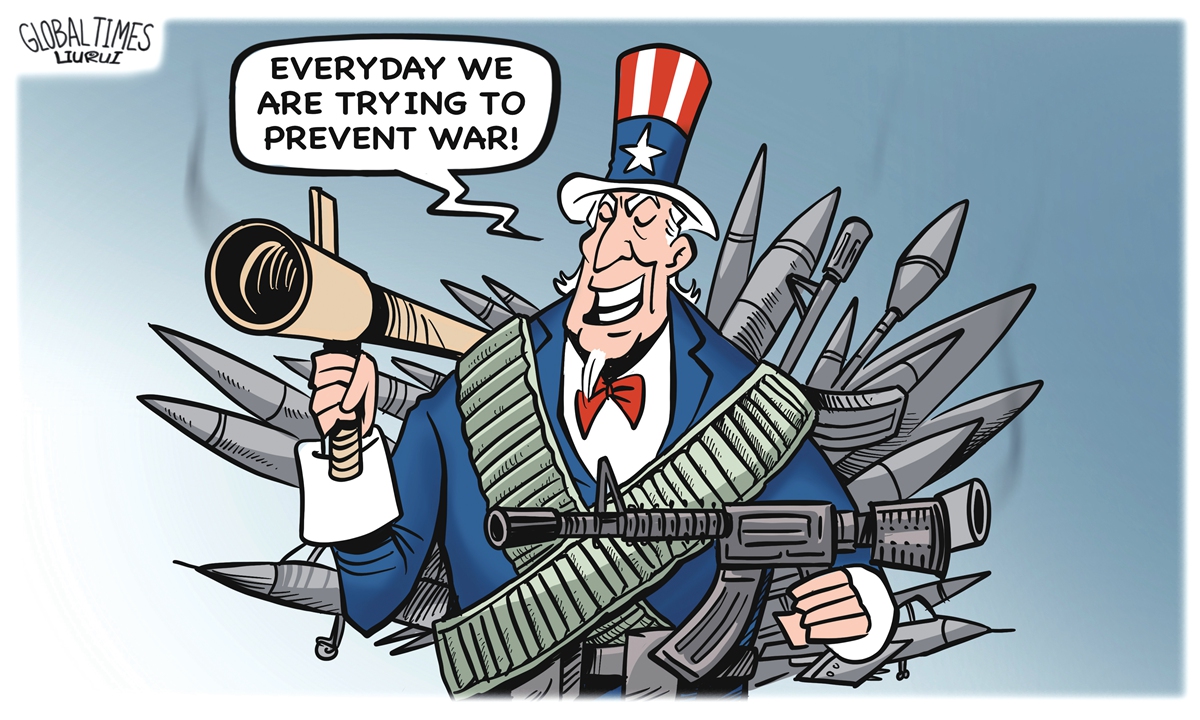

US hypocrisy Illustration: Liu Rui/GT

Dr. Henry Kissinger has a fear. He warned a few days ago that America is "at the edge of war with Russia and China."

Singapore also shares this fear. Singapore's next prime minister Lawrence Wong warns that the US and China may "sleepwalk into conflict." Many more countries have similar feelings.

The reason is that the genetic information of war is embedded in the genes of Western capital power.

The US has been spiraling upward in its all-encompassing containment of China, and there seems no high point at which it will stop and take a break. It is like a runaway horse running wildly to the precipice of war.

The question is related to what exactly Washington wants.

In fact, what Washington wants is not a fight to the death, but how to profit from a war, or rather how to profit from someone else's war.

Only if the interests of US capital are satisfied, it will not go to war with its adversaries.

Ultimately, what Washington wants is the global market, to maximize its profits.

Washington is not unaware that China does not have a plan to go to war with the US, and even the most anti-China people do not think that China will initiate a war against the US. But Washington sees China as an enemy because it has moved the US cheese.

JPMorgan chief Jamie Dimon recently said that the US government should take a stand by trying to match China's efforts to build soft power in the developing world. He told JPMorgan's clients, "If we don't do trade with Western allies, China is going to cherry pick every nation… They'll give them 5G equipment for cheap. They'll negotiate deals, lend money. They are trying to do it in Latin America. Our backyard."

The fears of Dimon, who could be called a representative of American capital interests, are the real reasons behind why the US has launched a series of containment actions against China.

If we put together the changes in US policy toward China from the Trump era until now, almost every time when there was an increase in anti-China sanctions, there was a "far-sightedness" to squeeze China out of the global market and manufacturing chain.

In the latest move, Pelosi and several US lawmakers went to Taiwan to stand up for "Taiwan independence." One of the main aims is to create tensions and further pulling Taiwan Semiconductor Manufacturing Company into the US chip siege against China.

Those so-called reasons of ideology, human rights, etc., are all to serve US capital control of global services and show us the capital competition for markets is brutal and ruthless.

According to 2019 data, the US share of the global economy has nearly halved since 1960. America's nominal GDP in US dollars is $21.4 trillion in 2019, or about 24 percent of the share of global economy.

Although China accounted for over 18 percent of the global economy in 2021, the number is rising rapidly. One of the most important things is not just that Chinese manufacturing is going global, but that Chinese capital is also starting to go global.

Chinese capital, by being "Chinese," does not change those fundamental properties of capital that Marx analyzed, so the management of capital has always been a difficult issue in national governance.

The Chinese government has no plans to encourage Chinese capital to seize others' territory or resources through war. In contrast to the historical path of Western capital's global expansion, there is a logic of "common development" behind Chinese capital going abroad. You might find the reasons from China's political system.

However, this does not matter to US capital. If we follow the logic of capital development as they see it, what matters is that Chinese manufacturing will eventually push them out of the global industrial chain, leaving them with no money to make and no work to do.

So, the first thing they want to do is to maximize their share of the Chinese market, including acquiring quality Chinese companies. And once that market is not so easily accessible, or Chinese companies are not as open as they would like them to be, the expansion of US capital power in China is constrained.

Then, the next thing to do is inevitably to implement a global stranglehold on Chinese capital and Chinese manufacturing.

History tells us that the option of war is an inherent part of US capital export and expansion, and that Washington is often easily manipulated by the impulse of capital power.

In fact, whenever Washington wants to strengthen its ability to govern, it borrows from the military-industrial complex, which is the most dangerous aspect of this great contest of capital power.

The author is a senior editor with People's Daily, and currently a senior fellow with the Chongyang Institute for Financial Studies at Renmin University of China. dinggang@globaltimes.com.cn. Follow him on Twitter @dinggangchina