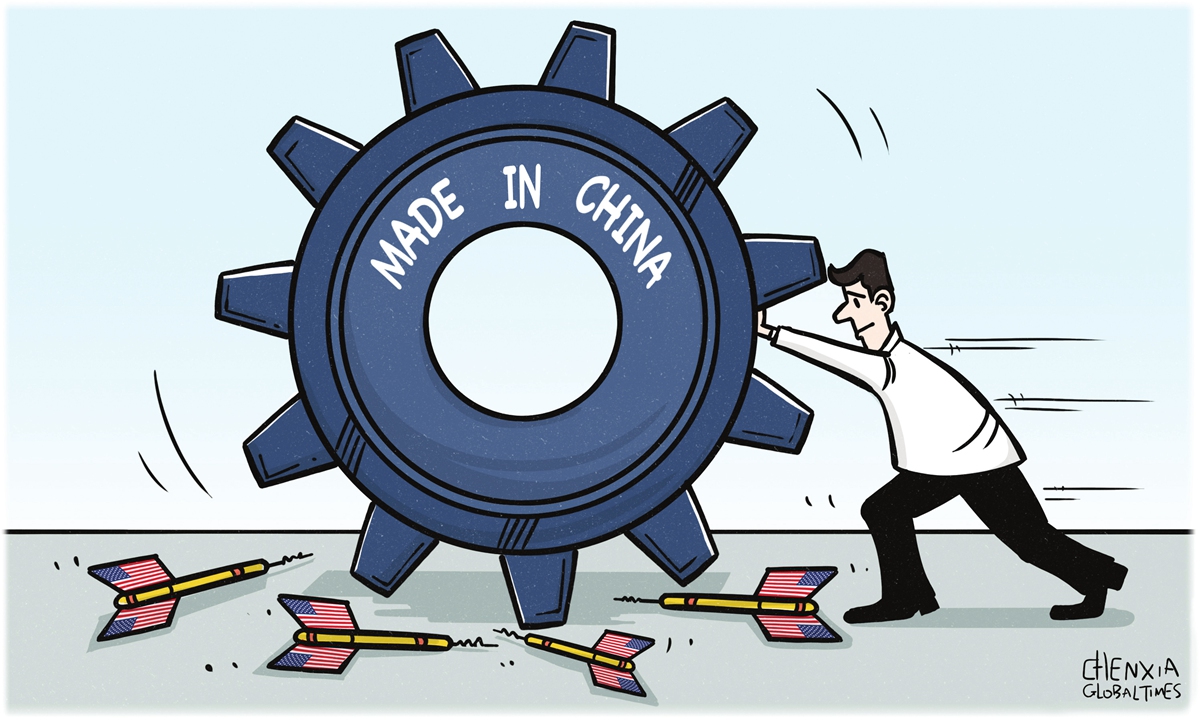

Illustration: Chen Xia/GT

The US containment of China's development has moved into the stage of comprehensive implementation. At both the high end and the low end, Chinese manufacturing has been systematically attacked.High-end attacks include controls on chip exports to China, and efforts to squeeze China's 5G technology out of the global market, while attacks at low- and middle-end range are mainly aimed at Xinjiang cotton, photovoltaic and other Chinese advantageous products.

On the other hand, the US continues to implement high tariffs on Made-in-China goods, even at the expenses of the self-imposed high prices, to lead US consumers and sellers to decouple from China. If China fails to take due countermeasures as soon as possible, it is likely that it will lose not just the global market, but also the dominant position that Made-in-China has held for years in the global supply chain.

The resilience of Made-in-China is illustrated by the increase in Chinese exports during the pandemic. However, while Made-in-China has no near-term concerns, it has long-term challenges.

Politicians in the US, Europe and even Japan and South Korea - major export destinations for Made-in-China - are proposing to gradually reduce their dependence on China, which goes hand in hand with a policy of bringing manufacturing back into their own countries.

In fact, foreign companies investing in China are already making adjustments to reduce their over-reliance on the Chinese market, adopting the so-called China Plus One investment strategy - looking for a "spare tire" for their factories in China. For example, Vietnam.

The CHIPS and Science Act of the US is essentially "a declaration of war" for taking over the high ground of the fourth industrial revolution, and it is a declaration of war against Made-in-China on a global scale. Chinese manufacturing is at an urgent juncture in protecting and consolidating its own position in the global industrial chain.

In a recent speech, Ren Zhengfei, founder of Chinese tech giant Huawei, told his employees that they should focus on profits and cash flows instead of revenue to ensure the company's survival. He advised not to spend money on non-strategic opportunities, but instead invest at any cost in strategic key opportunities. Our current position has been hard-fought, and is the result of the reform and opening-up.

To consolidate the achievements and resist US containment, it is necessary to fight tenaciously.

The possibility of continuing to rely on our previous strengths in order to upgrade our development and extensively target the global market has become almost entirely impossible.

Innovation is a gateway, but the development of good products and advanced technology needs to be profitable through domestic and international markets. Ultimately, it will depend on how we counter decoupling, or how we can more closely link and bond with the global industrial chain and market.

The best way to deal with decoupling is to link more closely, with more precise targets and more precise input. This includes the implementation of a more precise manufacturing export strategy through the foundation laid by the China-proposed Belt and Road Initiative. A popular argument is that Made-in-China is moving out; I prefer the word "extension," and we should proactively lead the extension.

A global economic contraction may be an opportunity for Chinese manufacturing to forge ahead, depending on whether we have a strategic arrangement to precisely extend China's industrial and supply chains, and whether we can implement it in a comprehensive manner. For example, when companies move their factories to Vietnam, the labor force is shifted, but the production chain is extended.

Look at the factories that have moved to Vietnam. Many of their technical managers, production equipment, raw materials and accessories are still coming from China, and a number of products are also supporting services for Chinese manufacturing.

Vietnam cannot replace China, but it can be more closely bonded to Made-in-China and the Chinese market, as can Japan and South Korea. We have already had a large market and a complete industrial system, and a trade network globally, so why can't we use these to build a more rational and equitable industrial chain?

The key point here is that we need to achieve common development through cooperation, so as to realize the restructuring of the industrial and trade system of the whole East Asia and Asia-Pacific region and break through the industrial encirclement of China by the US.

The author is a senior editor with People's Daily, and currently a senior fellow with the Chongyang Institute for Financial Studies at Renmin University of China. dinggang@globaltimes.com.cn. Follow him on Twitter @dinggangchina