US’ chip sales ban further disrupts supply chain; insiders optimistic about China breaking US’ stranglehold

chip Photo:VCG

The US prohibits two firms from selling sophisticated chips to China in the latest move of intensifying containment of China's high-tech sector including artificial intelligence (AI) and supercomputing. The US may further escalate crackdown on China's key chip links by restricting US firms' business and sales of more key chipmaking equipment and materials, but industry insiders are optimistic about the prospect of China breaking US' stranglehold given achievements already made in aspects like chipmaking tools.Nvidia stock price slid 7.6 percent to $139.47 during morning session on Thursday.

Nvidia said in a filing with the US Securities and Exchange Commission that the US government informed the company on August 26 about a new license requirement for any future export to the Chinese mainland, Hong Kong of its A100 and forthcoming H100 integrated circuits. It cited the US government's so-called concerns that the semiconductors may be used by China's military.

The company said that it may lose approximately $400 million in potential sales to China in the third quarter, and it's engaging with the US government in seeking exemptions.

AMD also received new license requirements that will stop its MI250 artificial intelligence chips from being exported to China, Reuters reported.

It's worth noting that Nvidia said on Thursday that Washington has authorized exports, reexports, and in-country transfers needed to continue its development of H100.

It is also allowed to perform exports needed to provide support for US customers of A100 through March 1, 2023.

Additionally, the US government authorized A100 and H100 order fulfillment and logistics through the company's Hong Kong facility through September 1, 2023.

The chips involved are graphics processing units (GPUs) that is one of the most important types of computing technologies and has been widely used in applications including graphics and video rendering, AI and creative production.

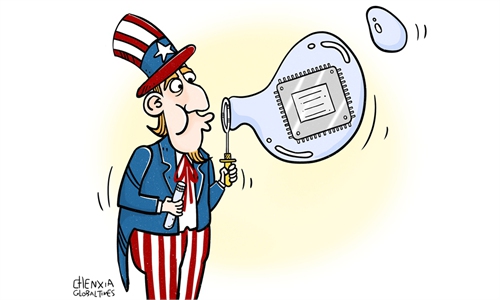

US' aim is to contain the development of China's high-tech sector to maintain its hegemony, Gu Wenjun, chief analyst at Shanghai-based industry researcher iCwise, told the Global Times on Thursday.

"The US latest move targets advanced computing power, which backs artificial intelligence (AI) and supercomputing, and thus will affect China's strategy of channeling more computing resources from the eastern areas to the less developed western regions as well as domestic internet firms engaged in auto-driving and cloud services," he said.

Currently, Nvidia accounts for around 95 percent of China's AI and supercomputing chip market share, though domestic start-ups are also conducting research and development (R&D), their work is still in an early stage, an employee of a domestic semiconductor firm, who preferred to be unnamed, told the Global Times at the 2022 World Artificial Intelligence Conference on Thursday.

"In terms of hardware, our gap with Nvidia has been closing, with some of Chinese firms' products showing better performance than Nvidia. But Nvidia does better in software operating system thanks to its product upgrade after so many years' cooperation with terminal firms," the manager said, noting that domestic suppliers will grab Nvidia's market share in China after it's banned.

Chinese Foreign Ministry spokesperson Wang Wenbin said at a routine press briefing on Thursday that US' move is typical technological hegemony, to which China firmly opposes.

"With its technological advantages, the US has time and again abused the concept of national security and its state power to crack down the development of emerging economies and developing countries. The move violates market economy principles, harms international trade rules and disrupts the stability of global industrial and supply chains," he said.

Wang criticizes the US of politicizing, instrumentalizing and weaponizing sci-tech and business issues, engaging in technological blockade to push for decoupling in a bid to monopolize advance technologies and maintain its sci-tech hegemony, and harming close global industrial and supply chains. "These moves will eventually end in failure," he said.

Shu Jueting, a spokesperson for the Ministry of Commerce, told a regular press conference on Thursday that US' move hurts not only the legitimate rights of Chinese firms but also the interests of US firms, urging the US to immediately correct its mistakes, fairly treat companies from all countries, including Chinese companies, and do things that're conducive to global economic stability.

Experts said US' latest ban is a follow-up of a series of its sweeping moves to contain China's technological rise. In addition to a crackdown on Chinese telecom giant Huawei and leading chip manufacturer SMIC, the US further bans ASML's export of extreme ultraviolet lithography (EUV) and older deep ultraviolet lithography (DUV) systems, pressures South Korea to join its Chip 4 alliance and enacts the CHIPS Act very recently.

As an industry critical to the development of the new economy in the 5G era, the chip sector has maintained close industrial and supply chain cooperation globally prior to US' disastrous disruption.

In general, US firms such as Qualcomm and Intel lead in chip design, European companies such as ASML provide advanced manufacturing equipment, Japan has many upstream materials like photoresist, while South Korea's Samsung and SK Hynix are giant memory chip producers and the island of Taiwan dominates the foundry market.

The Chinese mainland is the world's largest market for chip products. According to data from industry body Semi, the sales of semiconductor equipment in the Chinese mainland reached $29.62 billion in 2021, up 58 percent year-on-year, accounting for almost 29 percent of the global semiconductor equipment market. Moreover, the mainland also has competitiveness in chip packaging and test.

"As the US has imposed crackdown on almost every critical link of the complex chip industry, the US may probably only escalate crackdown measures in these aspects," Han Xiaomin, general manager of domestic leading IC industry consulting firm JW Insights Consulting Division, told the Global Times on Thursday.

"For example, the US has reportedly been mulling to restrict SMIC's access to chipmaking equipment used for 14nm process technologies on top of its ban of 10nm chips. Aside from EUV and DUV, the US may further ban sales of semiconductor IP, a chip layout design, to China," he said.

Gu added that the US may move to restrict US chip firms' business in China, for example, banning them from expanding production capacity of high-end products in the country and restricting US talent from getting jobs in certain sectors in China. "It cannot be ruled out leading firms in China's chip and internet sectors may face more crackdown from the US," he said.

However, experts noted that US' intensifying crackdown of China's semiconductor sector is a sober alarm to domestic companies, and will force them to increase exchanges between upstream and downstream firms to accelerate domestic replacement and accordingly drive up fast-than-expected progress of China's chip industry.

Amid the woes, Chinese companies have been accelerating in making breakthroughs in core technologies as of now. "For example, Chinese companies used to purchase most of the front-end defect inspection tools from US firm KLA, which accounts for about half of global market share, some domestic firms have now released self-developed prototype machines and some have been producing the tool in a small quantity," Han said.

In addition, local chip industry giants such as National Silicon Industry Group Co are proceeding with capacity expansions for 12-inch silicon wafers in a bid to improve the country's semiconductor self-efficiency, he said.

Industry insiders and experts have expressed optimism for China's ability to catch up with advanced countries in the semiconductor sector, saying domestic chip firms need to coordinate, increase investment and attract high-end talent for the sustainable development of the industry.

"China will not show weakness or give up the chip sector, I believe we will sooner or later make breakthroughs in core technologies and break US' stranglehold," the manager said.