The strong dollar should not become a sharp blade to cut the world: Global Times editorial

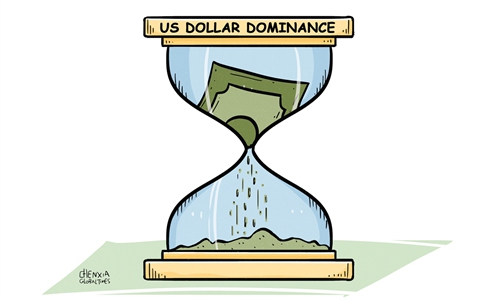

Illustration:Chen Xia/Global Times

The US Federal Reserve will hold a new policy meeting on Tuesday and Wednesday, with the decision on interest rate growth being the limelight. It is widely anticipated that the Fed will deliver at least another 75-basis-point interest rate hike to tame inflation. This might further increase the value of the US dollar against other currencies, which is at its 20-year high. Driven by the Fed's aggressive rate hikes, the US dollar is viewed as "experiencing a once-in-a-generation rally." For many countries in the world, this might be the beginning of another nightmare.

The meeting will witness the fifth time that the Fed will raise interest rates. The direct reason is to ease the high pressure of inflation in the US. But if people dig the root cause, this is an inevitable consequence of US' blind and unlimited money printing to temporarily maintain "prosperity." In other words, in the face of the deep-seated problems exposed by the 2008 financial crisis, Washington has been powerless, and unwilling as well, to solve them. Instead, it was extremely short-sighted to cover up the crisis and curry favor with the Wall Street, while taking advantage of the hegemony of the US dollar to quietly treat the crisis like dumping wastewater - draining it to the world.

A super strong US dollar and the fall of other currencies will, to a certain extent, ease the scorching inflation in the US economy, but the world will have to pay for it, which is often referred to as "when the US is sick, the world has to takes pill." The ensuing severe inflation, economic recession and other problems have already appeared on a large scale in many countries. Thirty-six currencies around the world have lost at least one-tenth of their value this year, with the Sri Lankan rupee and Argentine peso falling by more than 20 percent, since the dollar strengthened.

This has not only worsened the already weak economies of Europe and Japan, but also forced a large number of developing countries to swallow the bitter pills of the economic recession caused by imported inflation. Countless families were impoverished overnight. This is a very abnormal situation that is not supposed to occur, but it is the cruel truth behind the US "containment of inflation."

In fact, since the end of World War II, the US has used dollar hegemony to carry out "financial looting" or "export crises" against other countries several times. As a widely popular phrase in the West goes, the US enjoys the exorbitant privileges created by the dollar and the deficit without tears, and used the worthless paper note to plunder the resources and factories of other nations.

Each round of dollar appreciation in the past decades has been accompanied by extremely bad memories: The Latin American debt crisis broke out in the first round, Japan suffered from the "lost two decades" during the second round and the Asian financial crisis took place during the third. Particularly in the Asian crisis, which is still fresh in many people's memories, more than 100 million middle-class people in Asia fell into poverty, according to the World Bank estimation. The strengthened dollar, time and again, cuts the world like a sharp blade.

Therefore, while the political elites in Washington boast of the "myth of the American system" and take credit for "alleviating the crisis," thousands of poor families around the world are being trampled by them. They are not unaware of this, but still collectively choose to be indifferent and arrogant, as if this is the privilege that the "hegemon" should enjoy. As US former treasury secretary John Connally put it in the 1970s, "The dollar is our currency, but it's your problem." Today, the dollar is once again the world's problem. In a sense, it's hard to believe that the "prosperity" of the US is clean and moral.

However, the crisis cannot be covered up forever. Washington keeps laying mines but never removes them, which will eventually explode the US itself. The incompetence of US financial policymakers has been exposed by the consecutive interest rate hikes that have contributed to the abnormal appreciation of the US dollar with the purpose of defusing the severe inflation.

For the US itself, what will rise accordingly are the cost of corporate financing, the pressure on residents to repay their loans, and the price of export production among others. Meanwhile, the credibility that the US dollar has as a global currency is being continuously exhausted by the US "beggar-thy-neighbor" policy. Now the anxiety and insecurity brought by the US dollar to the world has heralded the beginning of the decline of its hegemony - regarding Washington's insatiable exploitation, Europe, Asia, the Middle East and other regions have explored the path of "de-dollarization," leading to the inevitable diversification of the international monetary system.

The best way to restrain the rampaging hegemony is to practice true multilateralism. Whether it was the Asian financial crisis in 1997 or the global financial crisis in 2008, the world seemed to have stumbled more than once by the same stone, which, however, is not that firm anymore. The instability and fragility of international financial markets have once again become prominent. It is precisely at such times that the international community should be more determined to cooperate and build a reliable, systemic and long-term multilateral international financial system. This cannot wait.