The mini-game "Sheep A Sheep" Photo: VCG

A new pass-through mini game named "Yang Le Ge Yang," translated as "Sheep A Sheep," has become a national online sensation in China over recent days but also aroused controversy over its likely profitability and game rules, media reports and some game players noted.

The game, which is available as a WeChat mini program and created by a startup game company Beijing Jianyou Technology, features a series of tiles with pictures of items often used in sheep husbandry. Players are required to place three matching tiles to eliminate them from the game. One who eliminates all the tiles wins.

The seemingly simple-rule game has nevertheless become not only a blockbuster pastime in China, but also a hot topic on China's social media platforms over recent days, as people rush to reach the second level, which is far more challenging than the first. Currently, the game has three levels.

So far, the game's official account has accumulated more than 160,000 followers on China's biggest micro blogging site Sina Weibo. The game's WeChat Index, an indicator of a keyword's popularity on Tencent's super messaging app, surged by nearly 65 percent in about a week.

Despite its early success, discussions around the blockbuster game have also mirrored some controversies linked to China's flourishing mini-game industry, such as collection of user data, originality and triggering defraud, but it still offers a bright spot in the generally slowing gaming industry.

Success despite concerns

Experts and players have mostly summarized the game's success using the term "hard fun," which means challenging users' desire to win the game.

"The rules look very easy, but actually it's quite difficult. The fun just lies in the contrast," one player told the Global Times on Wednesday, saying that she has developed a habit of playing 10 rounds of the game before sleeping at night, and she thought it as a very good recreation.

Zhang Yi, CEO of iiMedia Research Institute, told the Global Times on Wednesday that People need a common social topic in their leisure time, and this game meets the social needs with fast-paced mode and easy music, which is the main reason why it has become popular.

So far, Beijing Jianyou Technology has registered two trademarks for "Sheep A Sheep" in September, data on Chinese corporate information platform qixin.com showed.

On the other hand, the explosion popularity of the mini game also sparked some controversy as well. For example, several people told the Global Times on Wednesday that they are not satisfied with the game's rule that a user has to register his name and personal ID number before starting.

One person said she's not sure for what purpose the company is collecting her information, and therefore opted not to play.

Another doubt surrounding "Sheep A Sheep" is its profitability model. According to a report from domestic news portal nbd.com.cn, the game has not acquired an official game version number so far, a factor which might discourage potential investors given an increased level of risk.

According to Zhang, game developers are flocking to China's game market, while the release of game licenses is relatively slow. In terms of overall national regulation, the tightening of game licenses plays a role in improving the quality of games and reducing instances of poor quality gaming products.

"The sustainability of the game is key to attracting financing. At present, relying on advertising to achieve revenue is basically the profit model of all games on mini programs, as players are unlikely to pay in the game," he noted.

The "Sheep A Sheep" is also currently playable for free, but it has designed the game rules in ways to attract advertisers. For example, users are required to watch in-app adverts to win more powerful tools in the matching process. They are also encouraged to share the game on social media in exchange for desired tools to aid their play, which also helps increase digital reach and may also attract advertisers.

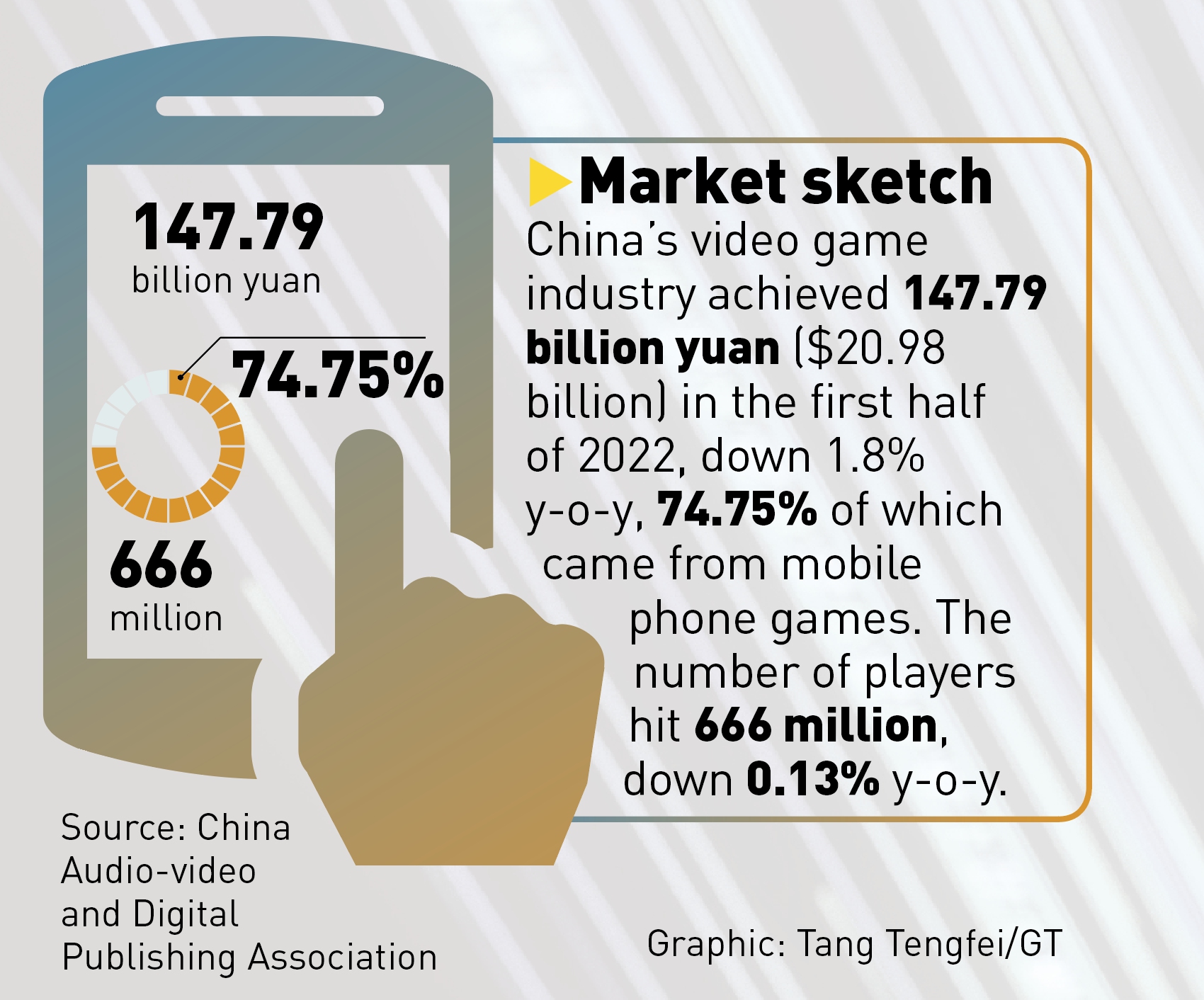

Graphic: Tang Tengfei/GT

However, whether the game's popularity can last to sustain advertisement income is also a question raised by observers.

According to Zhang, these types of games are not very sustainable and are often left behind by users after a period of time.

"Whether this game can continue its popularity depends on the ability of the operation team to develop more ways to play and make it more social," said Zhang.

Liu Dingding, a veteran industry analyst, also noted that this kind of small games contains no technical or patent barriers, so it is hard to maintain their popularity for a long time.

Besides, the game's explosive popularity has also attracted regulatory attention. The Ministry of Public Security recently cautioned on its Weibo account that some criminals would disguise as the game's customer service personnel to sell game tools and other services to users, urging players to be careful of unauthorized interactions during play.

Rise of mini games

With the repeated emergence of trendsetting mini games like "Sheep A Sheep" and Kai Xin Xiao Xiao Le (Or Anipop), the WeChat games ecosystem has increasingly gained public attention and is growing at a rapid speed.

According to a report published by Tencent Advertising and DataEye recently, WeChat mini games achieved more than 30 percent of commercial growth in 2021, a third consecutive year of high growth.

"Mini games have become a new space and new opportunity for China's mobile game industry," the report noted.

The report also showed that so far there are more than 100,000 developers building mini games.

The trend reflects a highlight in China's competitive and increasingly saturated game industry in general, which showed sort of bottleneck in recent time as of a result of tightening authority oversight and economic slowdown.

The gaming industry's combined revenue declined 1.8 percent to 147.7 billion yuan ($20.98 billion) in the six months ended June, according to a report published by the China Audio-Video and Digital Publishing Association recently. This marks the first drop since the data began being published in 2008.

The number of Chinese gamer users also dropped by 0.13 percent to about 666 million people in the first half of this year, the report noted.

Zhang said that so far, there are not many small game companies in China that have achieved profitability, with most still relying on advertising or outsourcing to make money.

"Small game companies generally do not rely much on capital, so the overall profit scale is not very big, while they are fighting in a less competitive market compared with large game companies," he noted.

Liu nevertheless said that the lifespan of most small game companies is short-lived. "If they want to become stronger, the support from big game enterprises including operation as well as technical guide is indispensable," he said.

He suggested that mini games can multiply profit models by pivoting from solely relying on advertising, to selling by-products such as game tools or developing e-commerce functions.